Why Bed Bath & Beyond filed for bankruptcy 💸

The fall from $12 billion peak revenue.

Welcome to the 144th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,300+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

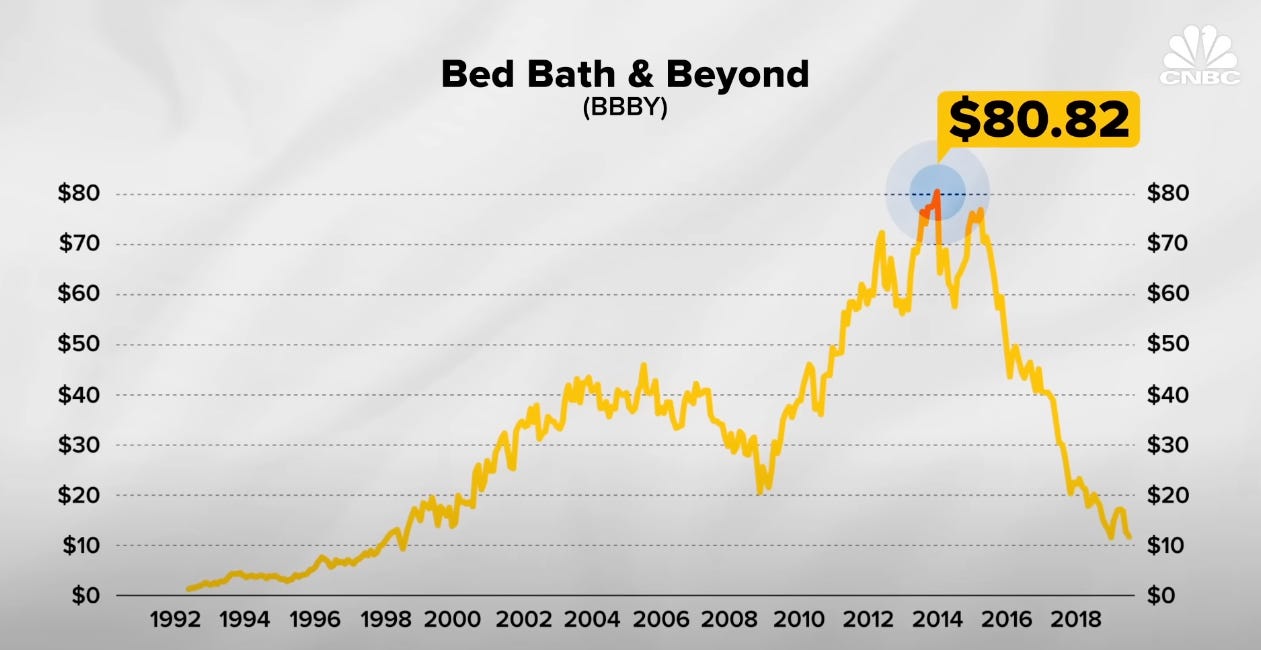

1992 : Bed Bath & Beyond went public ✨

2018 : It’s revenue peaked at $12 billion 💸

2023: Filed for bankruptcy, here’s why ⬇️

Quick context 🗓

Founded in 1971 as Bed n’ Bath in New Jersey with a single store, it expanded its categories into 1500+ stores. The American big box store specialises in home textiles, housewares, decorative home accessories & speciality items.

Everything was great until it wasn’t 🥺

Post going public, it had some amazing years of strong profits that allowed it to scale even in the public markets. It’s stock peaked around 2014 (went from $1.13 on listing day to $80 at it’s peak).

So how can such a succesful company go bust in a matter of few years? The lessons are critical for founders building legacy scalable companies, especially in India.

Why did Bed Bath & Beyond file for bankruptcy? ⬇️

The reasons go in-depth of why short successes do not guarantee long term value generating businesses. You might think - how can they make these mistakes but everything is white & black in retrospect.

1/ No consistent leadership 🌨

It had 8 CEOs in span of 20 years. Most spent only few years - sh*t hit the fan when their CFO committed suicide by jumping off a building. He had been named in a $1.2 billion “pump-and-dump” lawsuit by BBB & others.

2/ Didn’t solve for margins 💰

The BBB store managers used to procure goods, no national purchase division. This ate into BBB's margins as it wasn't sourcing directly from brands.

This is nuts considering the company was so scaled to legit create a sourcing division and still be massively profitable. It’s just lazy execution & unnecessary decentralisation.

3/ Confusing product selection at retail store 🛒

Speak to the regulars at the store & they will tell you - even mixers have 18 different varieties. It’s too much variety that used to be crazy confusing - leading to walk-in customers buy online at a competitor website.

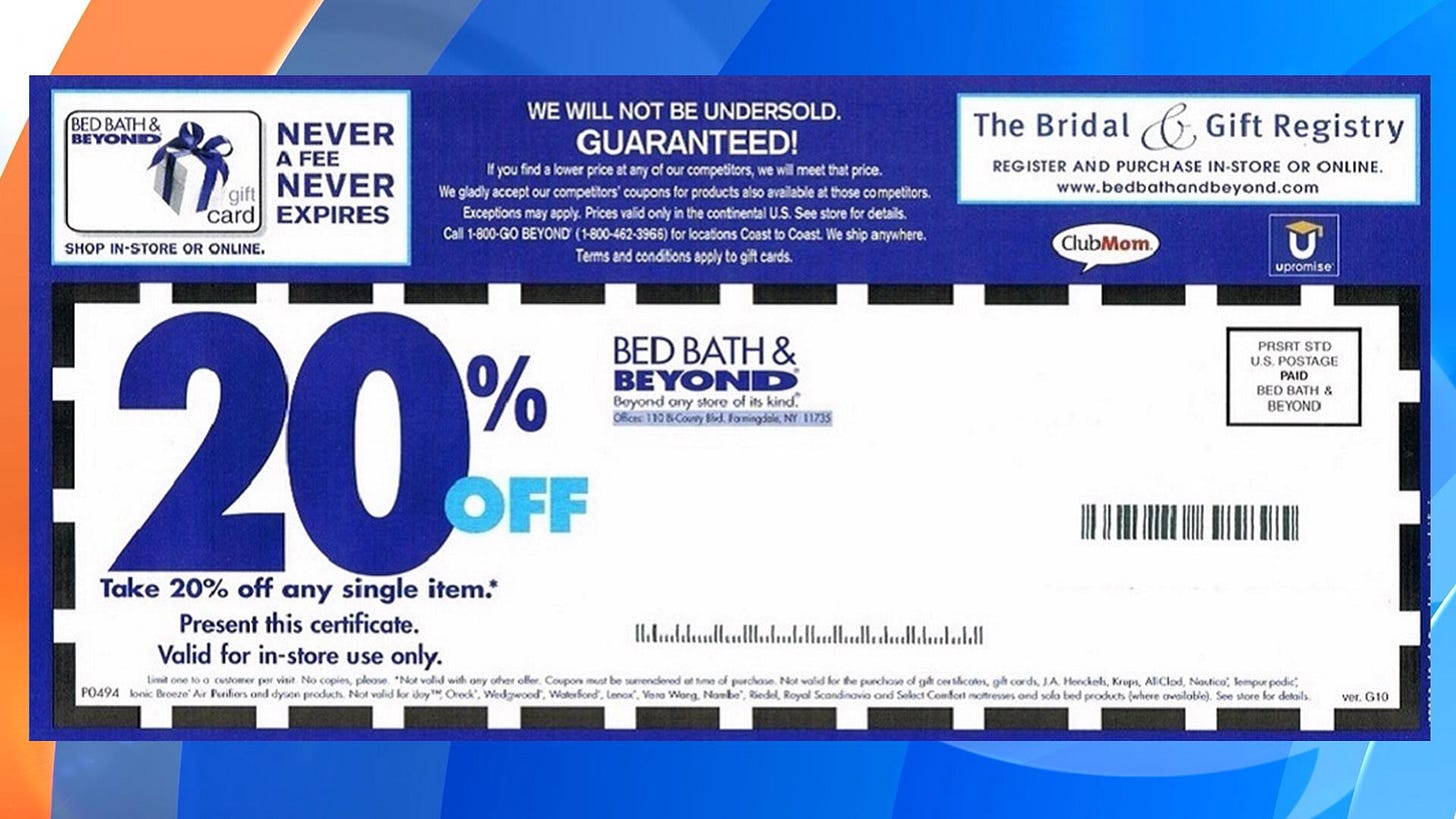

4/ Discounts & easy returns led retention ☠️

Flat 20% discount was always on. It killed the pricing. Most stores allowed expired coupons to be claimed. Customers never purchase anything without a coupon. When the brand reduced coupons in 2019, the business shrank massively. Plus, super easy returns created an unfit to resell inventory problem.

5/ Failed acquisitions 😵

What happened to Quikr in India with random categories happened to “BBB”. The leadership acquired companies left right and center, some of the companies were acquired just cause the founders were related to BBB leadership. That’s conflict of interest raised to infinity.

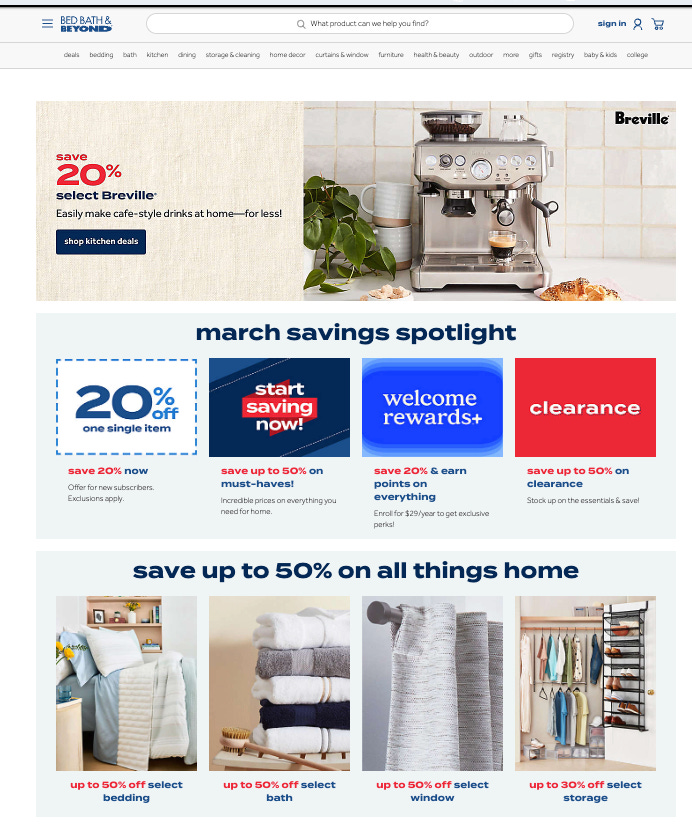

6/ Missed the e-commerce opportunity 💔

It never made online shopping as it’s core channel of distribution. The website sucked big time & it allowed Amazon to it's share in broad daylight.

That's was the BBB bankruptcy story 😞

One of the core reasons businesses of any size fail is “revenue growth”. There is no fundamental truth than “always be growing revenue”. As a founder, employee or investor - your job is to help the product generate more and more revenue while protecting margins.

And, learning revenue led growth is critical 💰

Most founders focus on distribution & keep revenue generation on the back burner. Don’t be one. Understand the nuance and be structured about it.

Learn the science of revenue led growth ⚡️

At GrowthX, we have helped over 2000 founders & leaders in India solve for a structure to revenue led growth. If you want to build a sustainable revenue led business, this is the tribe you should be spending time with.

How Ashwin cracked a senior growth role at Line 💙

Ashwin Pavery (GrowthX member since 2022), just joined Line as a Senior PM. He went from being a marketer first to now leading a functional product. What stands out? First, the Talent Team at GrowthX helped him crack the role. Second, his transformation from an Operator to a Senior PM in 5 months, has been game-changing.