Why will startup salaries go down?🔻

Founders's guide to March'23 appraisals.

Welcome to the 128th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

What is the venture capital world saying? 🥺

Most didn't sign any term sheet since the start of January. Most point to massive valuation corrections across seed to series D stage companies. That means no new money is flowing in.

Startup valuations have corrected massively, salaries haven't.

This is impacting startups' runway period 🛫

Most startups have less than a year of runway if they don't generate some revenue. That means they are going to resort to cutting cost. Not just layoffs but salary corrections (not pay-cuts but permanent corrections)

But, everyone wants atleast minimal appraisals 💵

This will lead to expectation mismatch across the ecosystem. Some early signs are already showing up. Those who were going to quit post march are quitting in Feb itself. A huge flux of talent across startups is moving companies.

I wonder - why no one is paying attention? 🤔

For founders, especially in early stages with little revenue streams - don't take this macro for granted. Start taking proactive measures.

Do this if you are a founder in Feb'23 itself ⬇️

1/ Speak to your key leadership 🎙

Build confidence in them. Help them understand business realities and make them part of the decision making.

2/ Offer equity stock options 🍕

Startup equity is gold-mine of wealth creation. Especially if your product has traction and has hit product market fit. Offer massive equity component to retain top talent. Make them co-owners.

3/ Communicate the "Why" of corrections 🙇🏻♂️

If you are correcting salaries - make it a 1:1 conversation. No random emails with salary corrections. If your team size is less than 50, founder should do it by themselves. Don't outsource this to the HR team.

4/ Show the mid-term future 🌅

In this time - your core & poor performances in the team are going to wander. Help them visualise where you are going and iterate on the narrative.

5/ Plan clear input actions inside OKRs 🛠

Showing the future without input actions is worthless. Help your teams take up revenue as the core metric if your product has hit PMF. Make sure their OKR reflect their impact on future cashflows.

And, do all of this in Feb. Don't wait for March ⚡️

Know a founder or a startup team who needs to hear this? Share this newsletter with them - they will thank you for waking them up.

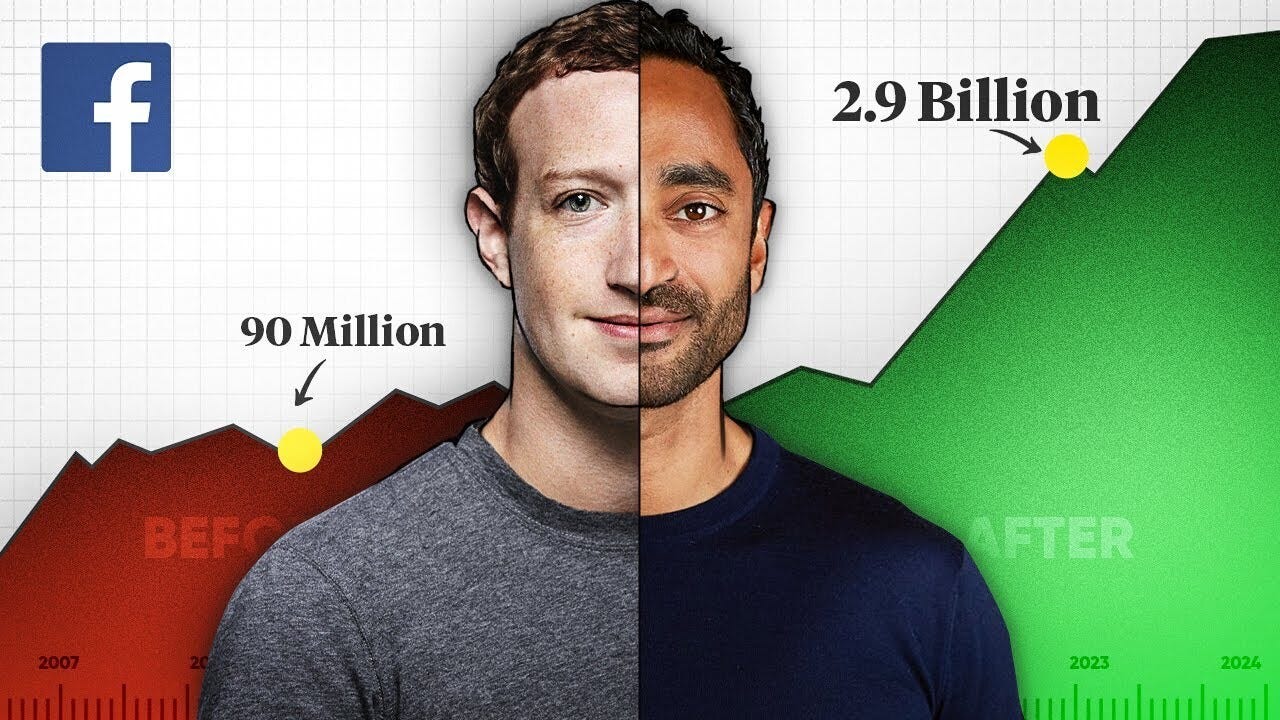

Did you know Facebook struggled to grow at 90 million users?

Here’s how it’s growth team solved the user grow stagnation and made facebook a 2.9 billion user product. Watch how did they do it 👇🏻

Missed last few stories?

Your advice is spot on, and it's crucial for founders to take proactive measures to ensure business continuity and retain top talent during these challenging times.