Failure insights from Nokia, Kodak, Yahoo & more 🙇🏻

Do you remember your Blackberry (BB) pin? Us neither!

Welcome to the 63rd edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Most startups do not have capital leverage.

Speed is the only leverage.

Speed comes from understanding user insights.

And then shipping experiments at lightning speeds.

But when startups grow older, they forget experimentation.

Today’s issue covers most loved brands that failed to experiment & innovate on time and were ruthlessly asked to leave the market

These are insights 🧠

From top tech plays in the last few decades. Surprisingly, lack of experimentation at these companies wasn’t because of money / resource crunch.

These were driven by the idea that if they have made it so far, no need to worry about smaller products popping around and getting micro-market share. But, always, remember - you too started small & got this far.

If you are someone who want to learn the process of picking the right problem statements (especially on growth), prioritising & tactically running experiments, GrowthX is the community you should be spending most of your learning time.

Nokia 📱

In the early smartphone and mobile days, Nokia was a market leader. In 2007 alone, the brand generated 51 billion euros when brands like Apple & Samsung were no where close it. But as people moved to lighter phones with more applications, Nokia stuck to its traditional handsets that weren’t compatible with the burgeoning trends.

What happened?

Nokia missed the bus on android completely. They stuck to Symbian OS & did not even experiment with android to see if they could gain much larger market share on android. The love with their own shitty software doomed even the hardware side of business.

The insight 💡

Don’t let your sunk cost (in Nokia’s case their own software) get in the way of running experimentation on newer trends. You can always scale back the new experiments if you don’t see an ROI. But not running the test in the first place can be lethal.

Kodak 📸

Literally an industry juggernaut, Kodak owned 90% of film sales, & 85% of camera sales in the 70s and is nowhere to be seen today. How come? It’s not like they did not innovate, but they killed its own growth.

What happened?

Kodak invented digital cameras in 1975, but worried that it would kill their photographic film business stopped the production. In fact, they helped Apple build their QuickTake digital camera in 1994. And soon enough, from 85% they went to 7%. Sticking to its traditional ethos, a visionary and innovator like Kodak, died a fast death.

The insight 💡

Ask this question to your team every once in a while, what product innovation we can do that will disrupt our current business? Can we ship 30% of our bandwidth onto building such products/ features/ experiments?

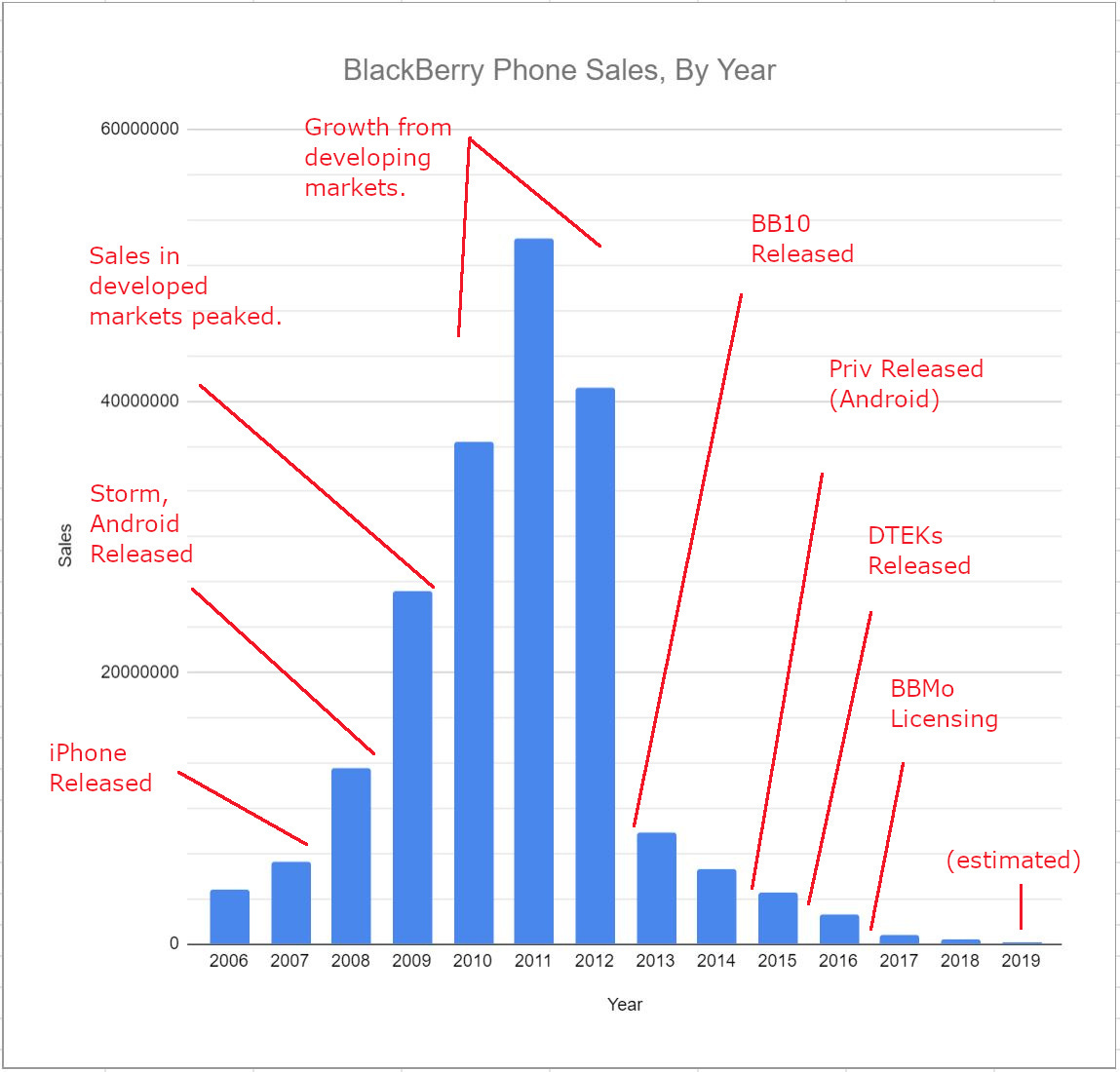

Blackberry ⌨

Another plea in the mobile phone industry, at one point in their journey, BlackBerry enjoyed a 50% of the US market share. BB’s claim to fame was their 2008 low-cost model called Gemini that became an instant hit & their BBM messenger was like crack to millennials.

What happened?

The biggest mistake by BB was to restrict their app stores & only maintain focus on their core services (arched keyboard & BlackBerry Motion). While Apple (iOS) and Android (Samsung) opened the avenue for developers across the globe, BB had a very small pool of apps to offer. And in no time, they were out from the market.

The insight 💡

Most of the time, business leaders pay more attention to what is close to their heart vs what users value the most. Software brings distribution to hardware. And distribution almost always wins. What are few features of your product that can bring distribution? Go experiments on them.

Yahoo 🔍

It’s painful to write this because we all LOVED Yahoo - our first email address or the chat rooms, the product was the rage in the early internet days.

What happened?

Search is a monopoly business. You either buy / kill / keep up with the competition. Yahoo was slower to understand and experiment on who is it solving the search queries for. It solved for the advertisers in turn giving the search share to this new kid on the block called, Google. On the buy side, they passed the opportunity to Google & Facebook. Once valued at $125 billion, Yahoo was recently sold to Verizon for $4.83 billion.

The insight 💡

Make a conscious call. Is your product additive or substitute to the user’s time or wallet? If it’s substitute - you need to be in rapid experimentation zone that will keep you out of the red ocean battle zone.

So remember 🧠

It’s not the lack of resources that will make your product obsolete, it’s the intent to take those experimentation efforts & risks. If you are someone who wants to build the craft of experimentation, you know what to do by now.