How is Meesho winning India 2.0? 🇮🇳

The underlying "right to win" for the 3rd largest e-commerce.

Welcome to the 174th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

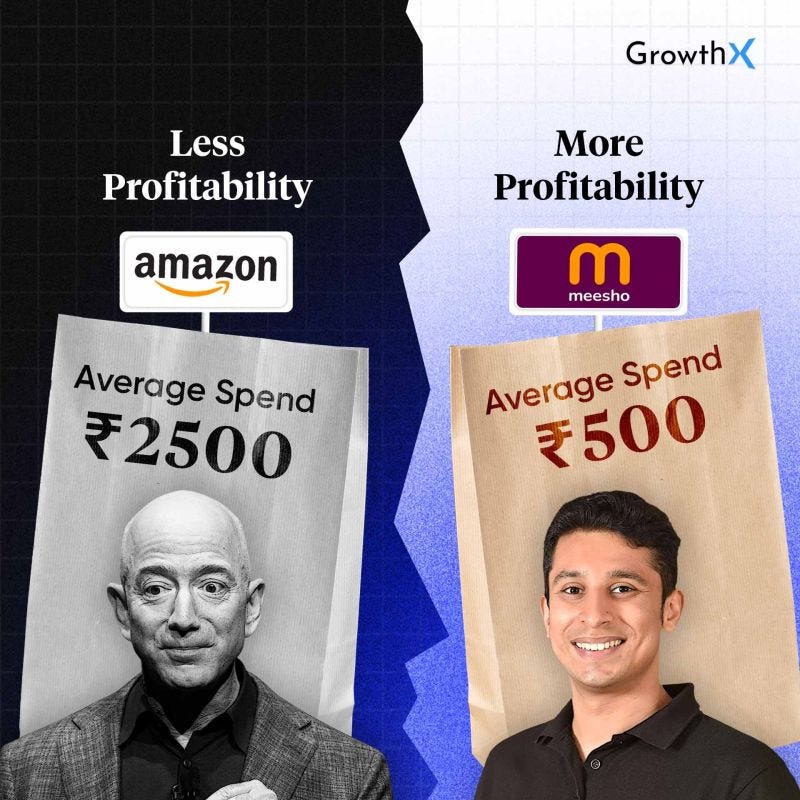

Flipkart/ Amazon's AOV is ₹1.5K to 2.5K 💰

Meesho's average order value is ~ ₹500 🔻

But, it's profitable & it's the silver lining ⚡️

Meesho, the shopping app for Bharat 🇮🇳

Starting in 2015, Meesho did multiple pivots from B2B2C to B2C in the last 3 years to become India’s 3rd largest horizontal e-commerce player. It's the only profitable e-commerce player in India and that's the important context.

Why Meesho’s profitability is so important? 🤷🏻♀️

1/ Most players have died except a very few 🥺

From ShopClues to Snapdeal. Either most have scaled down massively or have completely shut shop. It's a graveyard of 10s of marketplace companies.

E-commerce in 2010 was early to the market with the absence of internet penetration + payment infra (UPI) & lack of per capita income (spending power). Meesho’s revenue growth is so built on UPI.

2/ Online commerce is burning cash 🔥

Flipkart burnt over USD 3.7 billion in cash in about a year till September 2022. The company, in July 2021, raised USD 3.6 billion (about Rs 29,000 crore), which has been completely exhausted, according to regulatory filings.

While Flipkart's promotional expenses were alone 1,946 crore in FY22, Meesho managed to get its marketing costs down by 80% and tech costs by 60% over the last year - and maintained revenue levels.

3/ Extremely limited funding (Until COVID-19) 🙇🏻

Early-stage investing was thin for anyone trying to build an e-commerce marketplace. This is true especially if you’re building for colder markets like tier 2+ cities. While the data pointed to clear market growth for Tier 2+ cities, COVID-19 accelerated the game and gave Meesho a fresh supply of funds.

4/ Profits are a “must” for going public (IPOs) 💰

One of the reasons PayTm IPO went south at the start (and boy they have recovered so well) is the whole loss-making perception by retail investors. Meesho's profitability puts it in a comfortable spot for the coming IPO.

An 8000+ org pivoting from a ‘growth at all costs’ to ‘profit first’ before IPO proves that the ecosystem has matured & truly understood what sells in the public markets.

5/ Customer retention is winning ❤️

Of the 1 Billion orders Meesho fulfilled, 85% came from returning customers - it's mind-blowing. Retention & the frequency of ordering beats marketing to new customers every single day.

6/ The right tone for Bharat startups 🇮🇳

Meesho is the poster child for anyone building for Bharat Janta. When Meesho achieved profitability last week, it set the right tone for thousands of startups following in their footsteps on similar customer profiles.

But, it's still the beginning for Meesho and the whole Bharat category. As we brace toward the $7 Trillion economy, e-commerce today will look like a dot before the exponential trend line. Pumped to see Meesho succeed in the Indian stock market.

We were wrong about GrowthX

When Udayan (Co-founder, GrowthX) & I started discussing growth problems with the Bengaluru ecosystem, we used to think it was just a Bengaluru pop culture- discussing startup ideas, problems in scaling, hiring the right team and running large teams for real "Dhanda".

We were DEAD WRONG.

If I take a look at the applications we get every immersion at GrowthX, it's from over 50+ cities & Tier 2 towns. These include founders with seasoned operator experience, leaders who have led large teams and operators who are impacting really large revenue lines.

Let's get to some facts right 🤯

- 2500+ members

- 1,800+ plus internet-first companies

- 80% of top 100 internet company leaders

- 20% first/second-time founders

- 35% product leaders & mid-senior operators

- 40% of members with 8+ years of work exp

- 20L median salary, ~15% with > 50L salaries

- 75% of members active weekly

- 100% changed their social circle

Joining GrowthX increases your surface area of luck honestly 🪄

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.

Abhishek - there is no evidence that Meesho is making money ? And what is helping it to win the Ecom Battle ??