Why is Unicommerce going public?

Private markets aren't what they used to be.

Compounding careers are driven by exponential outcomes, which in turn happens with an obsession over your CRAFT & problem statements. Exponential careers don’t just happen by chance but through focused effort & intent.

Over the last 3 weeks, 100+ GrowthX members spent their days & nights obsessing over building bar raiser revenue strategies. Coming Sunday the top two teams are all set to present their growth strategies to the whole world LIVE. If you want to nail revenue-led growth, this is the place to be.

Let’s begin.

After spending a lot of time with Unicommerce’s DRHP (Draft red herring prospectus - preliminary document that the company files with the SEBI when it proposes to come out with an IPO), we got triggered to write this story.

So, what’s the back story?

Unicommerce is part of AceVector - the holding company that owns Snapdeal & Stellaro - a house of brands in the lifestyle segment. In 2015, Snapdeal acquired Unicommerce - in a span of 2 years, Unicommerce became profitable.

What’s really the product?

Every other ecommerce SaaS tool focuses on bringing more customers to a D2C brand through their website/ marketplaces (like Amazon), Unicommerce is fundamentally is in different business. It solves fulfillment of orders.

When you order than SleepyOwl coffee online - so much happens to ensure the delivery reaches you within 2-5 days. First, the order goes to a warehouse, then it is picked → sorted → packed → made ready for shipping → shipped intercity → shipped to a hub location & finally the last mile delivery.

This whole piece is extremely ops heavy.

With the Flipkart era, the frontend & backend have matured. On the frontend, your distribution channels are now sort of figured, on the backend you have third party logistics partners (example, Shiprocket). The middle layer is where the complexity still lies - the transaction processing layer.

Take Lenskart for example.

1000s of SKUs spread across 10s of warehouses. Add multiple channels on the demand side of the business and third party logistics providers on the backend - it’s a nightmare to manage. Today, most ecommerce businesses solve it using ops/ people.

This ops eats into the gross margins. No wonder, Unicommerce’s core pitch is to improve fulfillment efficiency and in turn solve for costs in fulfillment.

And, Unicommerce made all the right moves.

It knew that if it wants to be a middle layer, it needs to nail integrations with every demand side & logistics side player. Cause you can’t build any SaaS play if you lack the piping in between demand and supply.

Marketplace integrations pull order from different channels and keeps the inventory updated. Logistics integrations automates delivery management with third party providers. ERP integrations allow smooth financial reporting.

At scale these deep integrations automate an incredibly ops heavy part of an ecommerce business & make it extremely hard to replace as the number of orders & SKUs scale.

No wonder, Unicommerce is chasing enterprise clients.

So why go public now?

It is profitable. Unicommerce’s last reported revenue was ₹90 Cr (₹6 Cr profit). This public offering will go into what is called as “Micro-cap” companies list. Something that not a lot of startup founders want to go into as it restricts them from having a larger IPO and more lucrative institutional public investors.

Strong retention. Its net revenue retention is 133% proving a solid product market fit even at a 750+ enterprise client scale.

Ecommerce tailwind. China & USA have an ecom penetration of 31% and 15%. Even with Flip, Amazon & Meesho India only has about 6% penetration leaving plenty of possibilities. Plus, Unicommerce is category agnostic - take any ecom business and the problems at the nerve center are the same.

India's ecommerce has immense room to grow. If our per capita income grows as it is right now, we will have multiple layers of society buying online and this is at a 140 Cr people scale.

The South East Asia & Middle east. Unicommerce’s 176 enterprise clients last year had a good share of 45 clients from these markets. DRHP points to how Unicommerce wants to penetrate even further into those markets.

So why not raise money from the private VCs? Private markets are not what they were in 2020. For a company that’s profitable, growing eveyr single year and nailing business fundamentals - unfavourable conditions in private market - that’s what we are in Q1 of 2024.

Unicommerce story is a wake-up call.

If you are building in India and trying to raise your series A/B/C, it’s going to be an extremely tough year. Businesses with solid fundamentals need to keep this IPO route always in mind especially if you operate in categories that are bearish at the moment.

Having run GrowthX fundamentally profitable since day 1, we have experienced what it really looks like to solve business model foundations before you build for valuations.

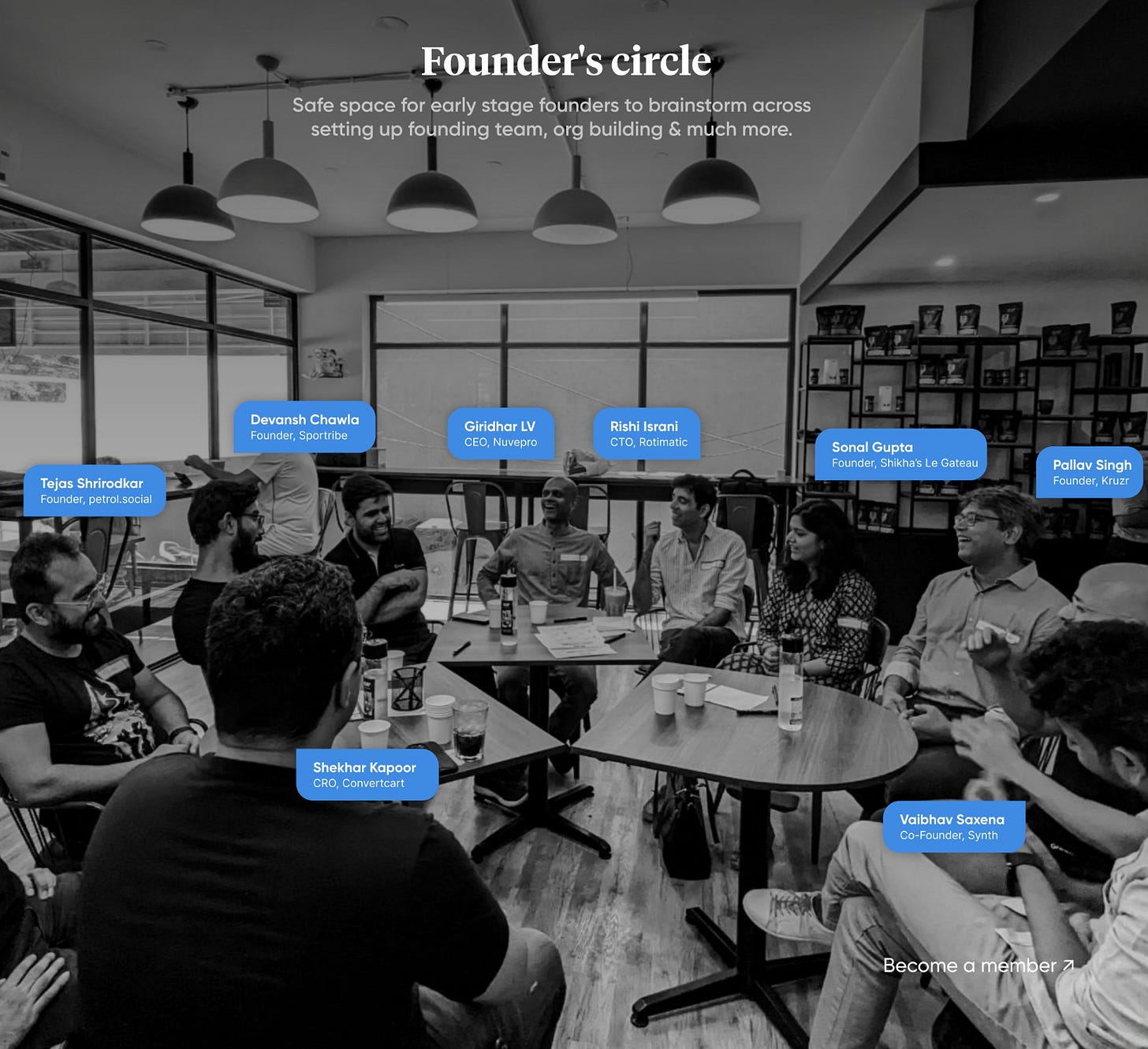

If you are a founder or operate trying to figure sustainable revenue growth while keeping runway intact, do checkout the GrowthX experience. In FY 2023, over 300 founders inside GrowthX made $150 million in annual revenue with the majority being unit economics positive.

Thanks for supporting this newsletter

If you’ve enjoyed this piece, do consider referring our newsletter to a friend. For your first referral, we’ll send you our Infographics ebook, which has a collection of growth & business infographics that have generated 1 Million + impressions across our social channels.