What's hot in AI? Investors weigh in.

Why investors love Lovable, and what they're betting on next.

Today’s edition

If you’re on AI Twitter (now X), your feed looks like this. A crazy good AI launch→updates from the OpenAIs, Anthropics, Deepmind, and Googles of the world→fundraising announcements→ another AI browser→a billion dollar valuation.

The more you see that kind of news, the more you wonder—how does a startup get valued that high? How are those startup founders finding breakout opportunities? More importantly, are there anymore whitespaces left?

We got to the bottom of these questions analysing investor dispatches from Unshackled Ventures, Bessemer Venture Partners, and Menlo Ventures. Here are all the insights wrapped in a crisp 7-minute read.

Before we begin, what are your plans for Friday?

Dilip (VC, Investor at Rainmatter by Zerodha) and Arvind (Sr. Product Manager, Sendinblue) are hosting India’s first underground night festival on Friday, Oct 31.

Whether you want to be running to DJ beats or you’re a founder looking to connect with other fitness geeks, this event is for you.

Let’s start with Lovable (recently valued at $1.8B)

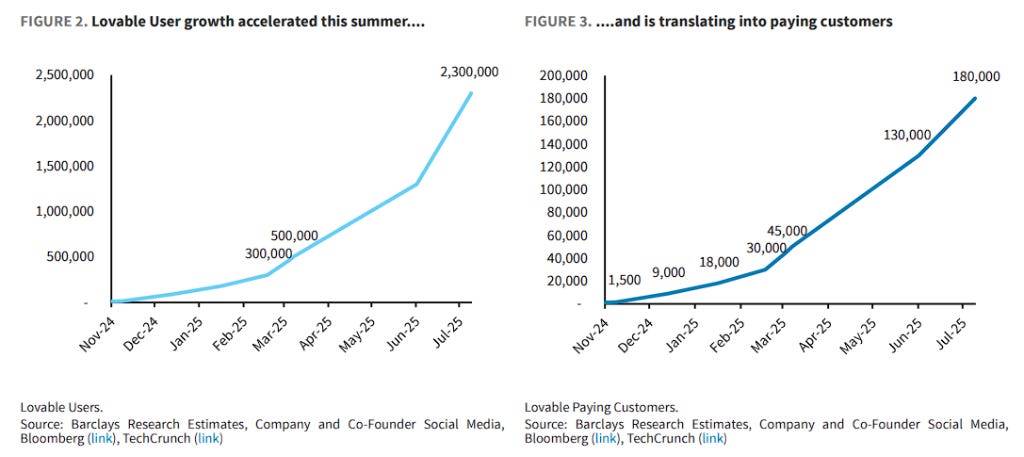

People will tell you to look at their growth journey to make sense of the numbers. So, let’s take a look.

Most startups take years to reach that many paying customers. That could explain why Lovable got such a high valuation: the high numbers reflect strong product-market fit, current scalability, and strong potential for future profits.

But AI investors say that there’s more to it.

So, why do some AI startups get valued so highly?

Will they survive with their competitive advantage?

Most AI tools are built on top of public models, like Claude or ChatGPT. Anyone can replicate that. What else separates your tool from the rest?

For Lovable, it was these three:

Network effects - Lovable doubled down on community-focused growth from the get-go. That helped the user base grow really fast and spread the word of mouth even faster.

Developer-first by design - Lovable solved the backend, error-handling, and reliability, that other code-based tools didn’t. They even went the extra mile, improving scalability, lowering latency, and supporting multiple users working on the same project. The contemporaries weren’t offering that package.

Quick feedback loops - Lovable implemented feedback, fast. The company understood that happy users meant paying users.

Can verticalized?

Building for everyone at once is extremely hard. And catering to every prospect’s demands, especially in the early stages, is almost impossible.

Vertical software survives because it’s built for one industry & customised for every prospect. That means stronger customer retention & easier sales in the beginning. As these companies grow, they build niche-specific functionalities & integrations while implementing compliances. Purchasing this software becomes a no-brainer for industry folks.

Lovable played it differently by staying horizontal but betting on community to drive scale.

Do they have a real PMF?

Does the market really want the product, or have you closed a few enterprise deals?

If you consider an increase in revenue to be a demand signal, a high-ticket enterprise deal could look a lot like PMF. That’s an even bigger problem with enterprises allocating higher AI budgets. Fun fact: global enterprise AI investment could reach ~$1.5 trillion in 2025.

Lovable went after individual users instead of enterprise deals and showed a 6-month compounded growth rate (CMGR6) of 51%. That’s PMF you can’t argue with.

Is the GTM and execution strategy promising?

Do they have a solid plan to get customers and revenue? Does the roadmap reflect market demands? Does the team deliver on time?

Lovable ticked all those boxes with its community focus and quick feedback implementation.

Where are investors placing their bets next?

Both on enterprise and consumer AI software.

Let’s start with enterprise AI. Why is it interesting?

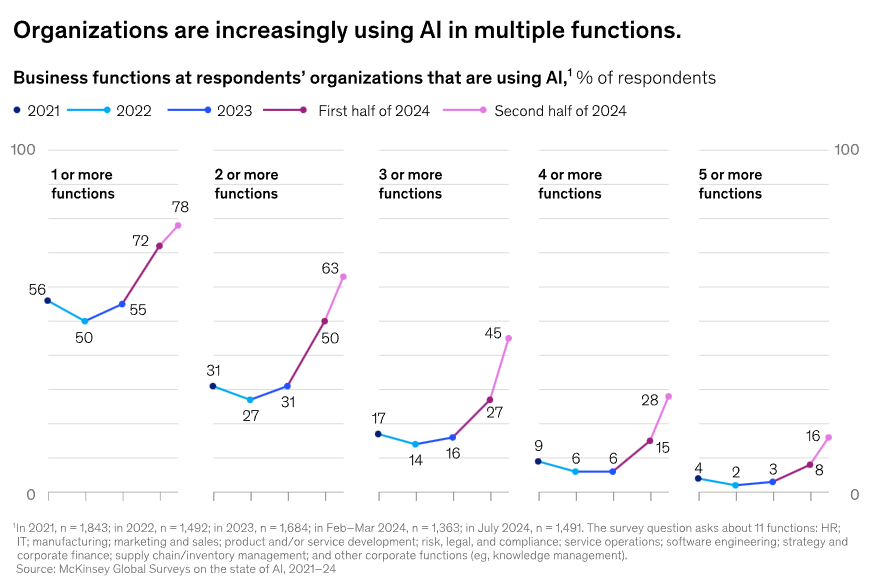

1/ One, companies are using AI for more than one function.

2/ Companies’ AI budgets are growing. (Remember the $1.5 trillion stat?)

Plus, AI can finally disrupt the systems-of-record (SoR) monopolies of companies like Salesforce, SAP, and Oracle. It can give you data the way you like it, without coding or migration, for really cheap. We don’t need an entire team to manage millions of records anymore.

Some examples: Day.ai (CRM), Doss (AI-native ERPs)

Notes for founders:

Collect data flowing into legacy SoRs with AI (adoption from day 1)

Use AI instead of code for data entry

Implement 90% faster with vibecoding tools

Reduce labour costs while improving time to value

What’s next? AI-native tools in CRM, HR, enterprise search (AI trained on a company’s internal knowledge), financial planning and analysis.

What about vertical AI?

New AI players are starting to take over what legacy vertical SaaS companies have been doing for years. But this time, even the most tech-resistant are joining in.

Why? Because AI finally works where these sectors struggle most: multimodal, language-heavy workflows.

What’s getting disrupted? Healthcare, legal, education, real estate, home services, to name a few.

Notes: Time-consuming workflow tasks are getting automated fast. Think clinical note-taking in healthcare, sending emailers to defaulters, doing research, reviews, educational content creation, coaching salespeople.

Moving to consumer AI

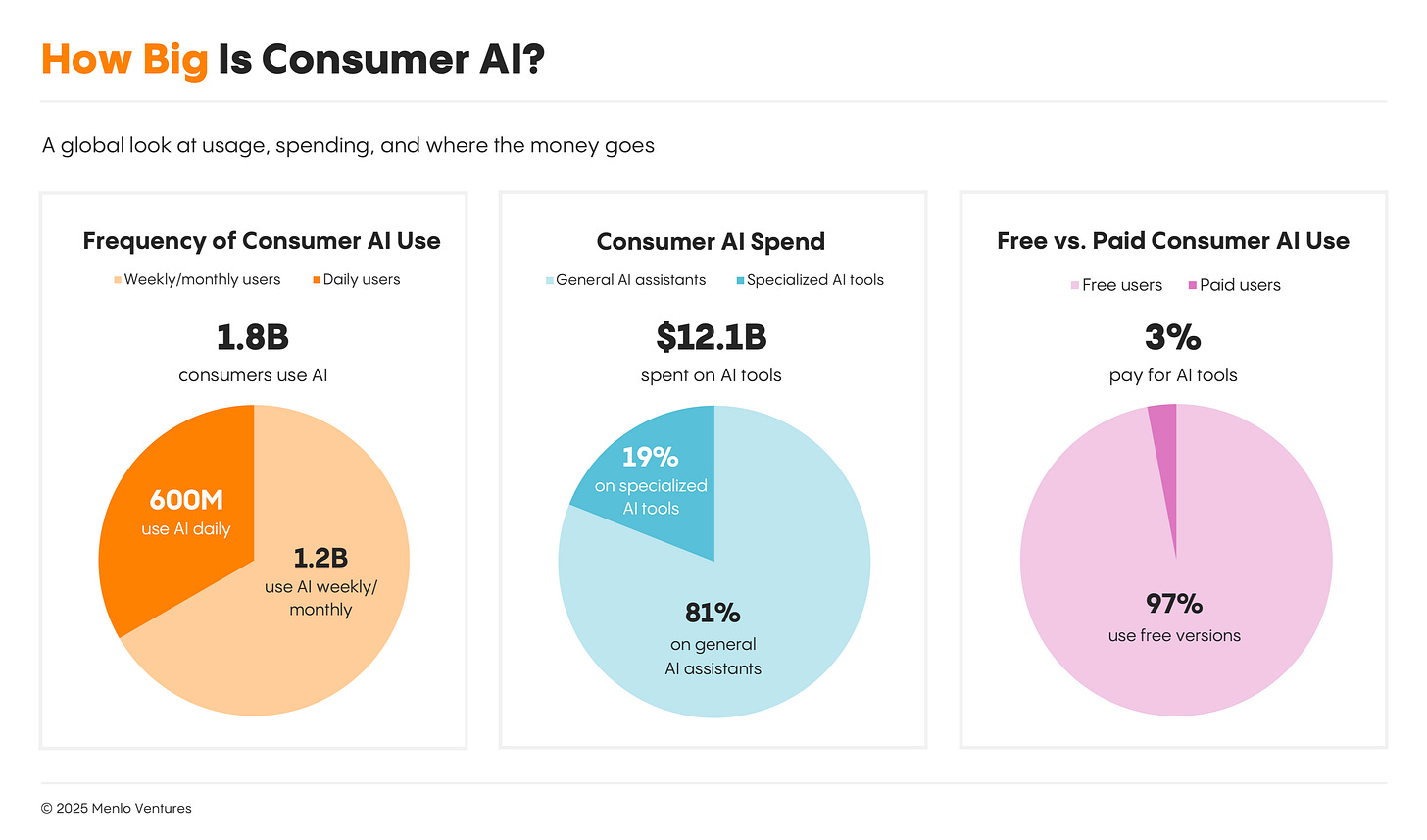

Over 1.8 billion people use AI every day, for free. And they stick to general AI assistants, like how your mum uses ChatGPT.

Disrupting in this space is hard for two reasons.

First, you’re only a new model or feature away from becoming obsolete. Remember, when OpenAI launched images on ChatGPT? People stopped talking as often about Midjourney after that.

Second, consumers love convenience. Meaning they will stick to a tool until it doesn’t work for them. And that plays together with distribution. For example, OpenAI was the first to launch a tool like ChatGPT and distribute it widely. So, people who began using ChatGPT stuck to it. Even today, 5% more US citizens use OpenAI’s ChatGPT, compared to Gemini, that launched a few months later.

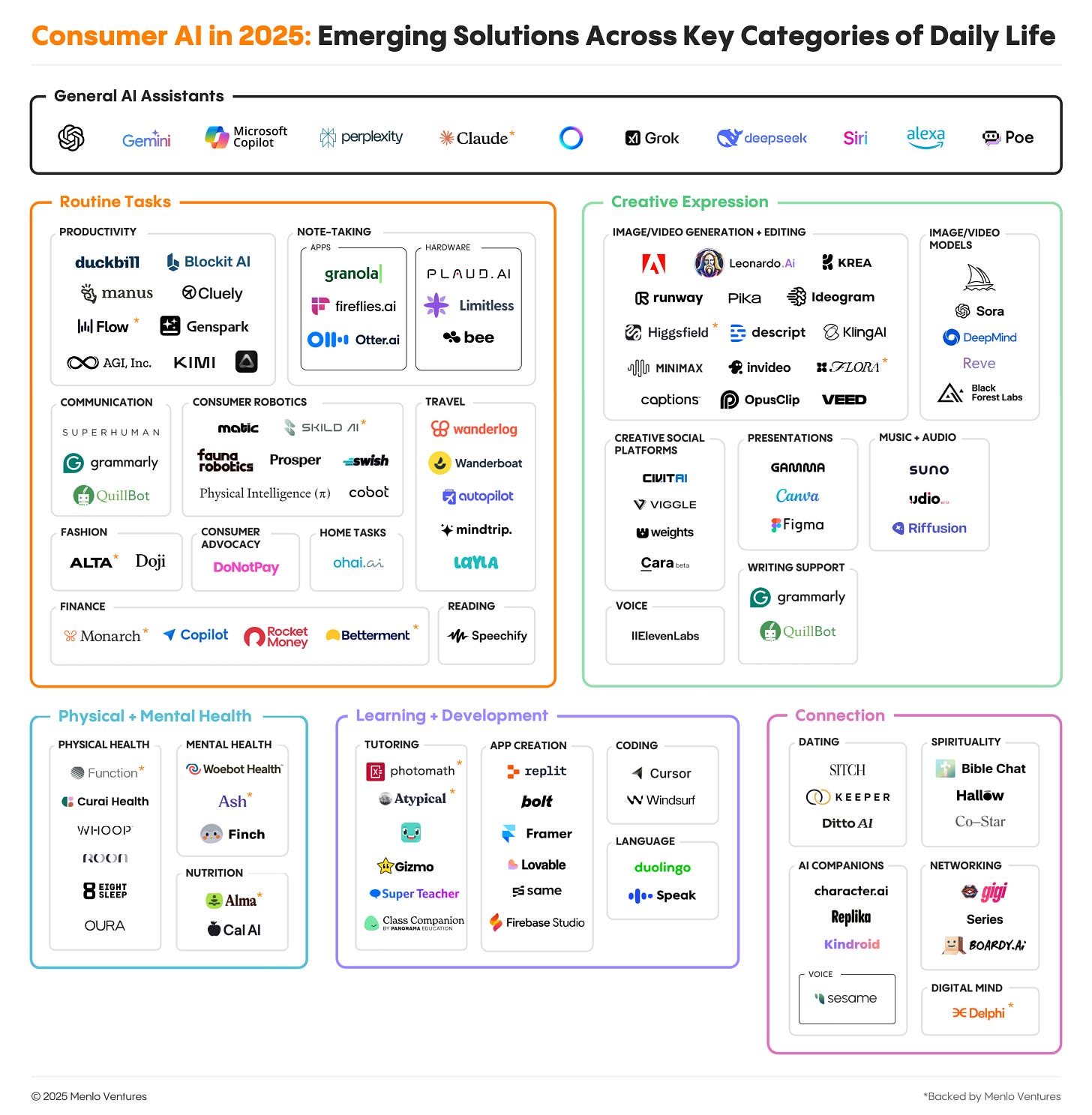

What’s getting disrupted? We’re seeing consumer AI usage across 5 key categories: routine tasks (productivity, communication, finance, note-taking), creative expression (image, video, music), physical and mental health, learning (tutoring, coding, language), and connection (dating, AI companions, spirituality). Among these, self-care companions and AI-powered email and scheduling tools are likely to see the next wave of innovation.

Notes: There’s a gap for tools that tackle high-trust, personal tasks in the market. And people will pay for it.