Behind Swiggy's private label brand🧋🍟

Amazon's "Cloudtail" playbook repeats all over again.

We’re 8 days into 2026.

How’s your ‘getting good at AI’ resolution going?

Building that first AI project is the hardest part. Show it online, and you have a hundred people judging you. And if you don’t, poof, 0 feedback, 0 progress.

We’re building a safe space for the AI-curious folks at GrowthX. Weekly live sessions, private conversations with over 5,000 AI leaders at top companies - Meta, Google, Lovable, Sarvam & ElevenLabs — a vetted community that’s literally building with you.

Today’s edition

In 2025, Indians bought 4 milk packets every second on Swiggy’s Instamart.

What’s crazy is that buying milk online wasn’t a thing we did 5 years ago. Today, you can find the same milk packet on Swiggy Instamart, Blinkit & Zepto, and BigBasket; get it fresh AND at the right price every single day.

Quick commerce has truly exploded.

But every major player is losing money.

Swiggy lost ₹1,896 Crores.

Zepto lost ₹3,367 Crores.

Blinkit lost ₹474 Crores.

All 3 want to cut losses.

There are 2 major ways to make a profit, & trust me, it’s not delivery/ platform & all those random fees. It’s advertising & private labels. Swiggy has picked up both. Here’s a crisp 7-minute read to deeply understand how Swiggy will get the profits.

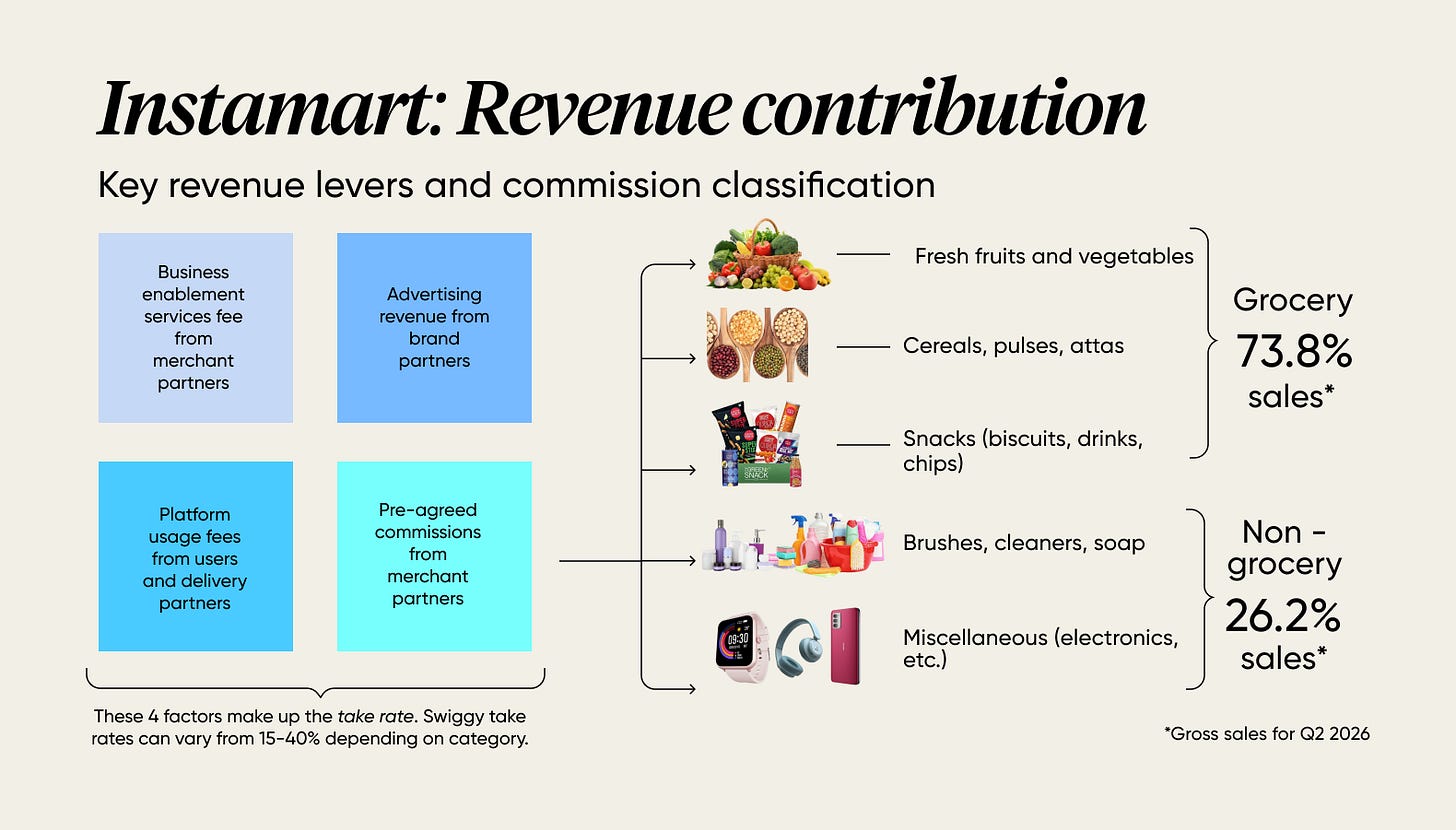

Before we get into the private label insight, let’s understand where Swiggy’s Instamart makes money. Spend a few seconds looking at the picture below.

Swiggy earns a small fraction of every order placed on the platform. This is the take rate. So, for example, when you buy items worth ₹1,000, they broadly make 7% to 12% based on what you ordered. Groceries, especially fresh groceries, have a lower take rate (lower commissions). Electronics? Higher order value & higher take rate (higher absolute margin ₹).

The problem?

Users buy groceries way more often than electronics. So the Gross Order Value (GOV) and average take rate for every order stay low. This is a problem, think it from Swiggy’s POV — on a ₹1,000 grocery order, they barely make ₹70 to ₹100. I can tell you from experience that this won’t even cover delivery partner payouts, discounts & dark store costs. This has led Swiggy to take a few steps.

4 ways Swiggy’s tackling low cart value.

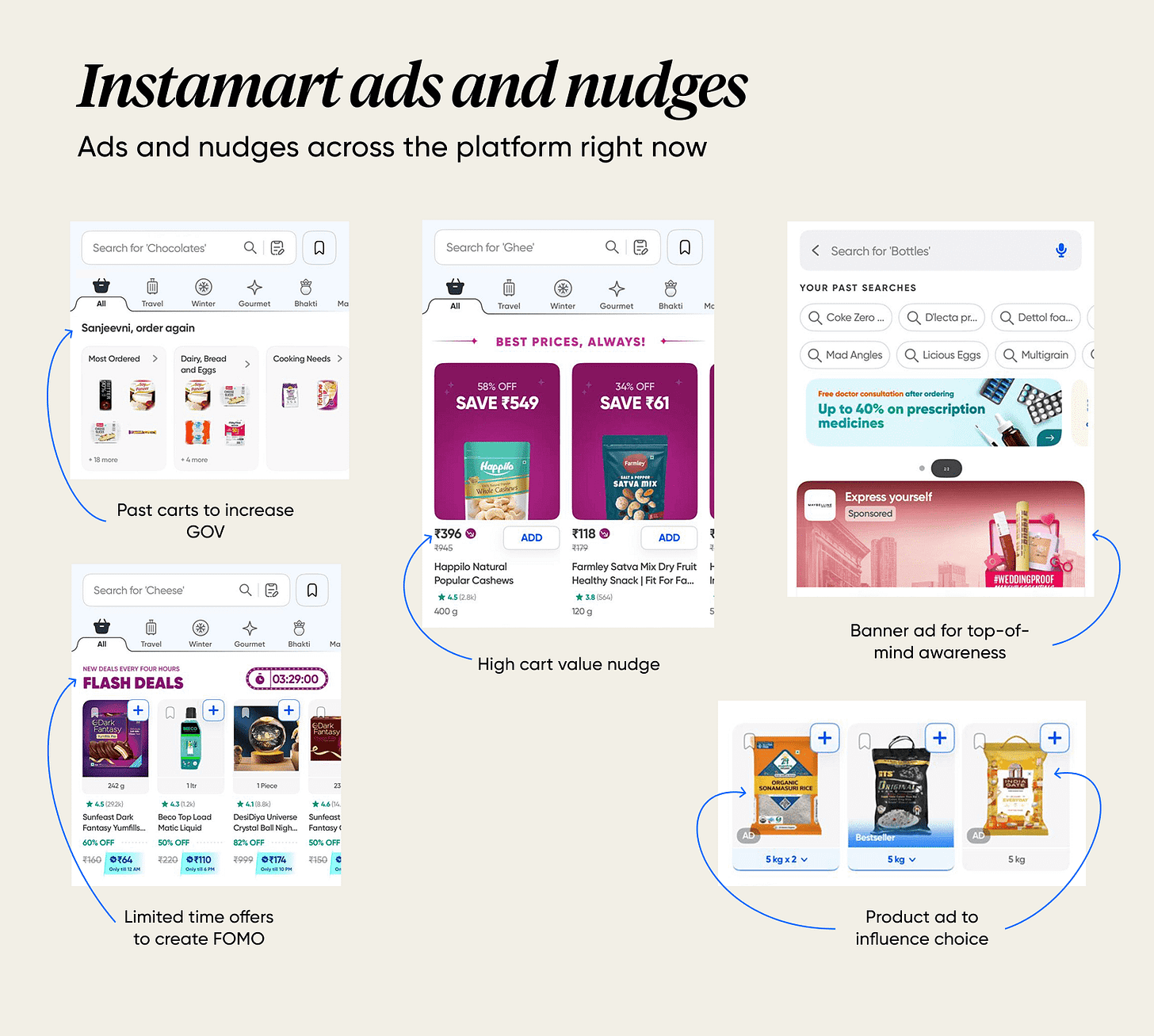

Advertising.

You see them every time you visit the app. On your main dashboard, whenever you search for a product, heck, even on the checkout page. The idea is to make money from sellers (the brands) who want market share in quick commerce.

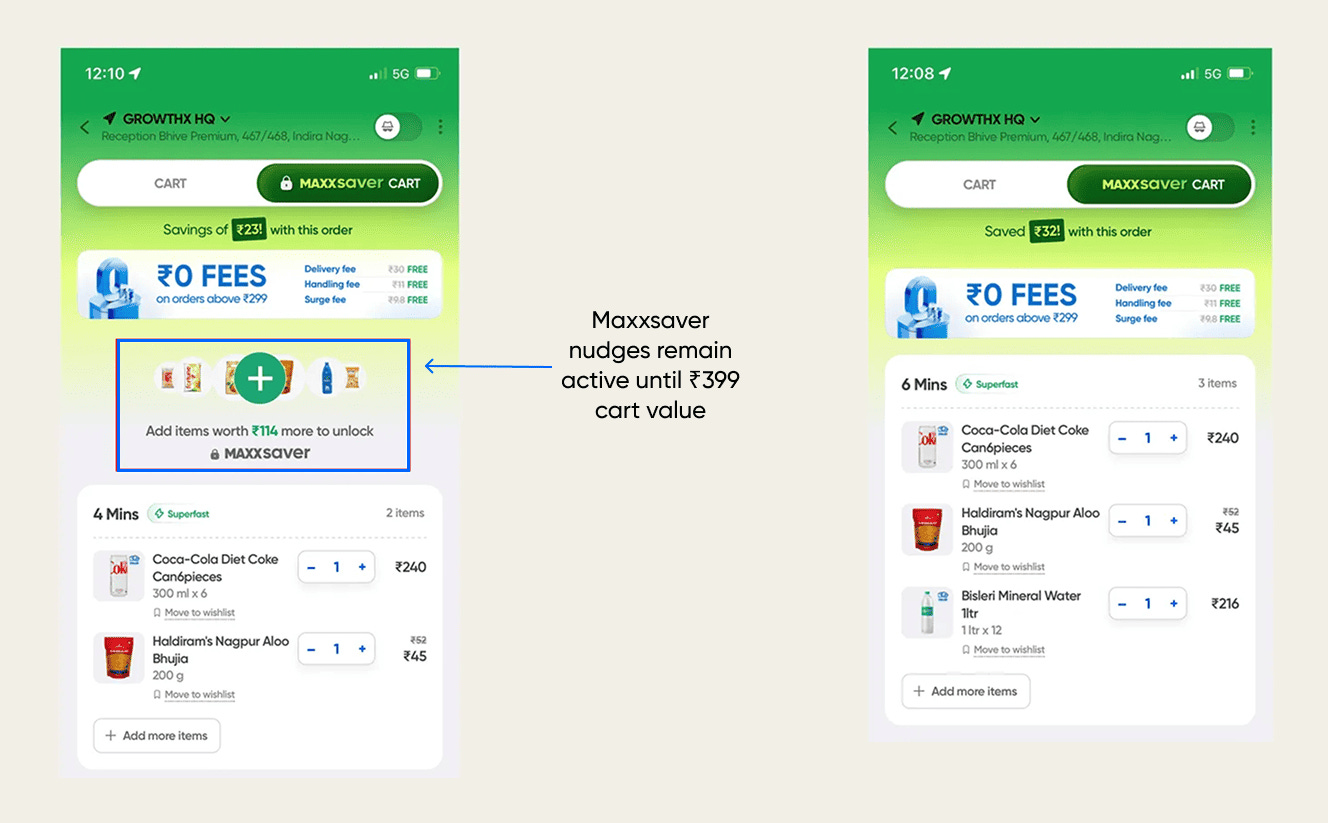

Maxxsaver cart

It follows the same principle as ads. Only, Maxxsaver is way more effective. In fact, officials credit Instamart’s 100% GOV growth in the last three quarters to Maxxsaver.

Why does it work?

Maxxsaver taps into a core Indian behaviour: the more you shop, the more benefits you deserve — in this case, discounts. The same reason our moms want free dhaniya every time they buy veggies.Minimum order value.

Question for you: Would you choose a q-commerce app with free delivery at ₹99 or at ₹299? Depends on your cart value. At ₹80? You'd pick the ₹99 option. But at ₹250? You'd probably add ₹50 more to hit ₹299 & unlock free delivery. This is a classic e-commerce strategy that Swiggy Instamart bets on.

Try speaking to someone in the western countries and you’ll learn that the minimum order values are super high compared to India. That’s a sign that Indian quick commerce is still far away from consolidation into monopoly / duopoly.

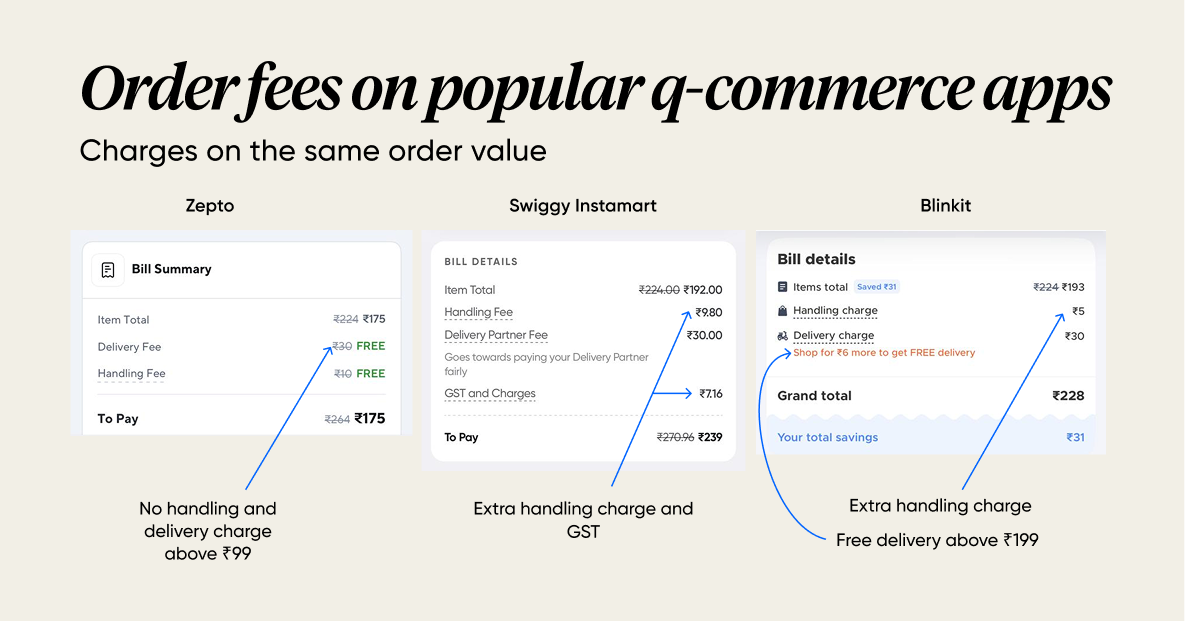

Higher miscellaneous charges

As you can see, Swiggy charges delivery, handling, and GST fees on top of the order value. Why? See, Swiggy must pay its delivery partners and maintain its dark stores. By passing some costs to customers, Swiggy keeps its economics in check.

But are any of these tactics effective?

Yes, and no. The business only works if customers keep coming back. And they're not for Instamart, at least not as much as competitors. Market share by Net Merchandise Value (actual value of goods sold after returns and cancellations) shows the gap. Blinkit’s market share: 52% while Swiggy (24%) & Zepto (23%). A strong perception here is that Swiggy Instamart is expensive than others for the same grocery items.

Enter Swiggy's private label brand — NOICE.

If you’re in quick commerce, you have to choose between pleasing everyone or running a business. Your consumers will always want the best deal. You’ll end up emptying your pockets to give them that — covering delivery costs, absorbing GST, or burning cash on discounts.

A classic example is Zepto.

They offer the steepest discounts but are drowning in losses & depend on investor funds to stay afloat. Even Blinkit, with a first-mover edge from acquiring Grofers and deep partnerships, isn’t immune. Its losses have grown 5X in just 9 months — margins are razor-thin.

Swiggy Instamart’s insight.

Quick commerce can’t be their sole source of revenue. So, it’s expanding into consumer products with Noice. So, what’s Noice?

Swiggy’s private label brand. Here, Swiggy partners with local food manufacturers to bring their products to market. Then, it slaps its own label on the products and sells them on the Instamart platform.

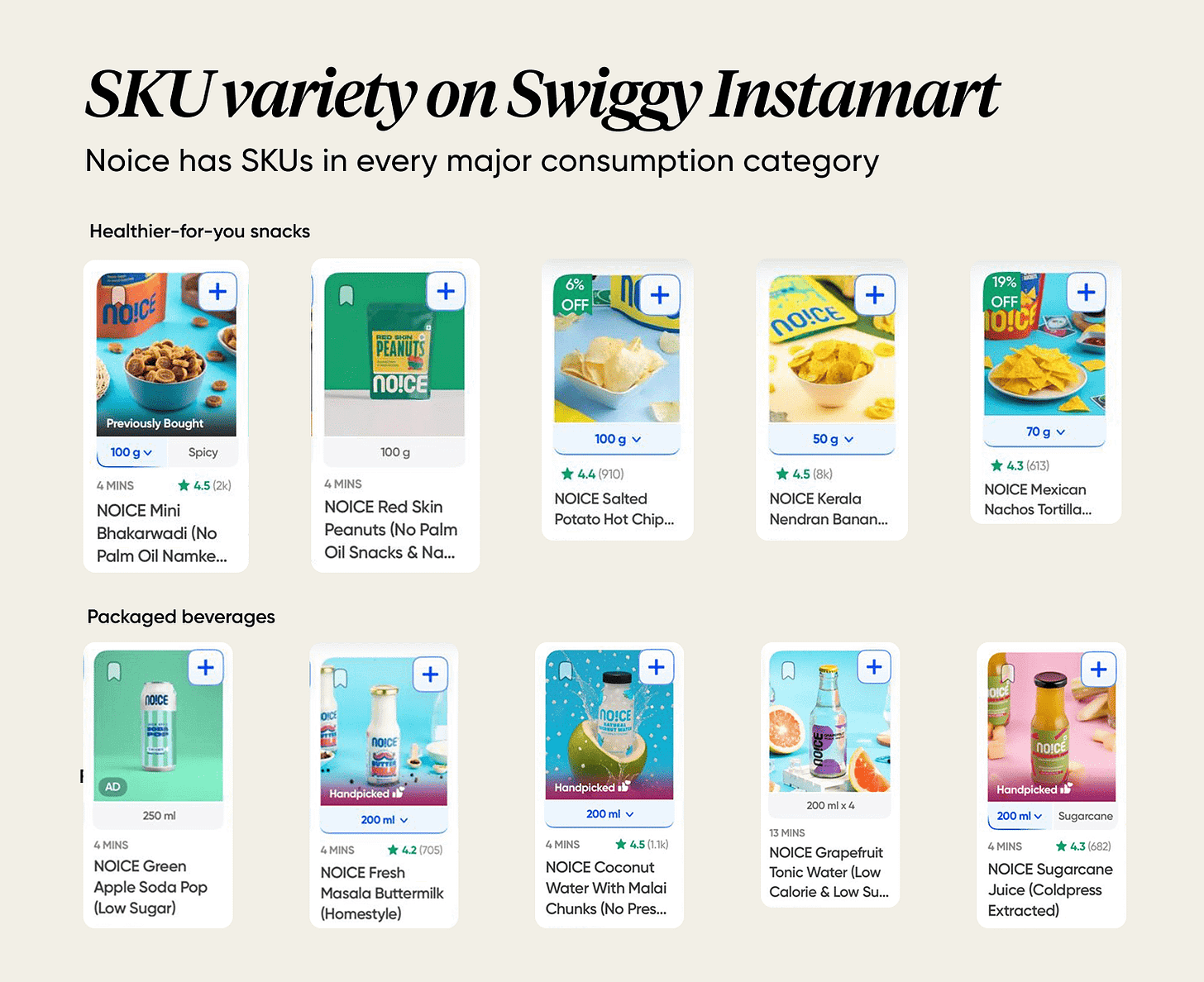

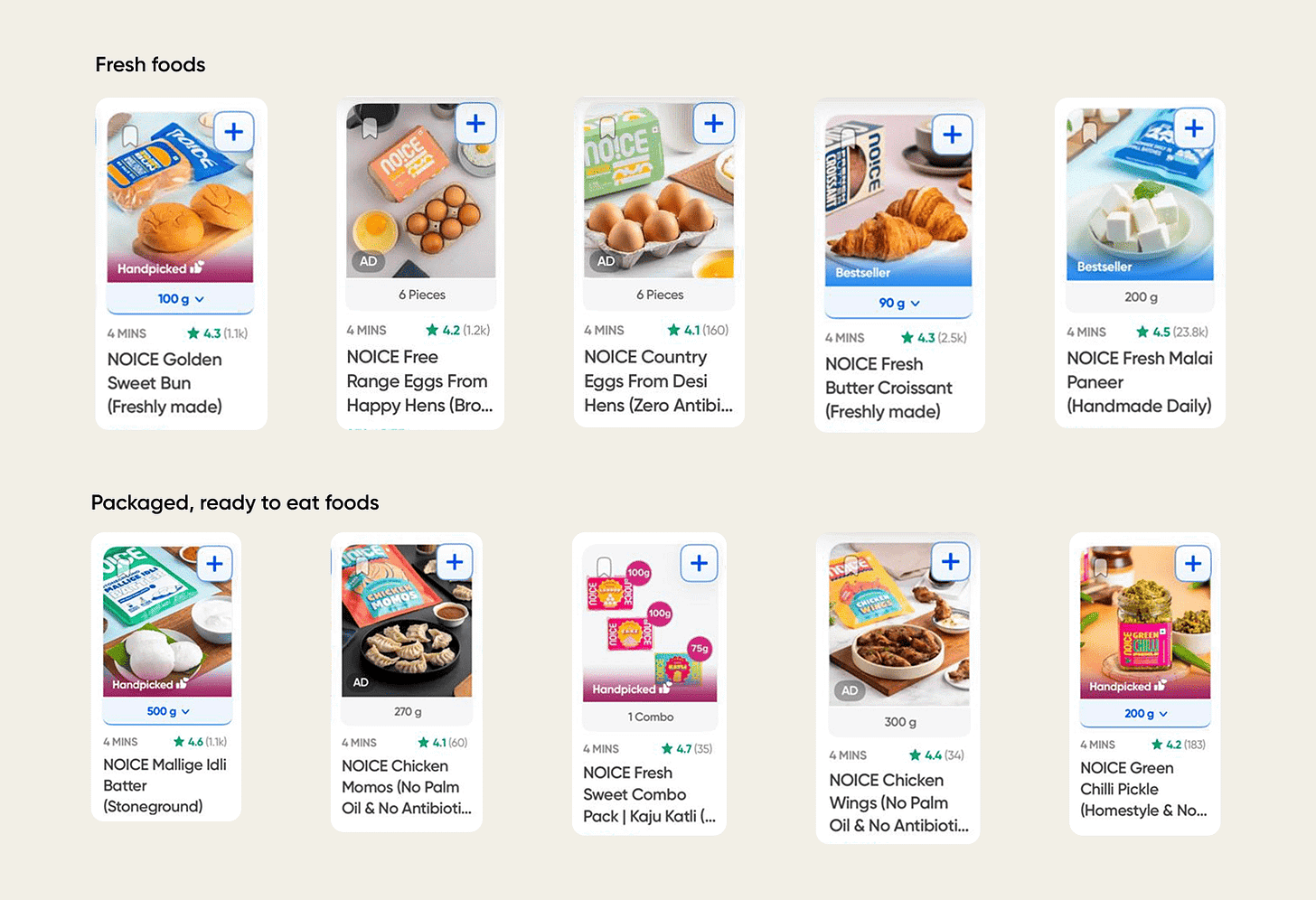

Search for homemade chips or kombucha, you will mostly find Noice as the first few options on Instamart. Noice is present in 40+ product categories.

Take a look at Noice’s product range above.

What do you see? A lot of their SKUs neatly fit into the snacks and beverages category. This isn’t by accident. Swiggy is studying customer behaviour on its platform & launching products based on hard data. The numbers back this up: snacks and beverages make up 32% of all q-commerce purchases.

And, snacks are high-frequency purchases. Customers order them in volume, too. That combination of frequency + large category share makes snacks & beverages the perfect entry point for a private label. There are two key insights here.

1. Private labelling is protecting margins.

They contribute 25-40% to the top line for modern trade retailers but nearly 80% to profitability. Those look like crazy figures, until you do the math.

When Swiggy partners with brands, those brands control pricing, shelf placement, and commission splits. Swiggy’s cut is small. Add in the costs Swiggy still bears like marketing, inventory & deliveries — and margins become razor-thin.

Private labelling helps Swiggy avoid this. By only looping in a manufacturing partner for cheap, Swiggy can do the branding, marketing, and distribution in-house and earn higher commissions. Instamart already has the platform and data to do all those things well.

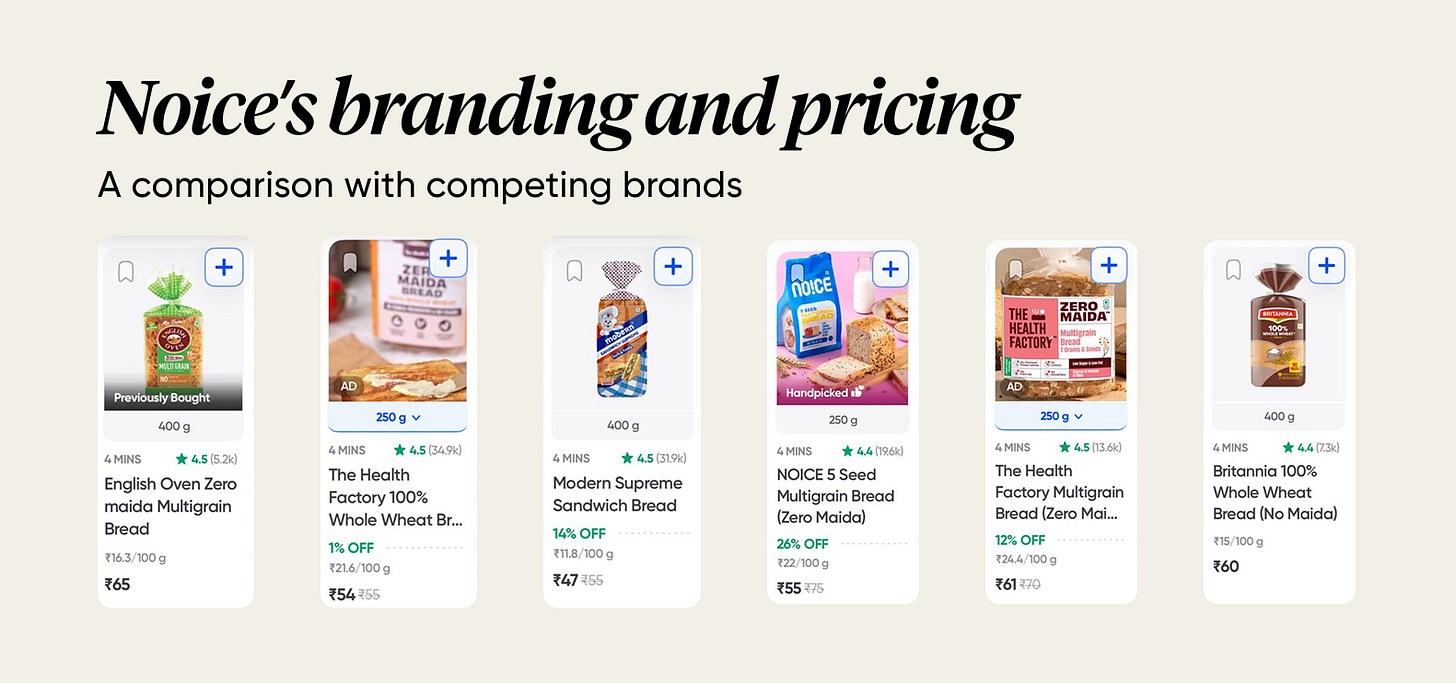

2. Nailing branding and pricing.

In retail, what gets seen gets sold. Look at Swiggy’s bread section. Noice stands out with distinctive, premium packaging — clean design and quality cues that position it alongside Modern or Britannia.

Here’s what’s interesting.

Swiggy isn’t playing the typical private label game (cheaper alternative to brands). Instead, Noice is priced at premium levels — right under the top-tier breads per 100g.

The psychology works like this: Premium packaging + premium pricing = premium perception. Customers see it as a status purchase, not a budget option.

The genius? Swiggy earns the full premium margin without paying brand commissions. They get premium pricing and private-label economics.

Noice’s reception is overwhelmingly positive. But can this private label take Swiggy Instamart to profitability? Only time will tell. We’ll keep tabs until then.

Seiously !!!

I think Swiggy Instamart is trying to place all it's product (Noice) at a premium category and they are exploiting the customers as they purchase from small vendors at a low price and sell them at premium price!!!

Loved the article but we should stop exploiting the “dhaniya insight” that Indian marketers think they have profoundly found on every quick commerce article/post