Why is Urban Company selling water purifiers?🥹

Insight behind testing cross selling with the right use case.

Welcome to the 138th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,300+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Water purifiers are a huge market in India. Top players such as Kent RO, PureIt, Eureka Forbes & more make it a ~2000 Cr annual market. But, why is Urban Company trying to compete in this category now? Let’s find out ⬇️

Quick Context 🗓

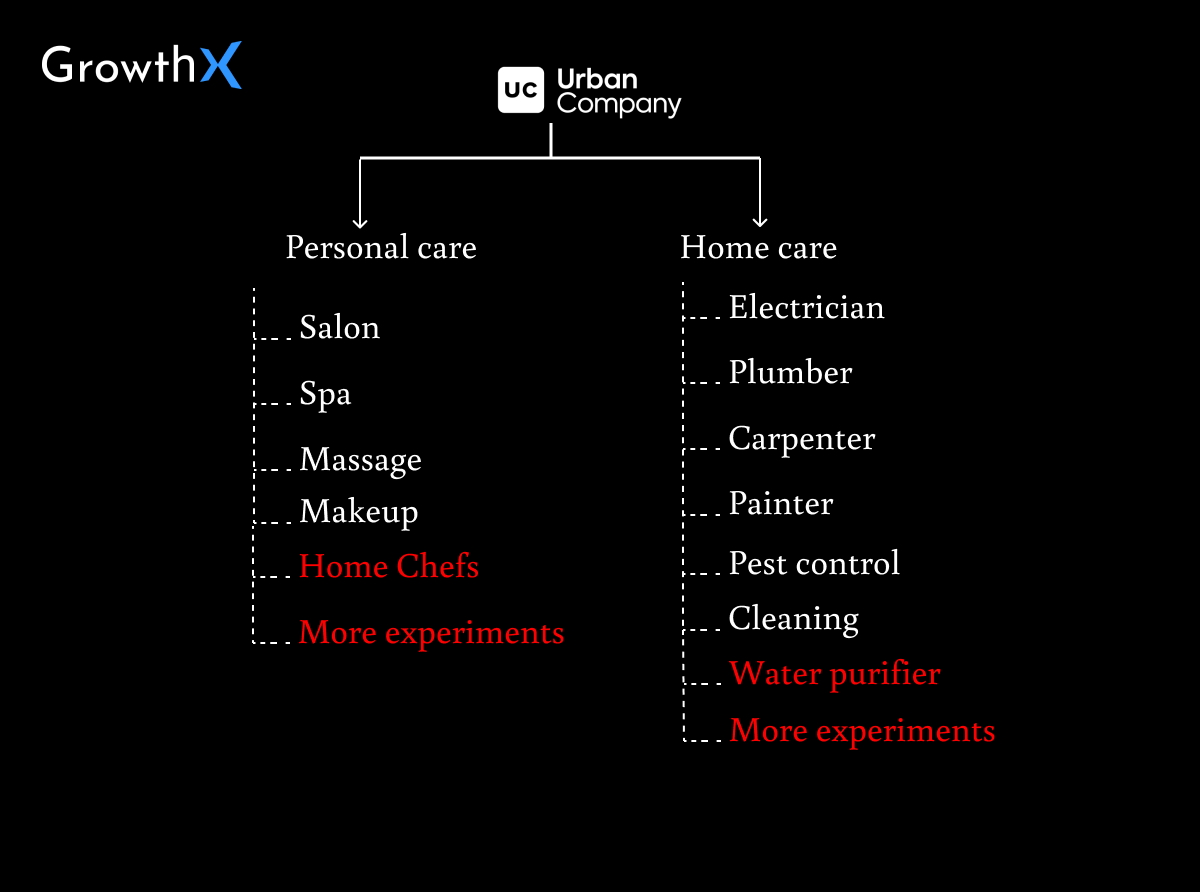

Urban Company (previously Urban Clap) is a demand / supply marketplace for personal care (salon, spa, massage) & home care (plumbers, carpenters, electricians). On one side they have consumers like you & me, and on the other a supply of gig workers who’ve been trained by Urban Company for specific services.

This is the only context you need to read through.

Now we move on to why it’s selling water purifiers.

Urban Company’s market is limited 🥹

It’s focused on metros and typically upper middle class & high income urban janta who want personal / home care over cheaper local options. The audience that values convenience of UC is limited.

Insight → Urban company can grow revenue through two levers in their revenue equation — frequency & average order value, cause paying customers are limited.

#Use Cases = UC’s revenue growth 💡

Few months ago, it launched “Home Chefs” where you could hire a cook twice a day at ~7/8K per month. Not a bad deal in most metro cities such as Mumbai, Delhi & Bengaluru considering the substitutes. It however, seems to have pulled the service back due to lower NPS & ops issues.

Water purifier is an order value game 💸

It will allow the brand to solve for the second lever → Average order value. The margins are good plus it has great trust that you need from a water purifier brand to be honest.

With a price tag of ~10K, the water purifier can solve for lifetime value per customer in a short time. Plus, the annual maintenance post 2 years creates a sweet recurring revenue pipeline.

That’s about the Urban Company’s upsell story ✨

Go back to the drawing board and ask yourself, what are some of the things you could do differently if you’re struggling with improving total addressable market in your own product category.

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.

If you liked today’s article, you’ll love this 💙

Is Jio a hardware company? 🤔

Welcome to the 195th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

If you understand the buying behaviour, you would realize that, when it comes to white goods, customers typically compare prices and features when they buy and that's where UC will lose out to larger horizontal platforms and offline multi-brand stores which provide a sizeable assortment and comparison facility...

On the other hand, a better business model would be for them to get into a b2b partnership with large online platforms, stores and perhaps D2C brands to become a provider for all their white good installation and repair services and ensure a consistent experience and improve NPS for them.