Profitability insight from Indigo & Paytm 💸

Quality of revenue >> volume of revenue.

Welcome to the 185th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Indigo made ₹762 Cr selling food & beverage business last year. Interestingly, it has a 70% margin on the food business. This will also happen to every single UPI player including Paytm. Here's the future👇🏼

The food analogy is the core to understanding how ₹10,000 Cr revenue companies can/ will/ should be built for the "Bharat" Janta. And the Indigo example shows. Of the ₹54,000 Cr, it made last year 13% was EBITDA → that's almost ₹7,000 Cr. Of the overall profits, the 70% profit margin from food & beverage contributed significantly.

Why should we care about this number?

Because that's the game Paytm is playing.

Let's segment UPI into 8 categories.

→ UPI (Peer to Peer/ Peer to merchant)

→ Lending (loans/ credit cards)

→ Payment gateways

→ Insurance (Life/ Medical/ Motor)

→ Travel (Bus/ Train/ Hotels/ Flights)

→ Investments (Stocks + Gold)

→ Events (Movie/ Concerts)

What is Paytm’s pathway to profitability?

First/ UPI (P2P/P2M) 💰

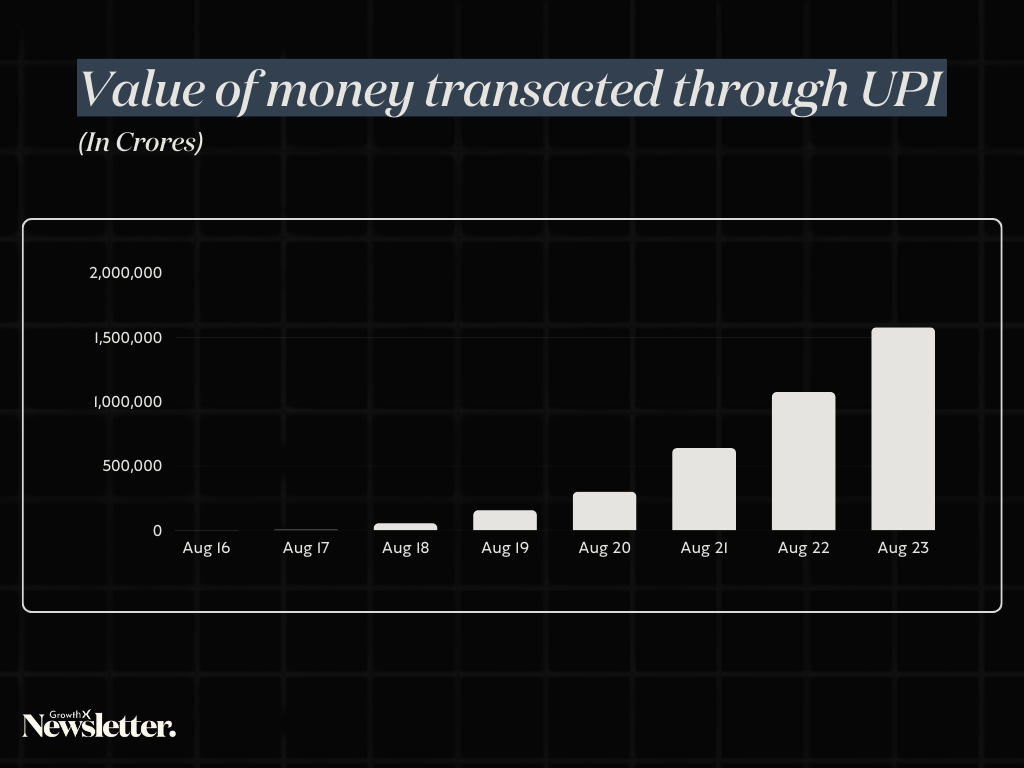

It makes no money for UPI apps even though the volume and # of transactions have massively grown over the years. They make only a portion of money from merchants using say Paytm payment gateways. But the margins are razor thin - similar to Indigo's margins on its core flight ticket sales business.

Second/ Lending ✨

Paytm disbursed ₹12,554 Cr loans in FY23. Assume a net interest margin (difference between interest generated from lending & interest paid) is close to 3 to 5% of the disbursed loan (upfront ~2.5% to 3.5% + 0.5% to 1.5% at collection), netting a margin of ~₹380 Cr. Please note, that Paytm Postpaid, Personal Loans & merchant loans are added to the bottom line.

Third/ Payment gateways 🛒

This vertical is extremely new at Paytm. It still made ₹1197 Cr from payment services in Q3'23 & netted ₹459 Cr in margins. Mind-bending Dhanda. This could be their version of Indigo's F&B.

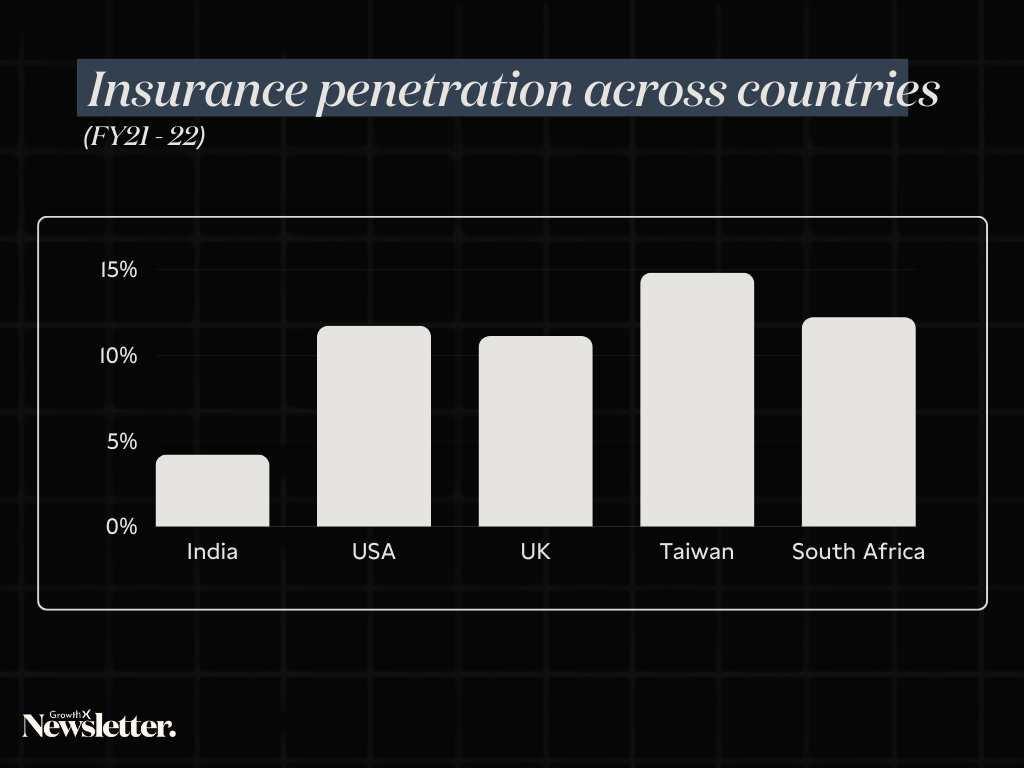

Fourth/ Insurance 🚙

It has at least 12 million insurance policies (could not get updated 2023 data, found some data in their IPO filing) - a tiny start in a market where insurance penetration is way less than the global average. Plus 2-wheeler insurance is huge for Paytm.

Fifth/ Travel + Investments + Events 💸

Paytm is the 2nd biggest movie ticketing player after BookMyShow. Overall in commerce (travel+movie+gift vouchers), it made ~₹600 Cr net revenue on a base of ~₹10,000 Cr in the last 12 months.

Enter, the tailwind of UPI on credit 💣

Offering credit with RuPay cards on Paytm is the next step for capturing margins through its lending and payment Gateway business. In the next 3/4 years, these 2 will contribute > 50% of Paytm's net profits.

What does the future of Paytm look like?

Business models are more than just solving user problems. Certain dynamics can create walled gardens - like PVR not allowing outside food in Cinema Halls. What Paytm or Indigo is building is a walled garden.

Their future cashflows & profits will be decided by how well they can keep users within the walled garden using product hooks, use cases, regulation or even killing competition (ouch!)

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.