Why is Tata bullish on the Sierra?

Tata's master plan to capture 25% of the SUV market.

GrowthX community allows you to be around people smarter than you, learn new skills every week & crack your next breakout role. Over 5,000 vetted professionals from companies like Microsoft, Google, Amazon, Apple, Jio, HUL, ITC, Coca-Cola, and more trust GrowthX to grow their careers.

Bookings for the new Tata Sierra opened on the 16th.

Launched just 20 days ago, the Sierra is said to put Tata back on the map. Shailesh Chandra, Tata Motors’ CEO, claims the launch will increase SUV market share from 16% to 25%. But can they actually pull it off? We spent the last few days finding out. Here’s everything we learned in a quick 6-minute read.

Recognise this car?

That’s the Tata Sierra, India’s first homegrown SUV that launched in 1991—also Tata’s first-ever passenger vehicle. It was designed to be the next aspirational vehicle.

State-of-the-art wraparound rear glass hatches for complete rear visibility, high ground clearance, ladder frames for rough terrain and floods, and a unique 3-door layout that saved space without sacrificing cargo room, ACs, or automatic windows— Sierra had it all.

But Sierra’s 3-door system just wasn’t practical.

Tata launched Sumo (1995) & Safari (1998).

These cars were huge, feature-packed, and their prices reflected it. These were out of reach of regular customers — too pricey. The common man wanted a compact, affordable car built for city roads.

Maruti tapped into this trend. It cemented its position as the people’s brand with back-to-back successful launches of the Swift, Dzire, and A-star in the late 2000s.

Hyundai, in contrast, captured the premium segment around 2008 with aspirational models like the i10, i20, and Creta. Better finish, premium features, and expert build quality, all at a great price, made it the obvious choice for premium buyers.

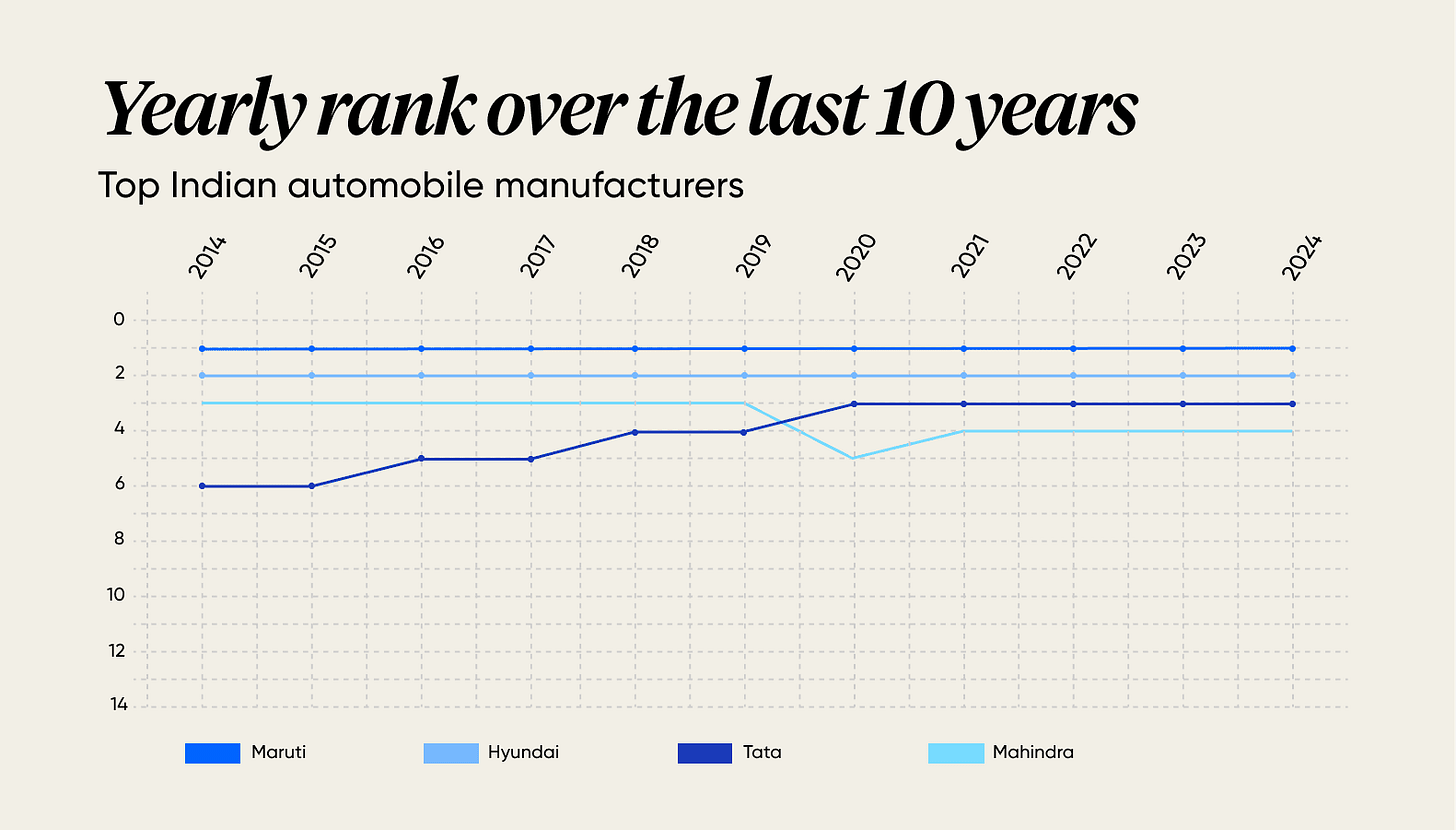

And in the SUV segment? Mahindra and MG began competing toe-to-toe with Tata by offering feature-rich models at competitive prices. Just take a look at the graph below.

Tata played catch-up for a long time — launching hits like the Indica (2002) & the Xenon (2007), alongside a series of misses, including the Spacio, Sumo Grande, Vista, and Nano. It kept battling outdated designs and poor safety perceptions.

Then, Tata revamped its portfolio.

Tata killed non-performers like the Sumo and Nano and launched stylish, customer-focused models. The strategy? Build cars that people actually want.

After the Hyundai Creta hit it big in 2016, SUV demand exploded — the segment grew from 23% in 2019 to over 50% in 2024. That means every 2nd passenger car sold in India was an SUV — mad! Call it aspiration, blame it on bad roads, or bigger car means better societal status, SUVs became & still are the hot thing.

Tata entered the market with its own SUV lineup.

They doubled down on R&D for engine efficiency and safety, while reverse-engineering premium Jaguar Land Rover features for their high-end SUVs.

The smartest move — they only introduced premium models after their budget lineup proved successful. It worked—perception shifted, and sales climbed. Between 2019 and 21, Tata’s SUV sales skyrocketed.

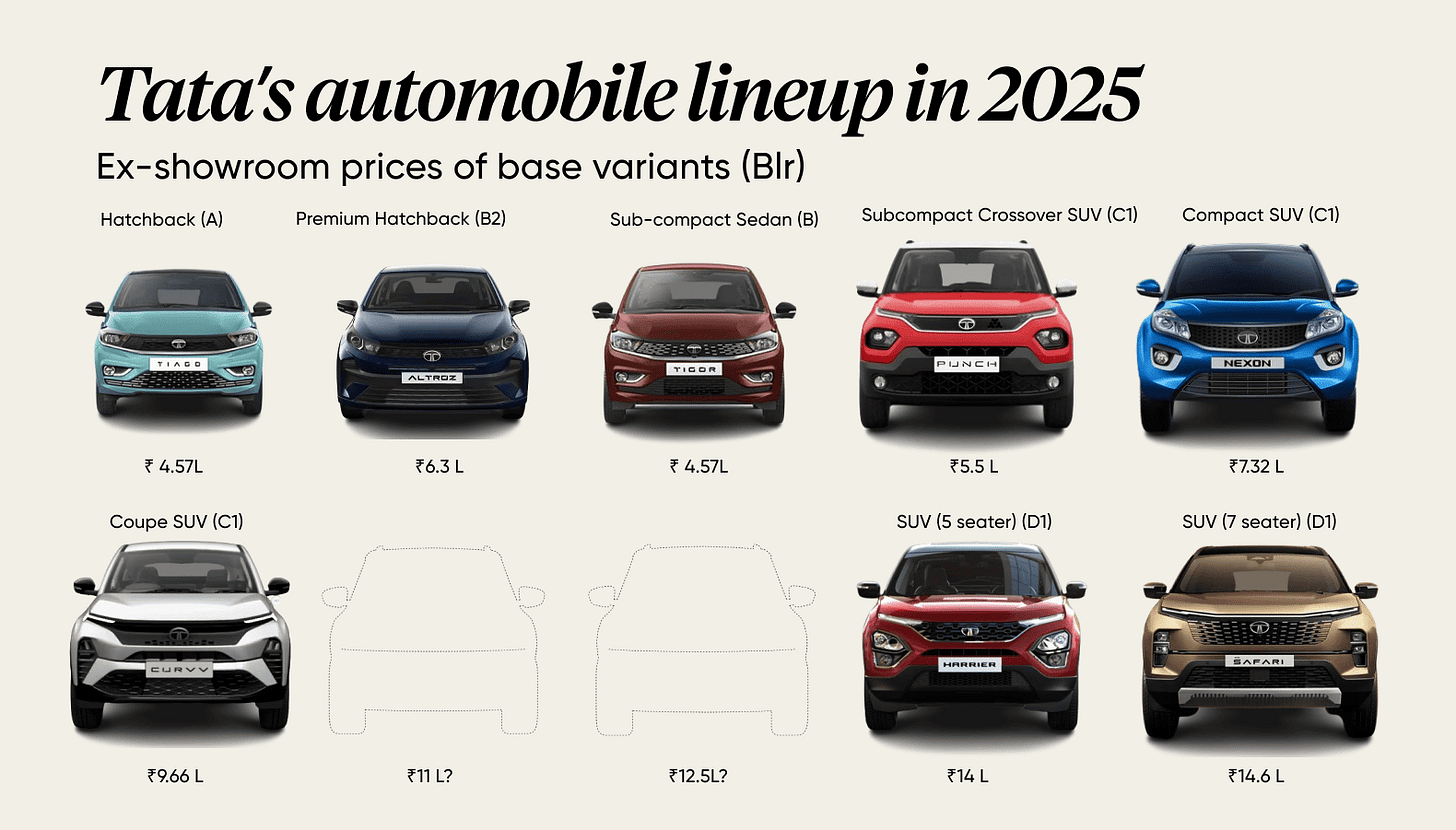

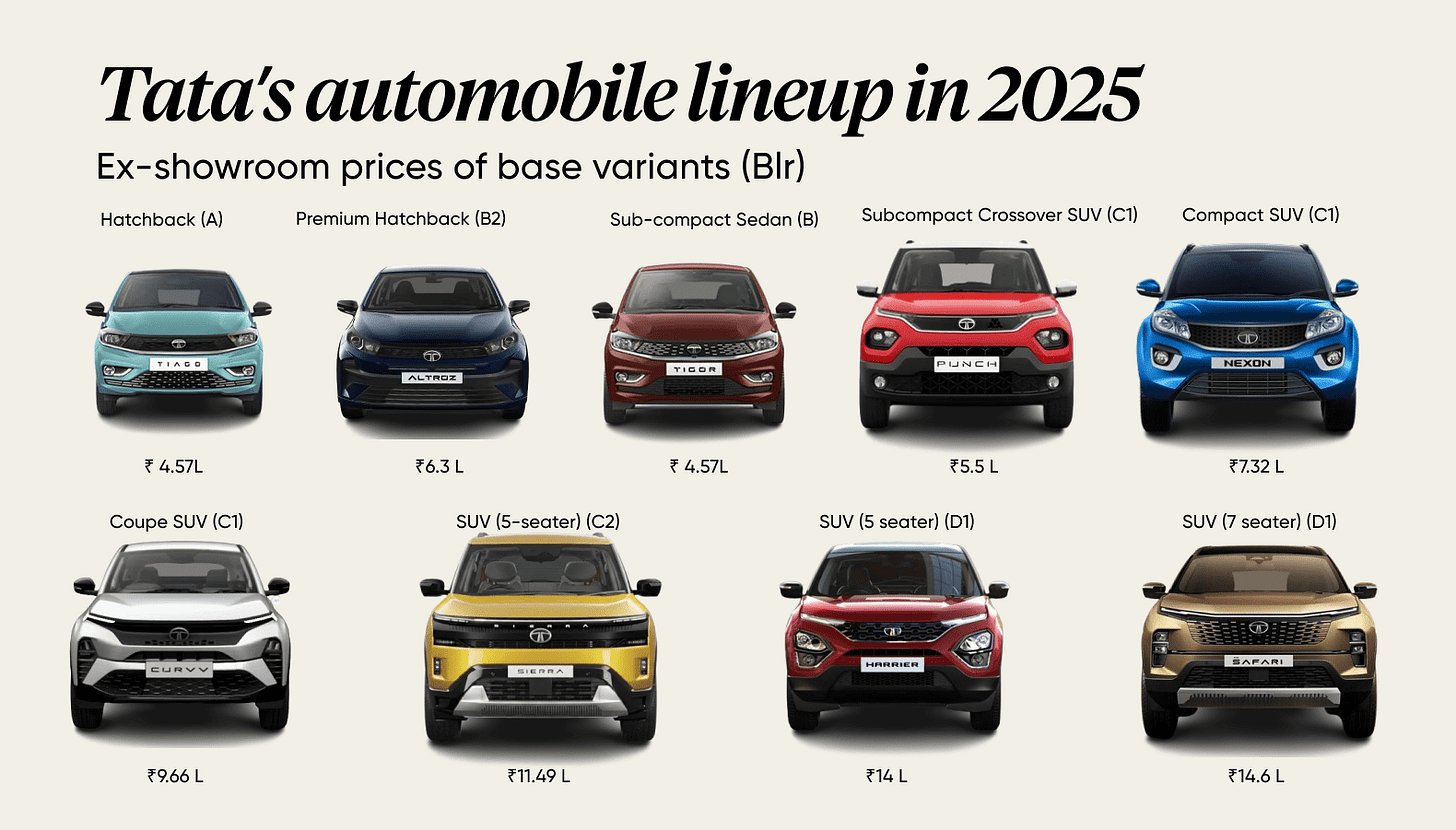

Today, Tata offers an SUV lineup spanning the C1 (Compact SUV - Nexon) and D1 (7-seater SUVs - Safari) segments. In fact, Punch & Nexon lead the Compact SUV (C1) category in sales. Reason? They’re spacious, have a stronger, safer build, and are available in petrol, diesel, CNG, and electric powertrains. This offers consumers an optionality that Maruti & Hyundai don’t currently offer.

This wasn’t enough.

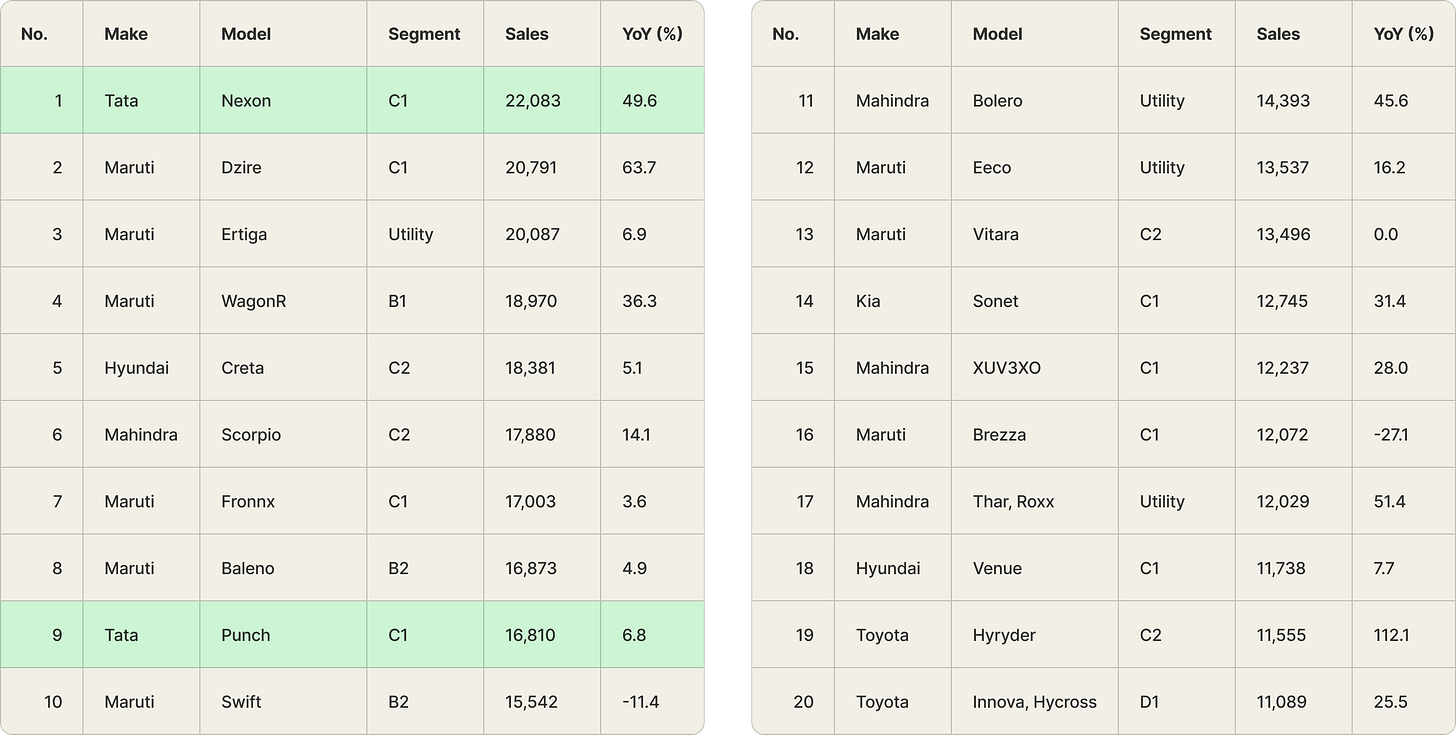

Look at the table below. Tata rules the compact SUV (C1) segment with the Punch & Nexon. But, when you look at SUVs (C2), the Hyundai Creta & Mahindra Scorpio rule the market.

Let’s understand this better.

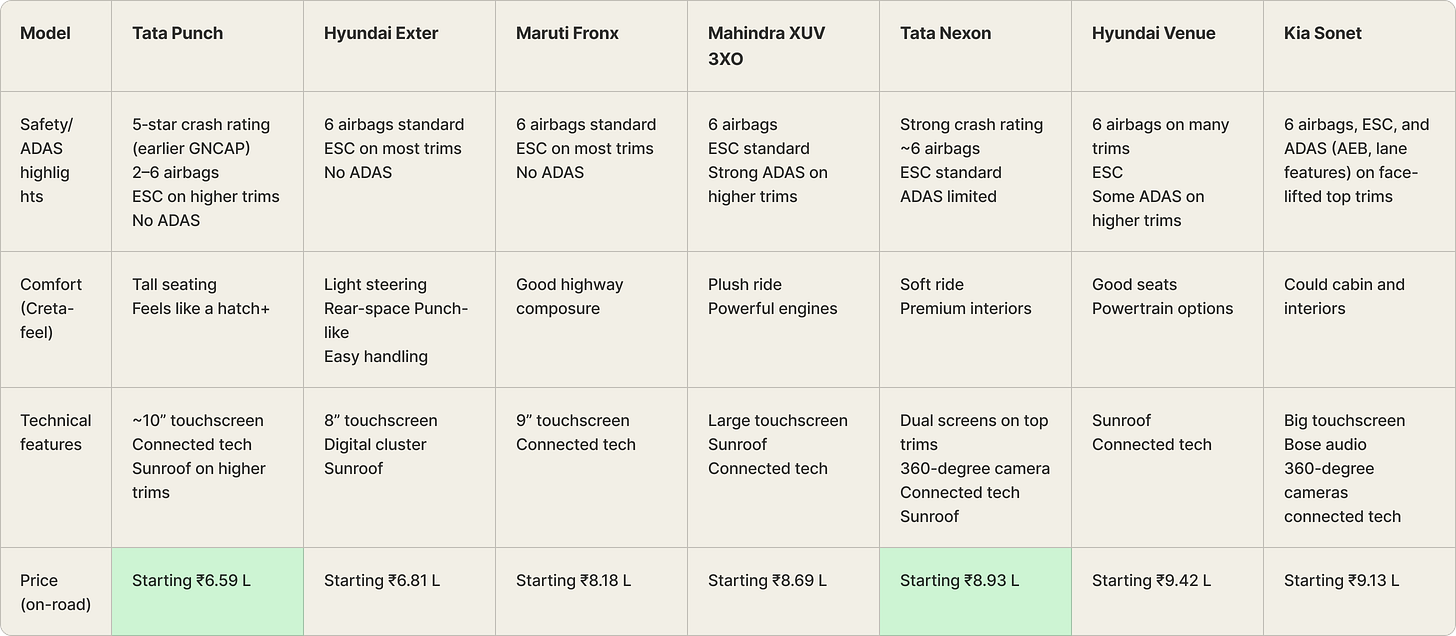

For a moment, let’s compare Compact SUV (C1) options between ₹5L to ₹8L. We’ll compare the features people love in the Creta (one of India’s highest-selling vehicles) for reference.

The Punch positions itself as a premium, feature-rich hatchback. In contrast, the Nexon positions itself as a safe, family-oriented SUV with premium features at a good price — something most Indian families want from a car.

But Sierra is not built to compete with Nexon or punch categories. It competes with the full SUVs (C2) ,which are above 4 meters in length, which brings to the mean of “Why Sierra?” and “Why now?”.

Tata’s Creta killer.

Before we get into the how, let’s see why the Creta has a 9-year stronghold over the SUV market. When the Renault Duster left the market in 2016, the Creta immediately stepped up and captured its market share. Ever since, the company has offered feature updates relevant to the Indian market at a reasonable price. No other player came close — until now.

The Sierra is a roomier, more premium-looking vehicle that offers the same driving experience at a slightly higher price. It can sway people looking for comfortable family SUVs and also fans of the original Sierra, eating into Creta’s market share.

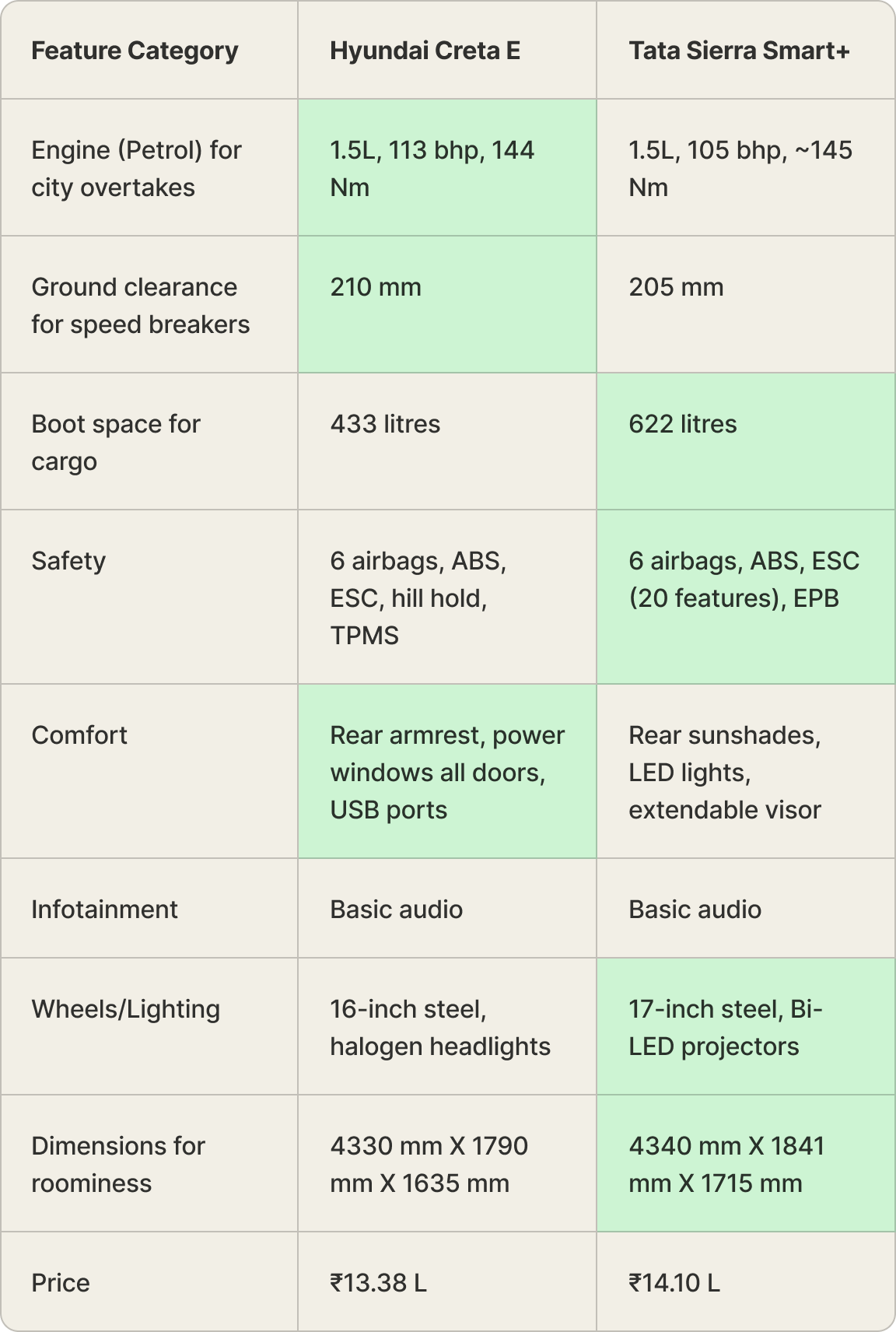

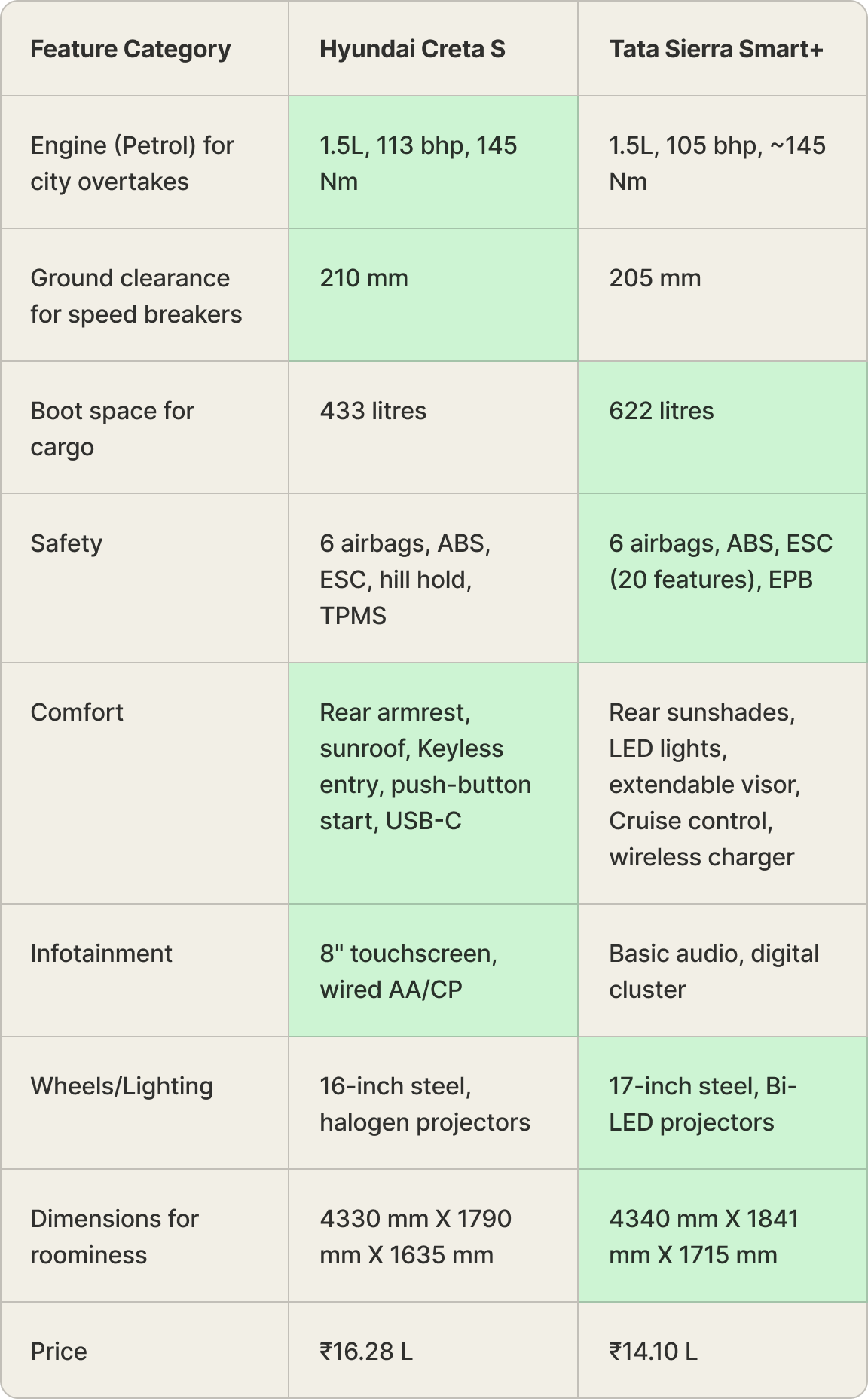

In fact, despite Hyundai Creta’s extensive model options, the Sierra holds its ground. A Sierra Smart+ (base variant) offers a similar driving experience and a more stylish design than a Creta S (middle variant). Take a look.

What does this tell you? Tata wants to go after the most profitable variant of Creta (the middle variant) and eat that share with Sierra. Interestingly, we think Sierra could have been slightly priced higher because consumers perceive expensive = quality while buying cars.

Tata now has a car at every price point.

At first glance, the Curvv & the Sierra might appear to be priced a little too close — and you are right. If you look at the numbers, Curvv sells about 3,000–5,000 cars per month, while the Creta averages about 15,000–16,000 per month. Curvv has failed to gain market share, which is why Sierra is the next bet. Whether Tata wins this bet or not, only time will tell.

That’s all on the Sierra story. See you in the next one.

Smart move targeting the Creta S middle variant instead of going head-to-head with the base model. The Sierra's value prop is clear because mid-range buyers are less price-sensitive and care about featurecompleteness. I test drove both last week and the cabin space diffrence is noticeable, but Tata needs to fix the after-sales reputation if they want buyers to stick around.

Even if this is a paid article, it is super well researched and the details are supeeee!!