How CRED, Tinder & Zomato build trust with their customers? 🤯

The four actionable frameworks that can be applied to your product.

Welcome to the 124th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Will you?

keep your retirement money in new fintech app?

allow a stranger to live in your home for a night?

buy a brand of smartphone that none of your friends use?

drink tap water in a remote unknown village you are visiting?

Most of us will answer “No” to these questions. But, what if I tell you -

fintech app has the Government of India as major shareholder.

home renting out platform is Airbnb & offers ~ $1 million insurance.

smartphone brand is “nothing” built by the “OnePlus” founder.

unknown village was recognised as the cleanest village in India.

Interesting right?

Let’s go deeper into how to the likes of CRED, Zomato & Tinder build trust for first time customers, repeat customers & improving average order value of your customers.

Framework #1

Solving for trust before the user discovers the product.

Let’s apply the framework to Tinder, a dating app.

Crisp marketing pitch → Dating app to meet new people & find friends.

Creative design → Checkout Tinder’s colour pallet & brand archetype

Ratings & reviews → Tinder’s play store listing is ~3/5; need to fix.

Balanced touch-points → No spam ads on social (IG/Facebook)

Borrowed trust → On Tinder’s website, first 3 testimonials borrow trust from users who found love on Tinder & got married. Or the Swipe Stories series, where real users talk about their tinder stories.

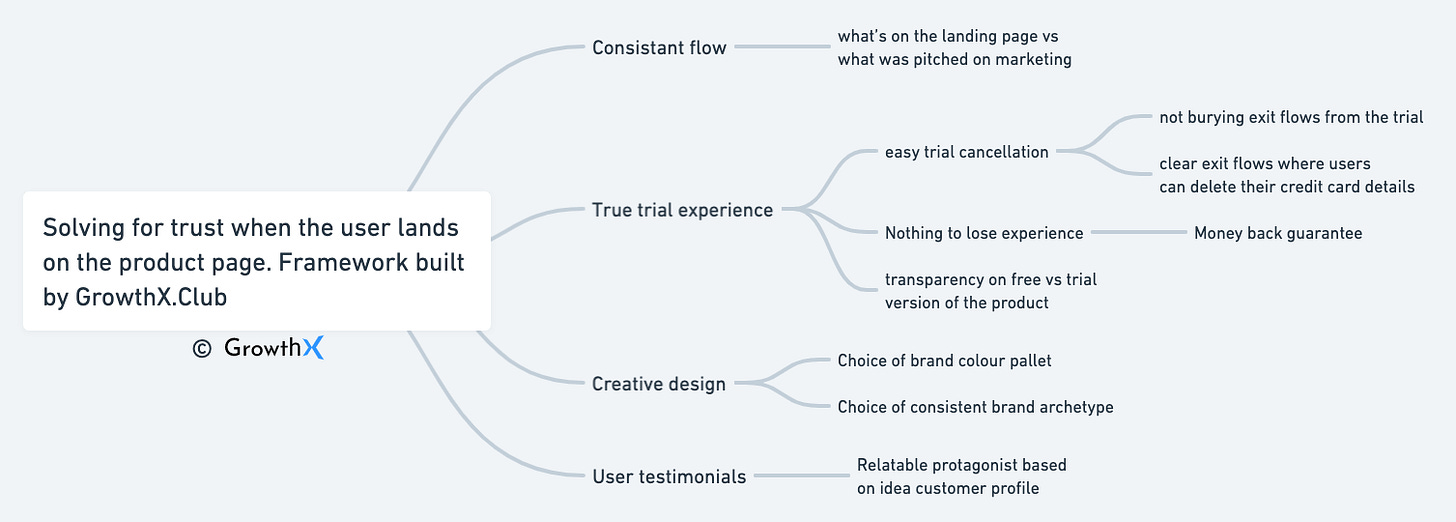

Framework #2

Solving for product discovery → purchase trust design.

Let’s apply this framework to Hubspot.

Consistent flow → shows consistent marketing pitch & landing page.

Trial experience → Clear 14-day trial communication, no cc.

Social proof → Borrowing trust from top internet companies that use them.

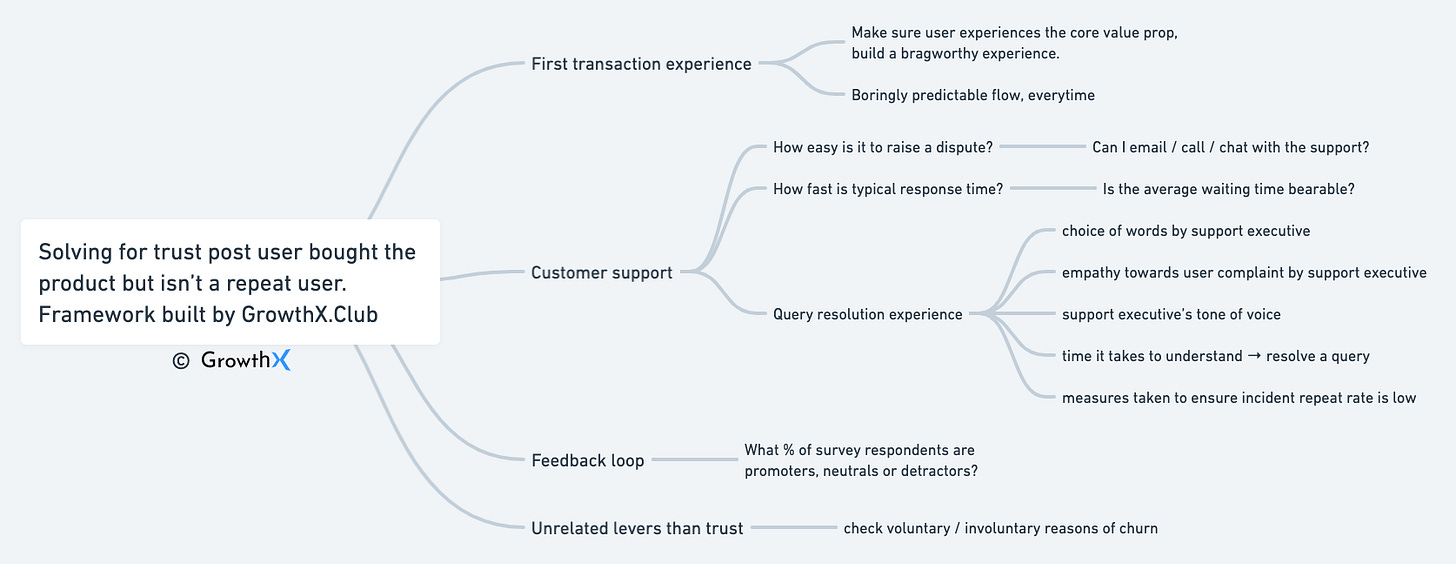

Framework #3

Solving for trust with the user who isn’t doing a repeat purchase.

Let’s apply this framework to Zomato.

First transaction experience → Did the first food order get delivered hot & on time? Does this happen for most first orders from new customers?

Customer support → How do I raise a complaint? Is the support buried under 100s of knowledge base bot responses? What’s the typical response when I say the food is not good? How much time do I waste every time I raise an escalation with a brand?

Do I always have to raise this on social media to get noticed? Feedback loop → How likely will you refer this product to your family/friends? Unrelated levers than trust → Did I move city & the new city isn’t serviceable on Zomato?

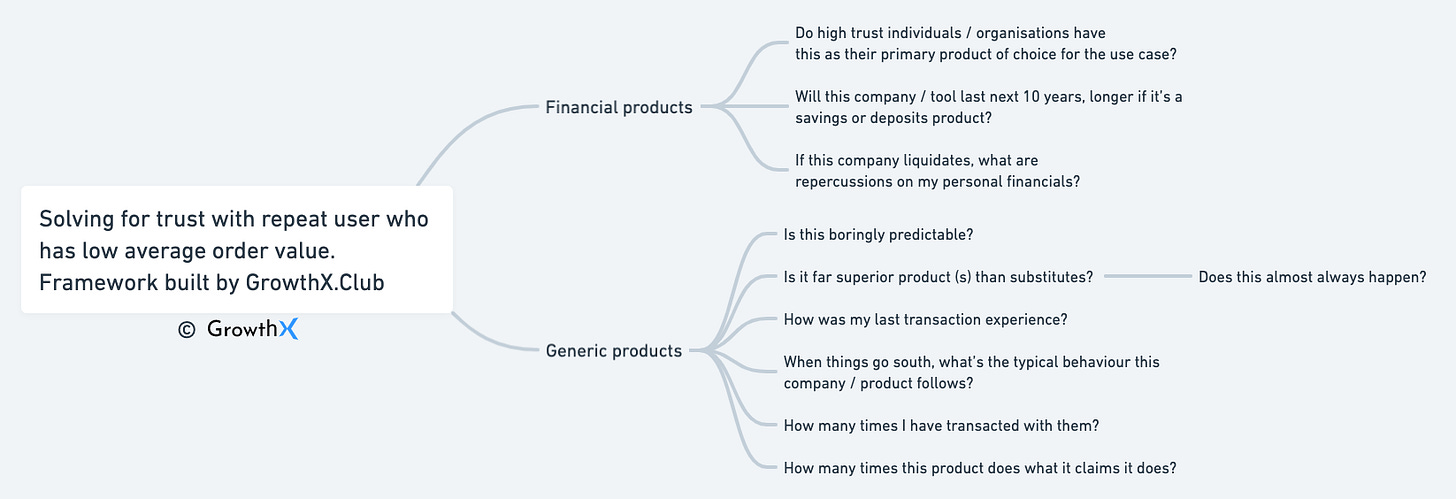

Framework #4

Solving for average order value/ basket size of the order.

Let’s apply this framework to CRED.

Do high-trust individuals choose it → Top CEOs, leaders, and affluent celebrities choose it. Madhuri Dixit, Rahul Dravid, and Ravi Shashtri * 10s or more endorse it.

Will this company last ten years → CRED has raised more money than any internet company in India. This raises eyebrows. Is it scaling too fast or too quickly? Does it have enough funds if it can’t raise money for a few years?

If CRED liquidates, will my money go under → Does it have a strong governance team? Is it compliant with RBI guidelines and follows the proper lending structure? Do they have deposit insurance?Is it boringly predictable → Does this bring no surprises on credit card payment failures? Is the flow water-tight for refunds, payment delays & more? When things go south, how does the company respond → Does the company admit mistakes and solves them without any social escalations? How good is their “choice of words” from the customer support executive?

Now you know why CRED UI design is at the core of building trust.

That’s all for now ✨

Go apply this framework on your product. You know the drill.