What killed Swiggy "Pop"? 🍔🍜🍱

The insight behind kill*ng a loved feature.

Welcome to the 100th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Our typical food ordering journey looks like this.

1. Scroll through a huge list of restaurant to find the one

2. Look through many menus & pick the dish you want to eat

3. Look for a deal so the ‘meal for one’ becomes worth itA lot of hard work for one meal right? I know, I know. I have spent legit hours figuring out what to order.

But, what’s the context of Swiggy building “POP”?

The Zomato vs Swiggy vs Uber eats wars were at full throttle. Swiggy found itself crumbling under the high burn & super competitive pricing (imagine ordering a meal at Rs.70 including free delivery on Uber Eats. How is Swiggy supposed to compete That’s when Swiggy went back to the whiteboard. It had some clear insights.

On the user side.

First, customers were confused on where / what to order from. Second, it was really a pain to curate a meal for one. Third, the delivery fee of ₹35 felt too much for a single meal.

On the delivery partner side.

The number delivery partners were constrained due to competition. First, the earnings per delivery person were limited throughout the day. Second, it had majority orders coming within few hours (lunch & dinner) & that caused inefficient operations leading to higher delivery time.

Swiggy deep-dived into few important user behaviour questions.

What’s the average item count in a typical Swiggy cart? What’s the % of total Swiggy order meet the meal-for-one criteria? What % of order from meal-for-one were made by restaurants with free delivery? What % of meal-for-one orders were abandoned due to delivery fee?

Basis above, Swiggy ran a test on meal-for-one type of audiences with a free coupon code to observe their repeat behaviour — it was glorious. Users that matched the definition of the ideal TG for POP did behave with higher repeat order rate.

Solving for single meal ordering experience would repeat in better retention. Plus, the delivery partner optimisation will lead to better margins.

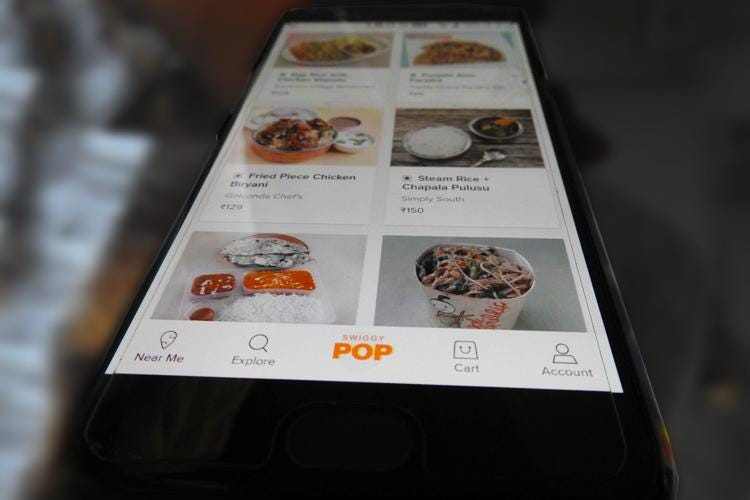

Swiggy POP was born 🎉

One touch | One meal | Free delivery feature built in 100 days. Pop was launched - a feature created basis customer trends & preference, and curated from a selection of over 20,000 items in collaboration with restaurant partners across metro cities.

First, POP solved for faster check out. The app open to ordering was lightening fast. It solved for classic system 1 design or rapid, faster, less friction flow. Swiggy made POP a one swipe order. With no need to charge more, talk about delivery fee or even show taxes, an additional cart page was abandoned.

Second, partner restaurants loved it. It helped restaurants get predictable volumes, reduce their TAT to serve meal orders, cut on losses incurred over unpredictable orders, & lower food wastage.

Most restaurants benefited from POP as their non-pop business with Swiggy was scaling really well due to visibility through POP. POP acted as sampling feature.

Third, order on POP were free from any ‘delivery charges’ because of the radius element. So it was a huge win-win from all aspects for the user.

Lastly, a saviour for delivery partners. Since POP operated within a 3 KM radius between the customer & the restaurant, delivery partners could do so much one in one hour. Plus, they use to do milk-run deliveries - pick from one location and delivery in multiple locations in one run ($$$)

The fall of POP 😭

In May 2020, right in the middle of the pandemic, Swiggy put an end to POP. When people moved back to their home towns & those living in tier-1 cities were home bound, the frequency for meal for one plummeted.

But, what went wrong? 🙇🏻♂️

Super low average order value.

Let’s do a napkin math. The average Swiggy POP order was around ₹100 to ₹150, assuming 15% commission translates into ₹15 to ₹22. Now most of POP orders had a milk-run model — meaning pick once & delivery the same item multiple times. Average milk-runs had 2 to 3 orders. That’s ₹30 to ₹66 commission per run. Swiggy’s average payout for such milk-runs were ₹40 to ₹60. Swiggy was hardly making any money on POP orders.

This led to pressure on increasing basket size.

Most restaurants that jumped the POP race, wanted to have higher prices. Swiggy wanted to finally make money & wanted to increase prices. It seemed like - you can’t increase prices with the POP model.

Swiggy POP had achieved the habit loop.

Users who had used POP over and over were retaining anyways & multiple tests showed that the retention did not drop significantly for POP users on feature removal.

And, Swiggy wanted to push users to new categories.

It entered the grocery space with Instamart, pick up and drop with genie & was running all over the place. This meant, Swiggy wanted users to active decisions on it’s home screen and POP was designed for the exact opposite flow.

That’s all on the Swiggy POP saga folks.

POP was launched to solve for long term retention & every product wants to launch their POP for retention. But, retention is hard. Finding the right levers to retention is even harder.

But, what has helped GrowthX portfolio of companies is finding the difference between — what are the personas of users who exhibit a certain behaviour vs those who do not. For example, if you are solving for Swiggy’s retention - look for difference between those who retain on swiggy and those who don’t.

Plus, if you want to deeply learn the science of designing for retention for your product, we go super in-depth inside preventive & reactive retention strategies in the GrowthX experience.

Learn about what we cover Click HERE.

I recently recorded the Unstructured Podcast with Vikram (Founder , DaoLens) & we spoke about how"Web2" distribution could solve for "Web3 growth". The approach to acquiring 1,000 DAOs in the full episode.