Meesho's Road To Profitability 💰

Why did Meesho beat Flip to the game?

Welcome to the 179th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,200+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

What are we covering today?

Meesho customer spends on average ₹500 per order. On the other hand, Flipkart & Amazon’s customer spends about ₹2,500 per order. So how did Meesho get profitable? ⬇️

Quick context 🗓️

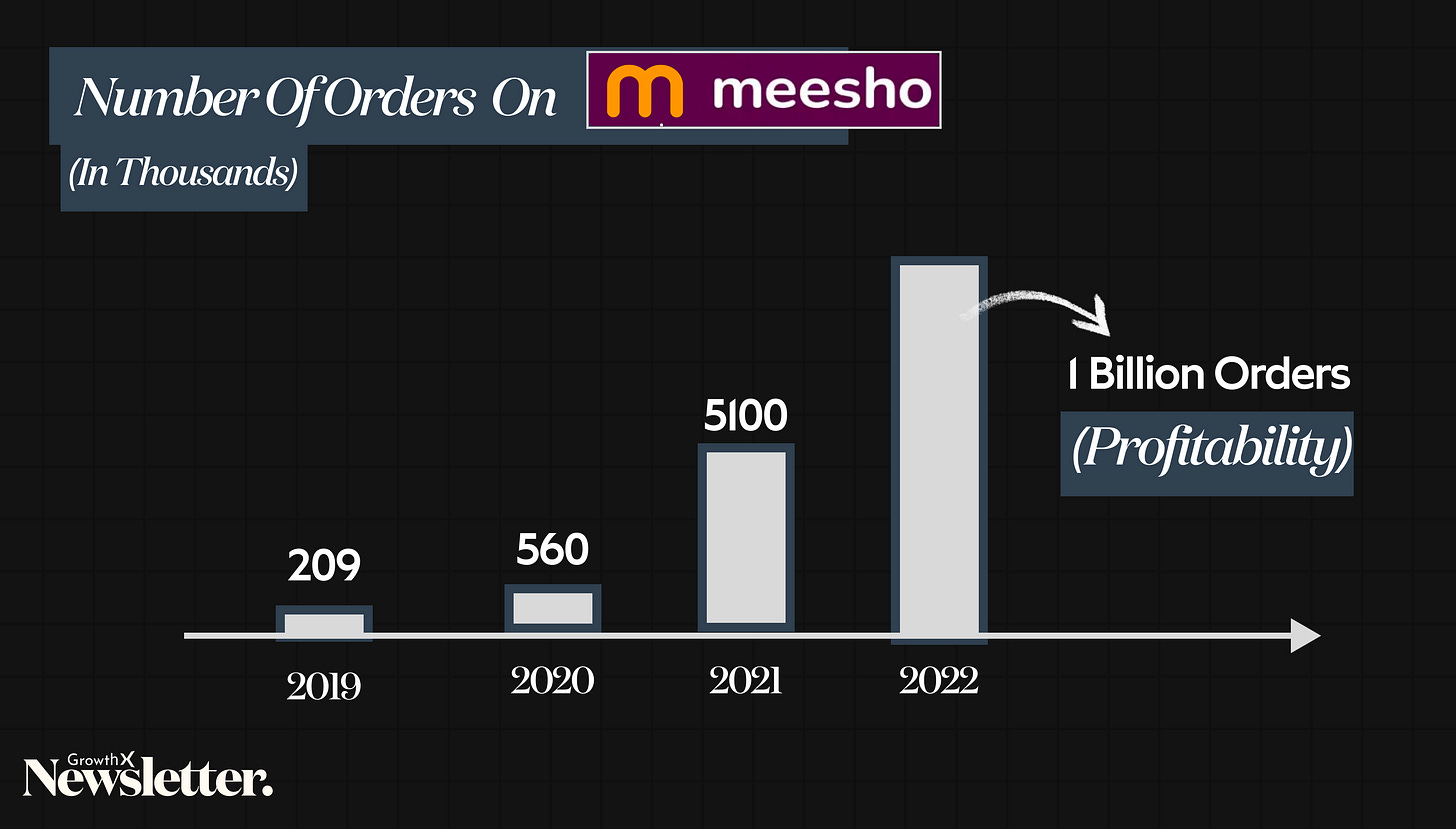

70 days back, Meesho released a public statement claiming profitability. Over a billion orders every year & 54% growth this year & there's a story.

How Meesho cracked profitability 👇🏼

1/ Repeat order frequency 🔁

Amazon especially has cracked the code here, its non-Prime members place 13 orders a year while Prime customers place 24 orders per year.

Meesho knew it had to solve frequency & more importantly "Trust". 85% of Meesho's overall orders come from repeat users. This is no accident - Meesho built this whole trust with Bharat audience with it’s B2BC model.

In the B2BC model until 2021, Meesho collaborated with suppliers and manufacturers to deliver products to resellers, who then sell them to consumers directly. The end consumer did not know anything about Meesho but the resellers built a lot of trust with Meesho.

When Meesho went from B2BC to B2C model, the trust was borrowed from these resellers to solve for the new model by keeping the reseller model intact as part of the consumer purchase flow. Here’s an example.

2/ Pushed costs down (read marketing) 🔥

In the last 12 months, it's marketing costs are down by 80%. That means it spends a really small number on acquiring/re-acquiring a user. It's making cash from existing users and gaining new market share organically.

50% of Meesho's first-time customers are buying online for the 1st time in their life. No wonder Meesho isn’t competing with Flipkart of Amazon for most pin codes in India - Meesho’s DNA is built differently.

These customers buy online because they trust someone in their social circle who bought online from Meesho. Now, you understand why their order volume did not drop even when marketing pulled the plug.

I would keep a watch on this trend and report it back in 6 months to all of you. My guess is there will be a continuous impact of reduced advertising on new customer acquisition. But if retention holds up - Meesho might just do what Airbnb did.

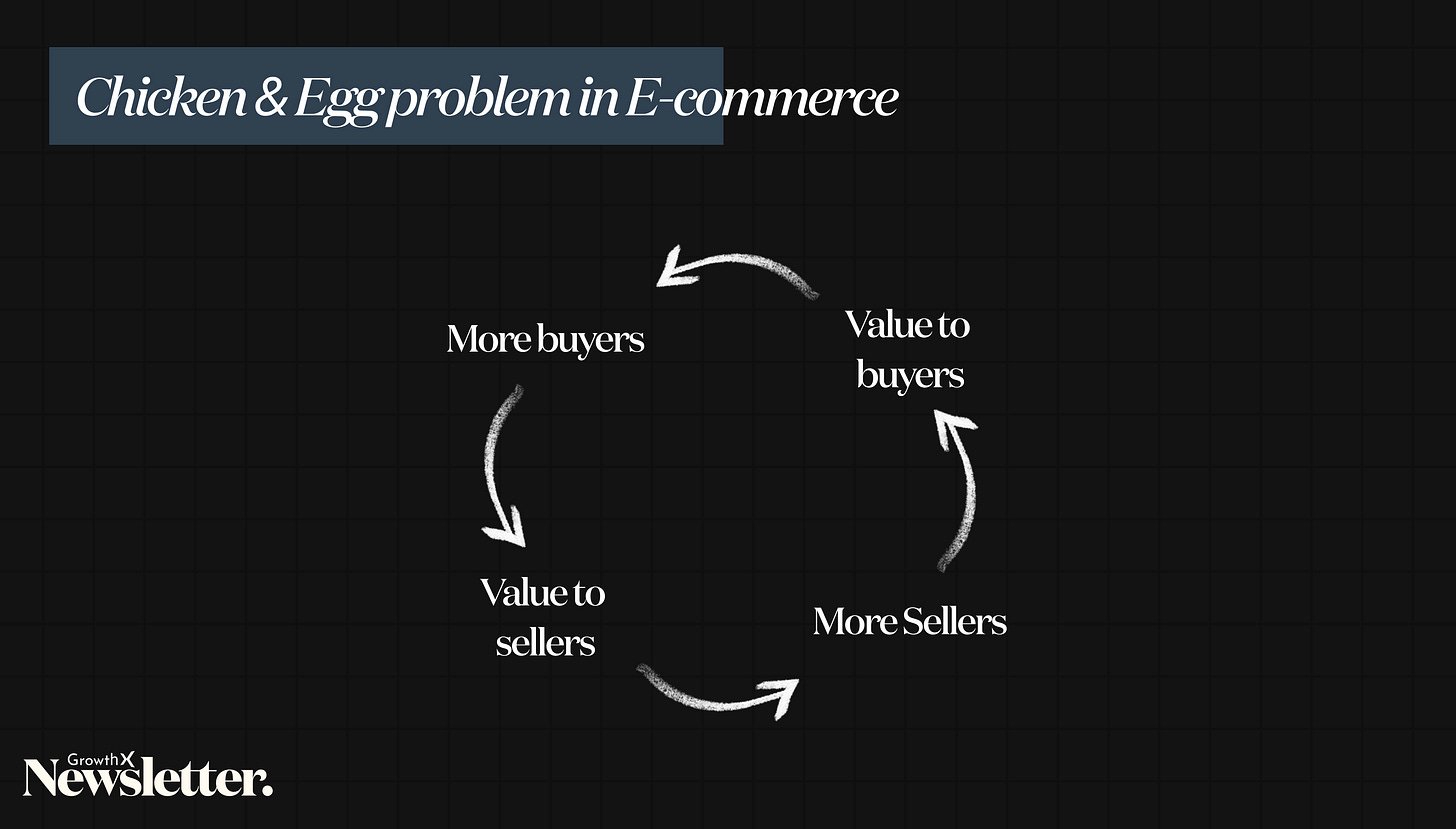

3/ Fought the chicken & egg problem 🐓

By 2021, Meesho became a marketplace from its original B2B2C model. This meant it had to acquire sellers to sell directly on the Meesho platform which offered the best pricing, value for money, and guaranteed delivery. It had to do what Amazon/Flipkart couldn’t.

Meesho launched 0% commission policy for sellers. It worked like a charm. No wonder Meesho made a large portion of its ₹3,232 crores from seller monetisation (ads + logistics commissions).

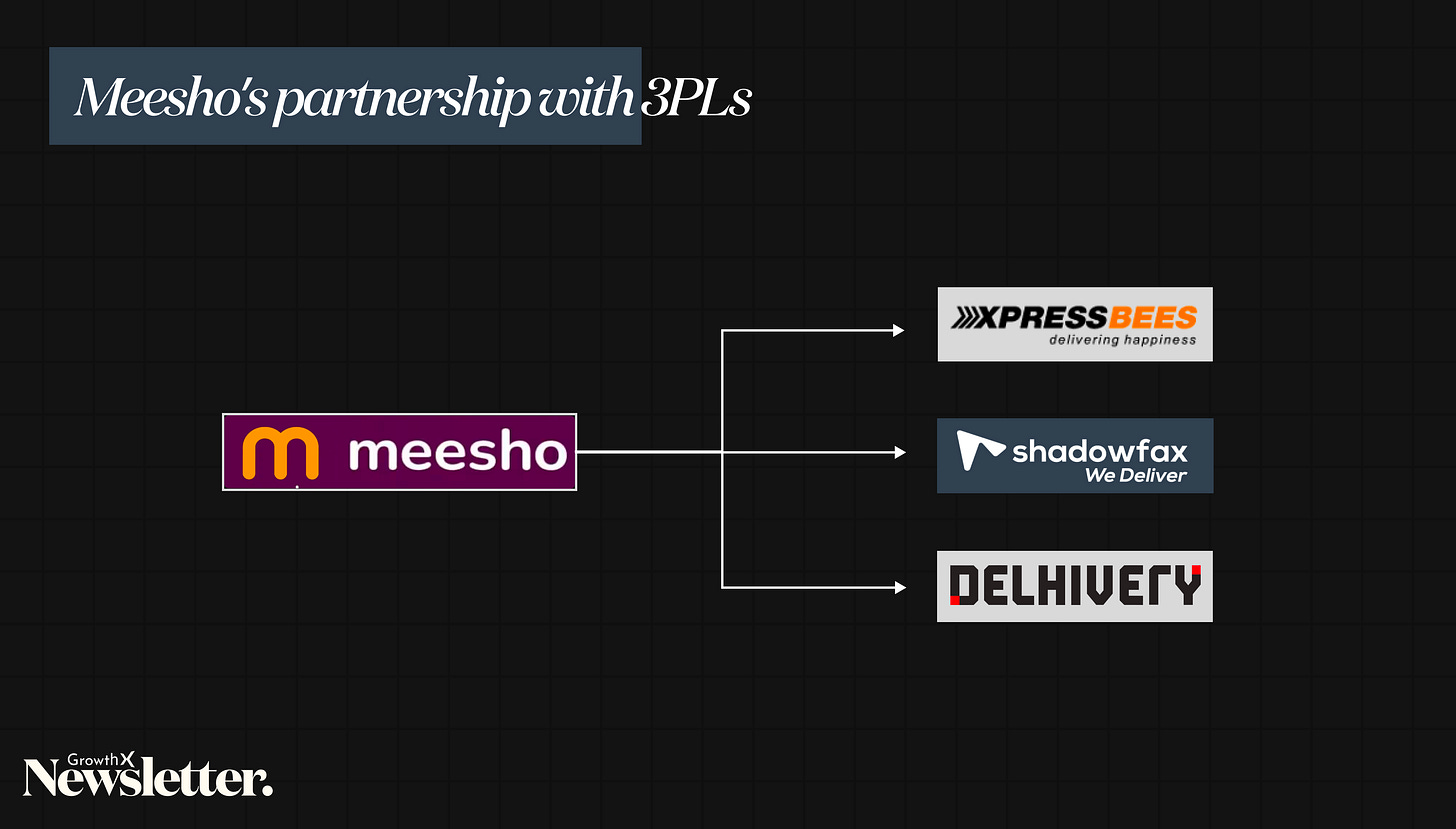

4/ Asset lite model with logistics 🚚

Meesho delivers about 30 Lac orders/ day & doesn’t own a delivery network. Instead, they’ve partnered with 3rd-party players like Delhivery & Xpressbess. Did I mention - that Meesho makes money through commissions from it’s partners? Mindblown.

5/ Building the Bharat moat 🇮🇳

Flipkart & Amazon tried their hands at nailing Bharat Janta (Tier 2/3+) and failed miserably. Meesho's extreme focus has allowed it to go deep into building the right brand, product selection, pricing, and delivery periods.

Try ordering from Meesho vs. Amazon. Amazon will deliver faster, but that's not what Bharat Janta wants - they went for the best value at the cheapest price. Meesho is fundamentally built around this DNA.

Sometimes I wonder, “Is delivering things slower & in batches the answer to making a margin in logistics-heavy internet businesses?” Wink wink Zepto.

6/ Cash is (still) king 💰

Even in 2023, most Meesho orders (~70%) are still cash on delivery. No wonder Meesho works like hotcakes Vs the ones pushing digital pre-payments. I still could not find insight into how the order return rates are and who bears the cost. If you know these, reply to me and enlighten me.

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.

If you liked today’s article, you’ll love these 💙

We covered a bunch about vertical e-commerce in India in the past few weeks. Go deeper into this category with these curated pieces.

Solving Dhanda for your product?

Learn the science of growing with revenues in the complete GrowthX experience. If you are a founder (Seed → Series B), Product / Growth Leader or just joined a growth team, this is for you. Click here to open the rabbit hole.