Why is Amazon betting big on India exports? 💰

No wonder so many things coming together.

Welcome to the 180th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,200+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

India’s export value in 2013 was $312 Billion, it has 2X-ed to almost $714 Billion. No wonder Amazon pledged $26 Billion - here’s how it wants to be part of the India export story 👇🏼

Some quick context 🗓️

The ‘Make In India’ movement, production-linked government schemes & foreign direct investment (FDI) pouring into the country helped in the growth of both these segments.

But, why does Amazon wants anything to do with export goal? 🤔

Think of this from a pure macro. China Vs US ties aren't good at the moment, pointing to a worsening scenario. Take the example of sustainable exports for example - Chinese exports to the US are now being charged a 20% import duty.

Amazon’s $26 Billion investment is to bring 10 Million MSMEs online, increase export volume to $20 Billion & in turn create 2 million jobs - by 2025.

India seems like a safe bet for Amazon Global 🇮🇳

Amazon is positioning itself as the player who will solve Indian exports to the US and the rest of the world. Amazon wants to create/ expand & monopolize the exports, for everything commerce.

Here’s Amazon's game plan for exports by 2030 ⬇️

1/ Building the pipeline for Indian sellers 🌍

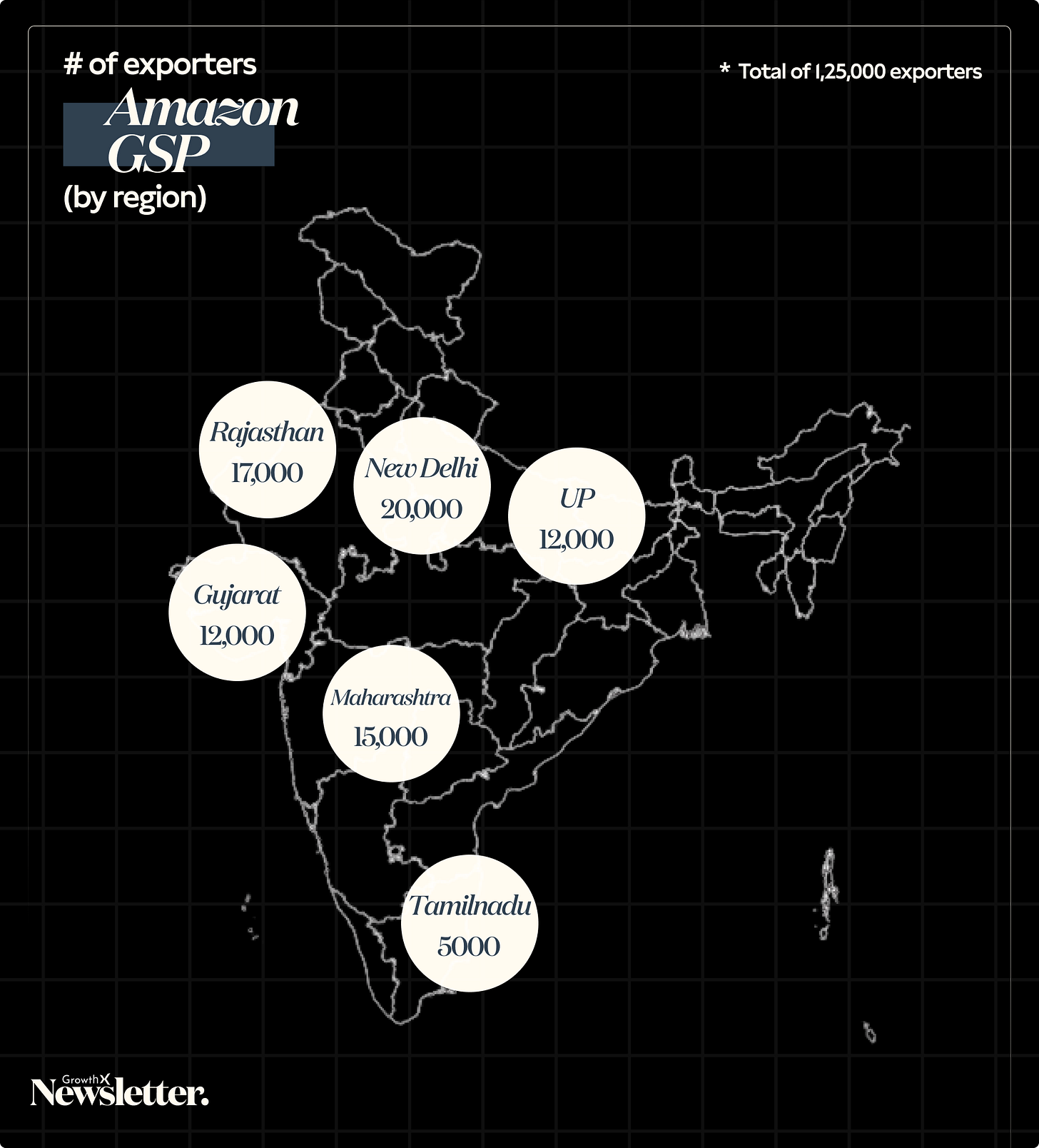

It launched its global seller program back in 2013, it's investing heavily to get Indian sellers/suppliers to be able to export to the US, UK, Canada, France & Germany. In FY 2023, this has processed $8 Billion worth of exports from over 125,000 exporters.

Some specific regions gaining momentum.

Sri Ganganagar, Rajasthan - $13 million

Haridwar, Uttarakhand - $23 million

Neemuch, MP - $1 million

Kolhapur, Maharashtra - $4 million

2/ Move offline to online, with tech📱

The majority of commerce in India is still retail. The significant friction to take this online is first logistics, demand generation & inventory/ pricing strategy. Amazon wants these sellers to just supply by coming online & let Amazon solve everything else - Amazon Tatkal is one such program.

3/ Picking up strategic ports + Indian railway 🚢

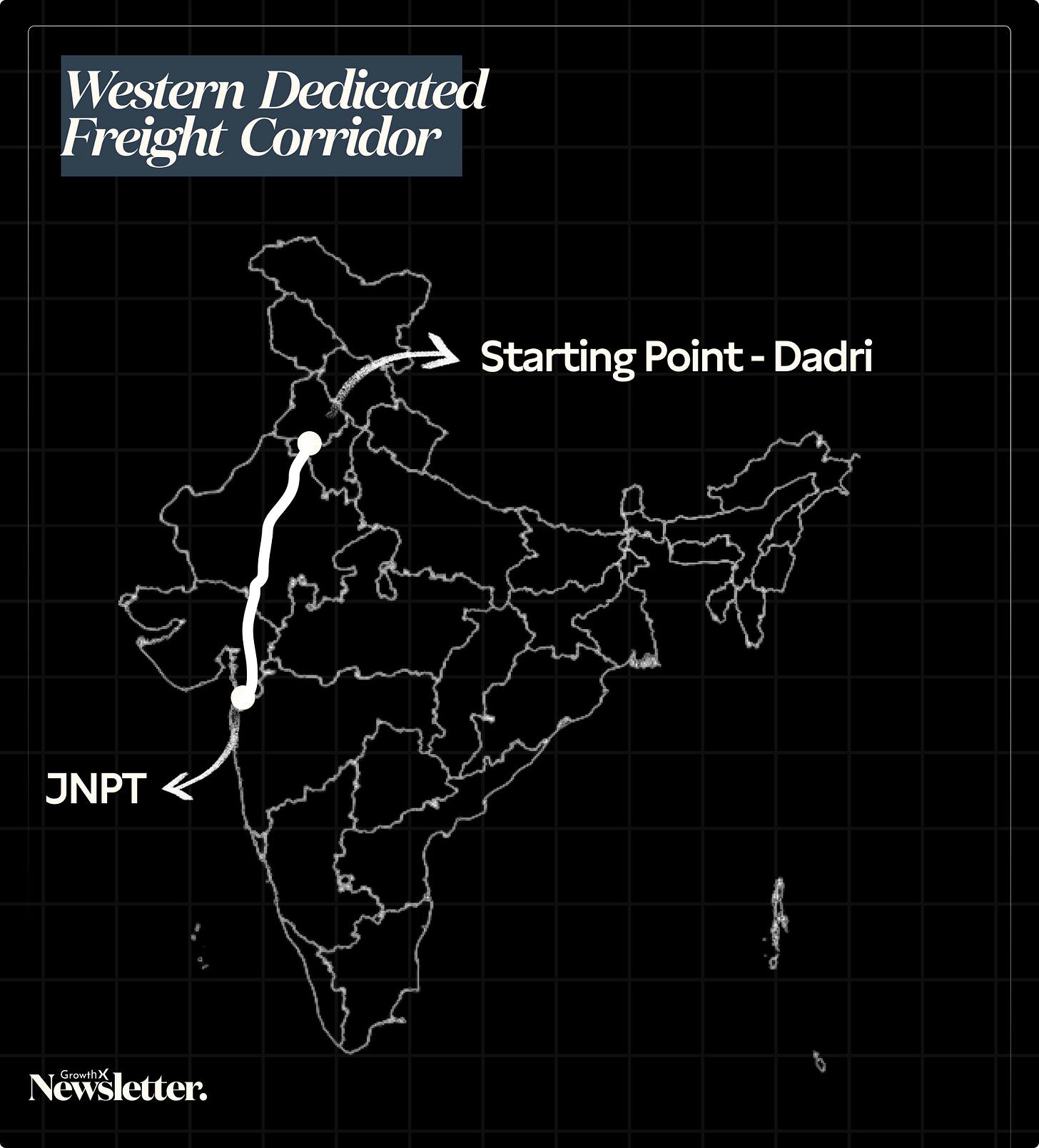

It has partnered with Indian railways for 625 KM western dedicated freight corridor - these cargo trains will now be extremely fast and will connect to Jawaharlal Nehru Port, one of the largest cargo-handling ports in India. To get you the magnitude of this move - in 2018 Jawaharlal Nehru Port alone handled 64% of import traffic & 34% of export traffic - mind blown.

4/ Partnership with India Post 📭

With over 1,55,618 offices, Indian Post is bigger than SBI's 28,856 branches. Amazon signed a deal to allow its seller to drop off their packages in an Indian post office, it will pick them up & handle the rest of the logistics.

5/ Opening up for every D2C player 🤯

It recently opened up its logistics API for any D2C brand wanting to use Amazon “only for logistics” - even if the sale has nothing to do with Amazon. Now imagine why Amazon would do this - I want you to think (this reminds me of Shopify & why it would launch its plugin marketplace)

That’s all on Amazon’s export capture.

Amazon is that wild Godzilla. It's a strategic advantage & as I like to call it - "Right to Win" is logistics & distribution. It's pushing the needle on both of these to become the monopoly for anyone trying to export to the globe.

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.

If you liked today’s article, you’ll love these 💙

We launched "David & Goliath" 🔥

A casual conversation at Third Wave Coffee in Koramangala with Ashutosh turned into a session of incredible insights. How he drove partnerships at Automate.io & essentially built deeper product integrations with Typeform, Slack & even Notion before Automate was acquired by Notion. Almost 180 days after we are launching the “CRAFT of Partnership Led Growth” with him.

What have #4, #5 got to do with exports? Both of these seem to be very India marketplace specific moves...