Behind Caratlane's ₹25K ticket size 🙇🏻♂️

The Tata-owned company that disrupted Indian jewellery space 💰

I’ve something special for founders who consume this newsletter - the Founder branding foundation. Be able to hire top talent, sell better & expands the surface area of luck for your company. Start learning for free today 💎

Back to the Caratlane Story ✨

Caratlane made ₹2,100 crores in revenue last year and is valued at ₹17,000 crores after Tata’s latest deal in 2013, a deal that made Tatas - the owner of a 99% stake in the company. But, Caratlane is far from an overnight success as the company was at the bring of failure in 2015 before it made a comeback.

Started by Mithun Sacheti in 2008, Caratlane is one of the earliest Indian e-commerce companies that you must know of. Let’s dive into what they cracked —

4 insights in the next 60 secs.

1. Solving for trust ✨

Jewellery purchases are different. It’s a high-trust purchase and the conversion is difficult because it’s an extremely touch-feel and an emotional purchase. Customers need to trust you more to pay you more — the hidden moat in the business. Caratlane solved this with:

Offline Focus: Went bullish on offline channel despite being an internet-first brand. Went from having 12 stores in 2016 to 220+ stores now —an 18X jump to crush the phygital (physical + digital) game so that customers can access products.

Tata Rebranding: Tata acquisition brought rebranding of the company’s logo with an additional text of “a Tanishq partnership”. Be it billboards or stores, customers get instant brand recall and trust of the might Tatas.

Fun fact: Services like free-home-trials, lifetime exchange guarantees, 30-day money backs & legit certifications became a solid hook.

2. A lifestyle brand pursuit 💡

Mithun & his team wanted to build for the “New India”— people who buy jewelry for repeated small occasions like anniversaries, birthdays, & promotions. The company wanted to be a lifestyle brand & not a “once in 5-year” brand.

55% of the entire Indian gold jewellery market is bridal jewellery. Mithun was looking to build something bigger on the other side of this market.

They ensured they were the go-to brand for every occasion — be it the 1st anniversary or the 15th anniversary, they had options.

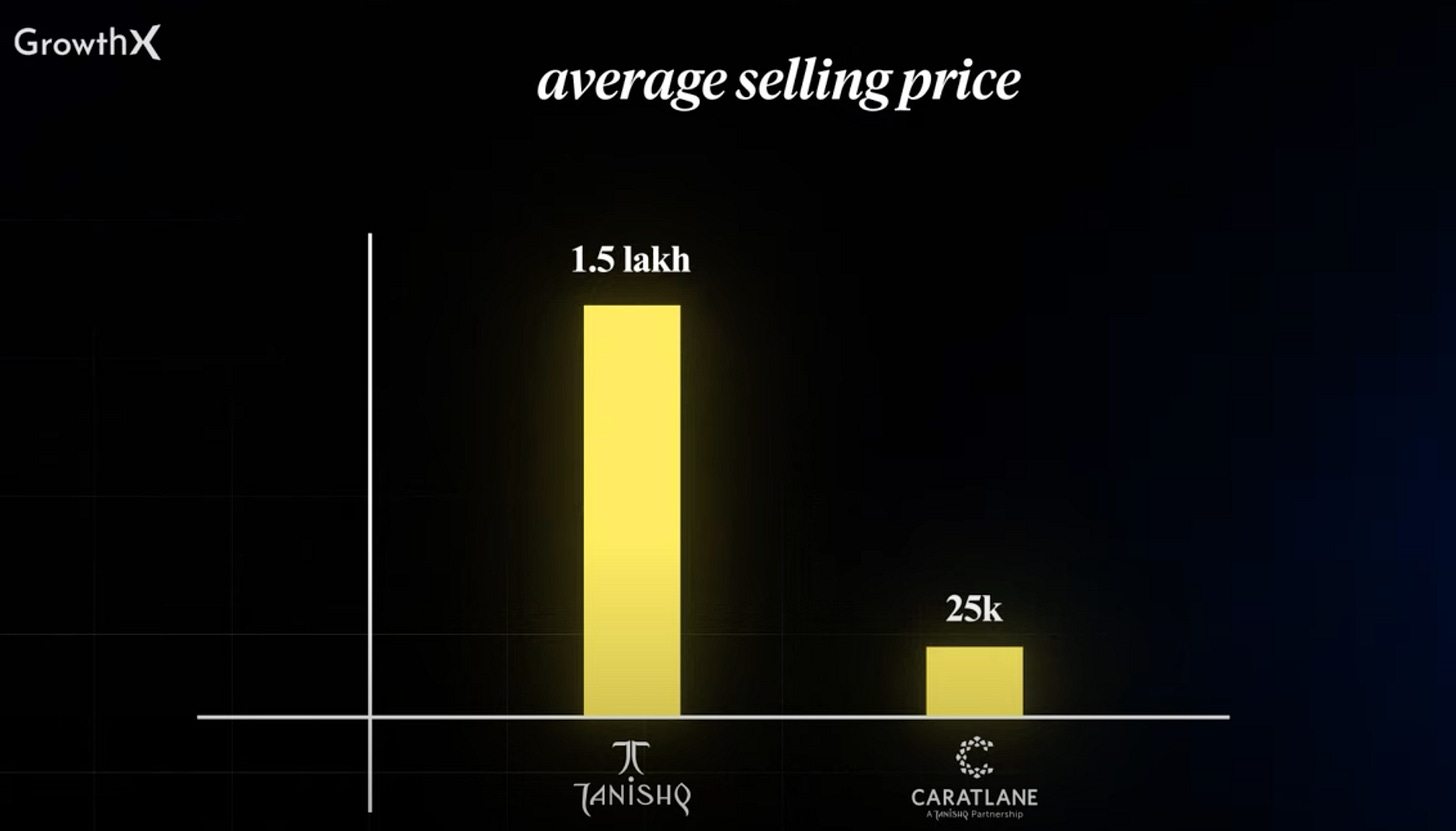

Pricing: While the average selling price (ASP) of Tanishq is ~₹1.2-1.5 Lakhs, for Caratlane, it is ~₹25,000. The positioned themselves as “the affordable brand in town” — a brand for everyone.

Silver Bullishness: Caratlane’s deliberate focus on silver helped them serve an audience that didn’t have the best options under the sub ₹10k range. Instantly became favourites of the young users who’d later convince their family members. Ps. This silver became the ultimate hook to later upsell other products with better margins.

3. Minimal inventory costs.

While the front end of the business looks shiny, the back end is where the real magic is taking place. Caratlane has gross margins of 35% (higher than Tanishq).

The answer lies in the minimal inventory costs. But, what is that? Inventory cost is basically the cost of the products stored in warehouses — excess inventory maintained to ensure that the company has enough stock when there is high demand. Caratlane removes this from picture by:

In-house production - making products only when the order is placed - similar to the Dell Model.

Simple & minimal designs - manufacturing is easy & fast enough to meet the 7 days shipping.

4. Tech-savviness at max.

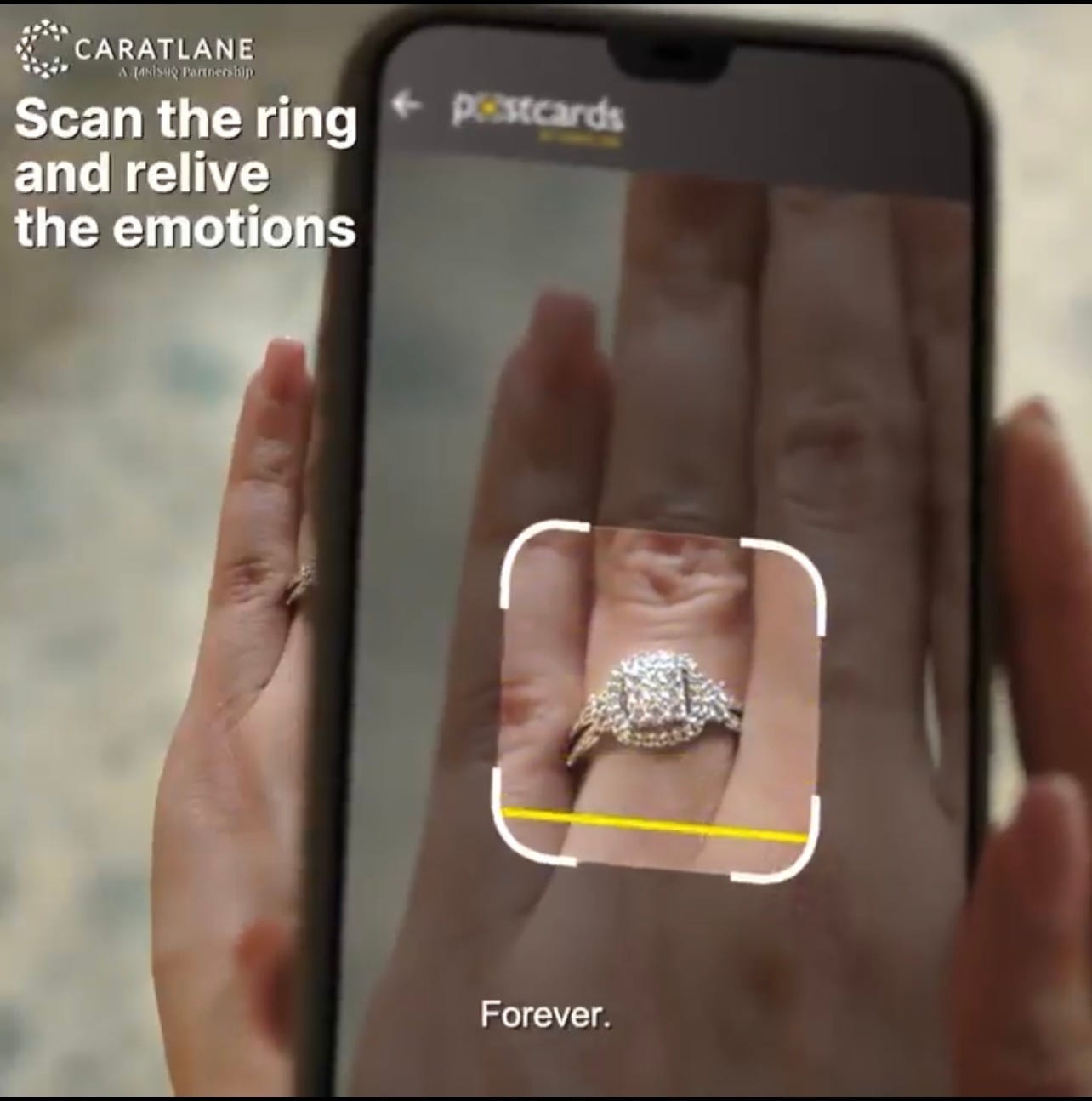

Caratlane is probably the most advance jewelry brand in the country right now. They've launched some of the most interesting and unique tech features in the industry. Btw, it was also the 1st company in the world to launch a virtual jewelry try-on app. Logic is simple - Innovate Rapidly → Ship most advanced features → Appear as the most tech savvy brand → Generate loyalty.