Inside State Bank's ₹50,000 Cr profit 🤯

The largest bank in the country turned a cash cow.

Welcome to the 178th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,200+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

SBI made a profit of ₹860 Cr in 2019. In 2023, it shot up to ₹50,232 Cr. What’s core behind SBI’s massive scale and more importantly how did it come out of recent losses - a lesson for anyone building fintech in India ⬇️

Some numbers 🗓️

State Bank of India is the largest public sector unit bank (& probably the oldest) in India with ~22,266 branches and ~ 47 Cr (470 million) customers. But, the fascinating part is how Profit Per Employee went from ₹33,000 in 2019 → ₹21,22,640 in 2023 - no more jokes on SBI employee(s) please.

Let’s step back to 2017 🕥

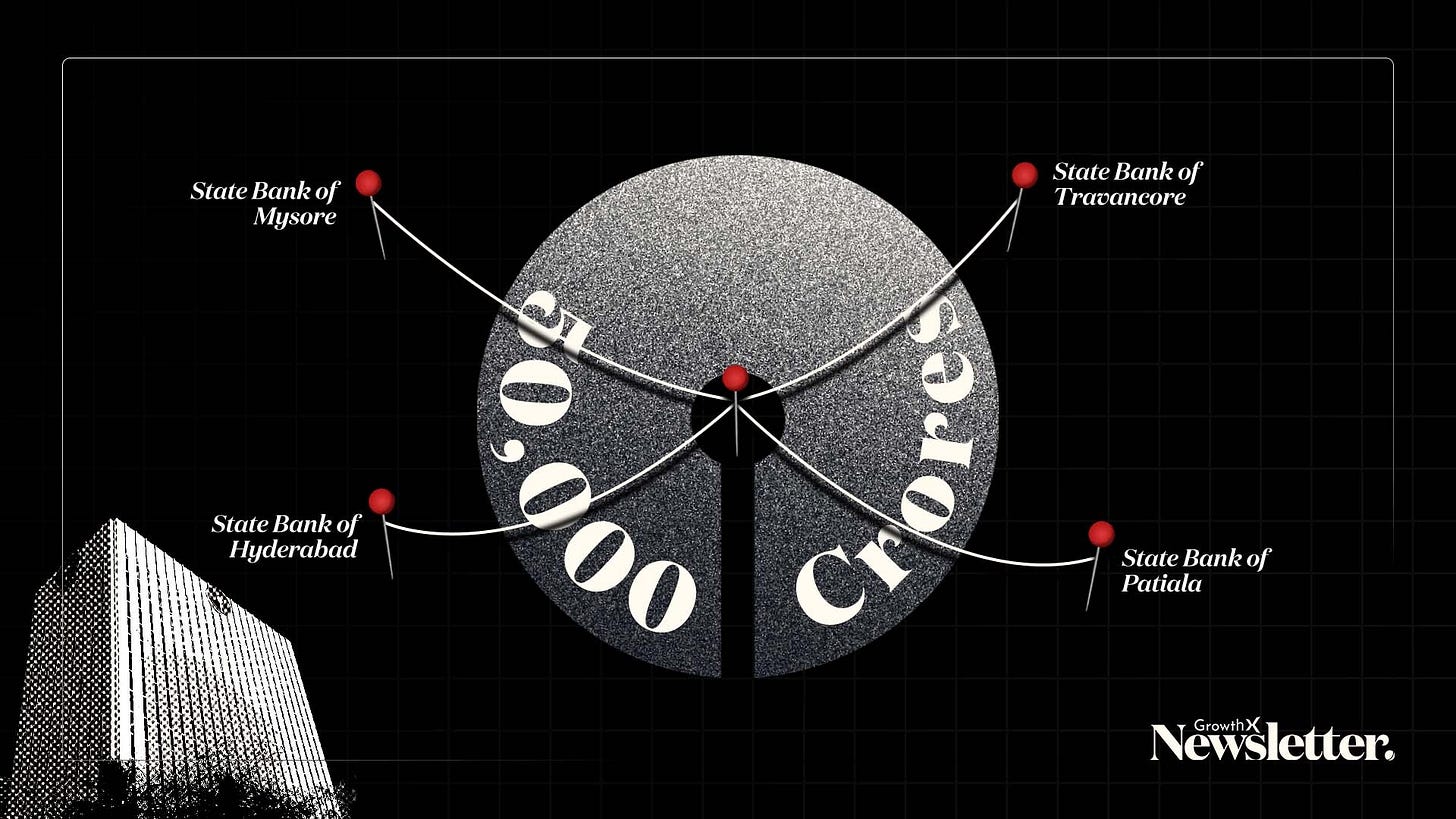

Back in 2017, SBI merged with a couple of banks particularly State Bank of Bikaner/ Jaipur/ Mysore/ Travancore & a long list. It made this move to reduce effort & things did go south - SBI had ₹65,000 Cr worth of bad loans in the acquisitions 😔

Bouncing back to profitability 💸

The journey of SBI going from ₹860 Cr → ₹50,000 Cr is a mix of digitization, India growth story, mergers & acquisitions working out & there’s more. I will try my best to paint the picture - let’s go.

Highlights in SBI’s ₹50,000 Cr Profit 👇🏻

1/ Retail personal loans are LIT 🔥

The post-pandemic period drove personal loan product adoption - 20% growth at a category level & SBI capitalized on the tailwind with its app - YONO. Don’t assume the 15% is a small number - the denominator here is massive.

Xpress loans (SBI’s quick personal loan product) alone saw a YOY growth of 22.72%, enabling SBI’s personal loan portfolio to cross 3 lakh crores - mad growth.

Interestingly, every 1 in 5 personal loans in India for the first 6 months of 2023 was taken for travel related expenses - we are becoming a consumption economy.

2/ Everyone gets a home 🏠

The pandemic redistributed the urban population to their native Tier 2+ cities. Momentarily, it made them choices they wouldn’t otherwise. Some of the temporary migration led to making emotional choices of building a house in their native towns. No wonder it has a cascading effect on SBI’s home loan portfolio. SBI added about ₹800 Billion to its home loans across Tier 2 & Tier 3 cities.

SBI’s distribution is like electricity - its everywhere. Partnering with housing finance players definitely helped but it still made most of the housing revenue from it’s own branch offices. No wonder the Zerodha founders thinks that’s what will drive adoption for the Zerodha universe of products.

3/ India is in the car race 🚗

India is still a highly lucrative market for car ownership considering there are only 22 cars per 1,000 people. Compared with China’s 200 cars per 1000 people, the Indian automobile industry has barely scratched the surface.

For SBI, Auto loans alone grew by a whopping 23%, taking SBI’s portfolio to almost a a lakh crore. All thanks to direct partnerships with car manufacturers, and building self serve model with ‘SBI easy ride’ - digital product for availing two-wheeler loans completely online.

4/ Domestic Investments FTW 💰

Profits from SBI’s investments alone brought in 70,337 Cr to the top line. The fascinating part is that 96% of these investments are made within India. The GDP growth of 7.2% with strong domestic consumption paid off incredibly well.

5/ Tech-first approach to reduce operating costs 🏗

Over the last 5 years, SBI’s operating costs only increased by 25,000 Cr while the net income earned increased by 100,000+ Cr. This is because of SBI’s active calls to scale the business with tech. Some mind bending stuff is happening here.

64% of the 1.24 Cr regular saving accounts were opened through SBI’s digital app. It introduced real-time pre approved loans that can be availed by sending an SMS. Plus, the whole pre-approved business loan product saw a massive 1076% growth with the YONO app.

Some reflections from the SBI story 🇮🇳

We keep shitting on our largest institutions all the time - I am no exception. These huge organizations require an extremely high level of conviction from the leadership. Kudos to the thousands of SBI employees and leadership that have turnaround the whole ship. When large corporates think and strategize like new-age businesses - magic happens & it’s repeatable/scalable/ defendable. Excited for SBI’s next chapter.

SBI’s growth is extremely important for every startup 🥹

We don’t realise this but India’s largest banks succeeding is very important for the whole startup ecosystem. For one, it builds trust across the financial well-being of the country attracting outside investment but more importantly - it allows access to capital at fair rates in VC/ equity markets because banks keep business loan rates in check - think why invoice financing competes with VC world.

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.

If you liked today’s article, you’ll love these 💙

Are you building a real Dhanda? 🇮🇳

You will have either of the 4 problems - access to capital, building the product customers want, and being able to distribute your product at scale. Oh and ensuring you are able to monetize. Trust me, it’s a science more than art. Go to the rabbit hole to see how 600+ founders are figuring out the science to grow revenues.

What is interesting is sbi serves the pm Jan dhan account holders as well as big business. It is there in rural areas as well as in metros. Its leadership so far has been able to balance these various roles deftly. Going forward these challenges will become more demanding because the catch up is now to be with China

The SBI story is an example of what a cutting-edge leadership which is confident of its potential can achieve with truly domestic talent and resources. It has built a model which is strong and can be used for scaling up. As the nation grows, SBI may have to lean more on new age technologies and IT's frontiers to provide the ballast for India's resurgence.