Why OTT platforms mingle with telcos? ❤️

Welcome to the 92nd edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Last week, we covered how gift cards have revolutionised the way people buy things for each other & became a trillion dollar feature. This insight led us to another niche topic - The telco strategy of OTTs to sky rocket their subscriber growth? We cover this lesson today.

Quick back story 🧠

Distribution is the queen, remember? Roll back in time & think about the days when you watched content on television - a world before OTT. Do you think your local cable operators ‘only’ made money through the monthly ₹80-100 subscription fee? Nopes. Even then, broadcasters paid large sums of money in the name of ‘carriage fees’ to make their channels available to millions. So, when your favourite OTT platform right swiped your telco operator - it was love at first sight.

As much as ~400 million Indians will consume Netflix, PrimeVideo, HotStar, AltBalaji, SonyLiv, Zee5 & more OTTs through their telco operator bundles by 2023.

So when did the party start? 🍾

After 2016, when Jio did the gimmick of cheap-data & free calling, the game changed forever. More than ever people were consuming content on their mobile phones, even in the remotest, most sparsely populated Indian cities & villages.

This was the inflection point for OTTs. With Jio’s cheap data & majority of users not willing to pay for content / OTT, it became an existential move for the OTT players to form these Telco partnerships. This has led to more than 70% of OTTs acquisition to come from Telcos.

Who hosted & who joined? 📺

One word - Jio.

It played the long game with acquiring 25% stake in Balaji Telefilms, resulting in making ALTBalaji’s content available to the then 160 million Jio users in 2017. This was followed by another partnership with Eros, adding more content for Jio users.

Netflix & PrimeVideo got FOMO.

With Jio’s partners scaling subscriber volumes, they were forced to join the clan. Before anyone knew, everyone was in.

Why did it work though? 🎯

1. It brought scale for everyone.

Finding synergies with telco worked out beautifully for OTT platforms because of the distribution. On the other hand end, telcos crumbling to push users from 1 price point (the lowest) to the next one found a feature. Airtel, reliance, Vodafone were able to push their low paying groups to move up a ladder on the pricing plan.

2. It solved for retention for telcos.

There had to be something meaty for telcos to make them prominent in their offerings, consistently. With the ongoing price war, porting became a huge challenge for all telco companies. Customers were seen shifting provides over the smallest issues. The OTT bundles created binding of sorts. With running subscriptions, it became a task for users to call it quits and move on, resulting in improved retention.

3. It opened newer revenue streams.

The initial VAS - value added services for telcos were ringtone, wallpapers, but now its pipping hot OTT content. Similarly, OTTs are now enjoying telcos’ distribution at much cheaper cost than using Google/FB expensive ad channel.

What holds in the future?

Today OTT consumption makes upto 10% of India’s total TV subscription market - it has added new users (untapped before, like the older audiences), newer markets (like tier-II, & tier-III cities which weren’t primary markets), and solved for everyday revenue & engagement challenges for both OTT & Telcos. This will keep scaling & improve the average revenue per user for Telcos for a long-long time. Also expect more Telcos to start buying major stakes in OTT platforms.

But it’s an important partnership lesson 🧠

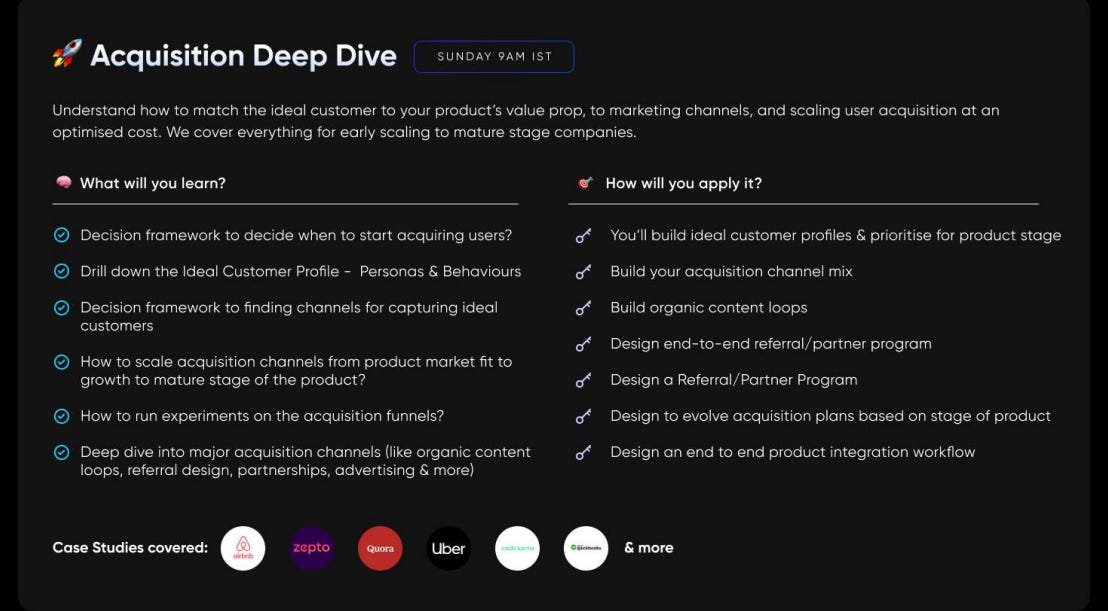

This channel worked for both OTT Telcos cause they solved for the user & for themselves. We discuss the science of cracking partnership as a distribution strategy at GrowthX in depth especially for internet first businesses. If you are building distribution strategy for your product, you should, checkout the new GrowthX experience. It covers everything from product readiness to distribution to solving for scale of distribution. All in a electric community of top growth leaders.

Thanks for this!

Telcos have always looked out for ARPU. More data consumption leads to increased ARPU, and hence any vertical that increases ARPU has been targeted by Telcos including OTT, Gaming and much more recently online education (Vi).