Why 28% GST might destroy Dream11 & others?

GST council is just doing some crazy amount of taxation & more.

Welcome to the 164th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,300+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

In 2020, Google pulled PayTm from play store. Yesterday, the GST council levied 28% GST on fantasy gaming companies. Here’s what Dream11 & GamesKraft are up against - also what future holds for online gaming industry.

Some context 🗓

The GST Council, in its 50th meeting on Tuesday (July 11), decided to levy a uniform 28 per cent tax on full face value for online gaming, casinos and horse-racing. This has created a string of chaos.

How these apps work, legally? 👨🏻✈️

A user on Dream11 deposits ₹100 onto the app to pick players for an upcoming fantasy IPL match. The player uses "skills" to pick players and hence the app is technically not a "lottery".

How are taxes calculated then? 💸

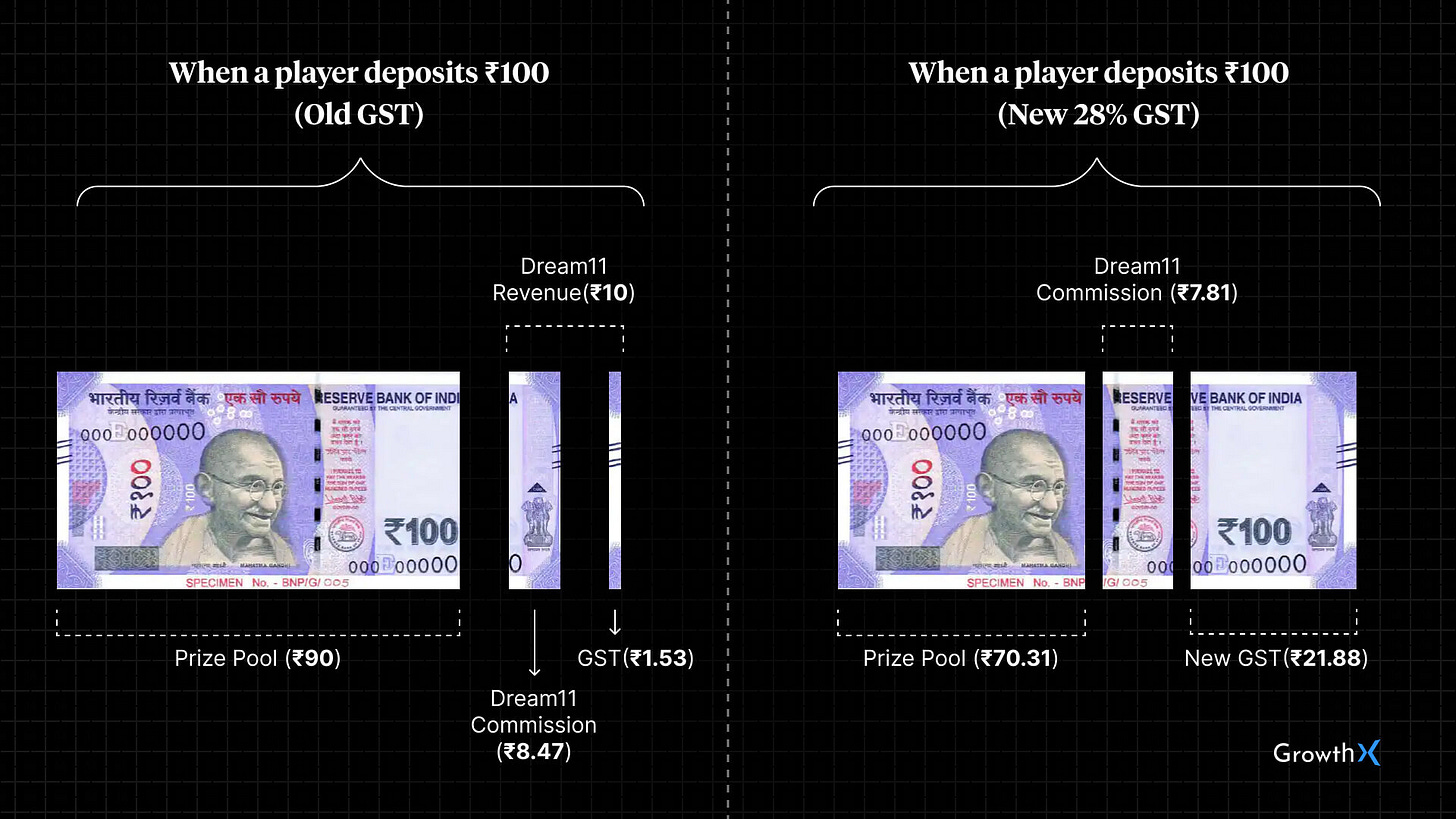

When a customer deposits the money onto the Dream11 app & wins a specific amount - Dream11 charges commissions as a % of the overall deposits done in a game. It also levies 18% GST on this commission.

The new GST policy is slightly crazy 💔

Remember that ₹100 deposit example? GST council now wants to charge 28% GST on the whole deposit amount and not just on commissions. I will repeat this again - 28% GST on the whole deposit - mad crazy.

This will break the online gaming model 🕹

Online gaming model is simple - it's a service that "facilitates" fantasy skill based gaming and makes 10 to 15% on overall deposits pool. There is no other revenue stream - no subscriptions/ little ad monetisation.

Online gaming is (was) extremely profitable 💰

Gamescraft reported ₹937 Cr & Dream11 reported ₹142 Cr profits last year. But, all of this on the basis of how GST was calculated up until yesterday. With the new GST policy there won't be any profits to book.

How will this affect this category? 🤔

Firstly, these apps will start charging that 28% GST on deposits to their customers (assuming they don't win the case against GST council). Fewer users will participate & prize money will go down massively.

Think of it with a simple example 🎲

A user deposits ₹100 into Dream11 and gets charged 28% GST so effectively they are only getting ~ ₹78 into their Dream11 wallet. Plus, add the 10% commission charged by Dream11 & you have a recipe for disaster.

What's the only way out? ⚠️

Contest this decision in whatever court you need to fight this policy in. These gaming companies already have a union of sorts and are gearing to battle this policy out. It will be interesting if they can turn around this GST policy.

Regulation changing the game 🎯

We have seen that with the 2016 demonetisation (PayTm got advantage), limiting new payment gateway licenses (Razorpay will get the advantage) & so on will keep happening.

Gaming category has solved for revenue growth ⚡️

And, it's not by chance. It's a structured approach on why these companies can acquire customers at a cost and ensure they retain and are monetised to make a return on capital.

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.

If you liked today’s article, you’ll love this 💙

Did RBI setback Paytm's lending dreams?

Welcome to the 198th edition of the GrowthX Newsletter. Every week I write 2 pieces on startups & business growth. Today’s piece is going to 95,300+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Loved the visual representation

GST is not applicable on the following products :

a) HIGH SPEED DIESEL

b) Aviation Turbine Fuel

c) Natural Gas

d) Motor Spirit (Petrol)

e) Alcoholic Liquor for Human Consumption

f) Petroleum Crude

On the above mentioned products still Central Excise Duty and Sales Tax is levied by Central Government and State Government respectively. GST will be imposed only after the GST COUNCIL recommend the date in future.