Indian sonars are in a tough spot.

Daily wear gold jewellery might soon overshadow their business.

Before we begin.

When was the last time you exchanged numbers at a networking event, met the folks again, and they remembered?

Most networking spaces think they’ve done their job once they bring people into a room. At GrowthX, that’s just the start. Real connections are built when you work together to solve real problems side by side.

5442+ members, including folks from Lenskart, Chaayos, SleepyOwl, and Google, think so too.

Today’s edition.

India’s obsession with gold is legendary. Weddings, festivals, gifting — jewellers and parents are convincing you to buy some more.

Yet, if you ask your family sonar about business, they’ll tell you things haven’t been looking great. At the same time, everyday gold jewellery sellers like Palmonas report great sales. The brand, established in 2022, sees ~3X repeat purchases. Why is that?

We dug into the question over the last few days. Here’s what we learned.

Real gold is bad business.

Gold is so rare that India imports it.

80% of all jewellery made in India is gold jewellery. And India has only 3 mines to support the industry: Hutti, Uti & Hirabuddini. Classic demand-supply mismatch.

So, India imports the rest. Plus, jewellers aren’t the only bidders; the tech industry needs the precious metal for chips, too. The two forces combined drive gold prices higher. As of 29th Jan 2026, the price is ₹17,885/gram.

Then, manufacturers raise gold costs even more by wasting it.

Pure gold is soft and harder to handle, making it easier to waste. That’s why 24K gold (99.9% purity) has the highest wastage, followed by 22K (91.6%), 18K (75%) and 14K (58.5%), respectively. You get the drift.

Lastly, the government regulates sales & takes a cut.

First, there are the hallmarks. As a sonar, you cannot reduce wastage charges by selling 18K gold at 22K prices to cover wastage costs + keep margins. You must state the purity of your gold after rigorous testing. Additionally, you pay 3% GST.

What do you do then? Pass on the costs, including wastage costs, to customers.

Selling everyday gold jewellery makes sense from a margin perspective.

Why does everyday gold jewellery have better margins?

Take a solid 18K gold ring, weighing 8.4g.

The gold itself costs ₹1,02,400. Add ₹19,000 in making charges and ₹4,000 in tax, and the total comes to ₹1,42,223. After covering all costs, the store makes a profit of ₹16,823, which is about 12%.

Now compare that to a 2g, gold-plated vermeil ring.

This ring has just a thin layer of gold over a silver base. The small amount of gold costs ₹128; the silver base costs ₹790; and the plating charge is ₹600. It sells for ₹3,607. After costs, the store makes ₹2,089 in profit — that’s about 58% margins!

It’s simple maths.

Low raw material cost + Low wastage + Slightly inflated prices = Better margins on products.

The market opportunity in everyday jewellery.

To date, players have employed two tactics to achieve profitability.

First, keep costs low and pocket the difference.

This works for everyday jewellery. Players use cheap materials and sell at reasonable prices, making big profit margins on each piece. Customers don’t care about material purity or whether they can trust the brand — they just want unique designs at low prices.

Street vendors and small local shops dominate this space.

They’re profitable not because the same customers keep buying from them, but because the demand is so high that they never go out of business.

Second, build trust to sell high AOV jewellery.

Your family jeweller did this for generations — handcrafted pieces, guaranteed quality, designs made just for you. Then in the 1990s, something shifted. Jewellers went big.

Players like Kalyan, Bhima & Tanishq standardised everything from testing, hallmarking, to mass production. Instead of relying on word-of-mouth trust in one neighbourhood, they spent crores on marketing to build national trust. Soon, they were everywhere.

Then Bluestone found a segment everyone missed.

Fine everyday jewellery sold online-first. The kind you splurge on but actually use. And initial customer trust? They built that through their try-at-home model. Big players, with a trust legacy, noticed. Kalyan and Tanishq quickly launched sub-brands like Candere and Mia to grab the same customers.

Now the demi-fine category is having a moment.

Cheaper than BlueStone but still using premium gold plating (>2 microns thick). It’s the kind of jewellery that resists wear and tear. The kind you can even wear while swimming & use for years, unlike fashion jewellery.

Wait, why do Indians want demi-fine now?

Three reasons.

1. Indians aren’t investing in gold like they did.

Shocking, considering that’s what our parents, AND their parents, did. But why?

Gold jewellery as an investment made sense when we moved frequently. The metal was rare (therefore precious), and carrying it as jewellery made more sense than leaving it at home. The practice stuck. People kept buying gold jewellery — for weddings, festivities and even as gifts.

Cut to today. The demand for gold is so high that we’re importing it. It’s so much that, in 2015, the Indian government introduced Sovereign Gold Bonds to encourage people to invest in virtual gold so that they wouldn’t want the real thing.

Except they did.

Customers continued to buy both physical gold and tax-free gold bonds (now taxed after the Budget 2026). Demand surged. Then, global geopolitics took gold prices several notches higher. Meaning consumers had to save a lot more than their parents to afford real, solid gold jewellery.

2. Demand for everyday fashion jewellery

Traditional gold jewellery is practically unusable for everyday wear. It’s heavy, bulky, doesn’t go with most outfits, and it’s expensive.

Fashion jewellery better suits a modern woman’s lifestyle.

It’s lightweight, inexpensive, and looks good with many more clothes. Better cost per use. That’s precisely why the Indian daily-wear jewellery segment has expanded.

That said, low-quality base materials pose a massive challenge for the space. Tarnishing and skin irritation are common issues during long-term use.

So, women treat fashion jewellery as short-term use products — use it while it looks good, then dispose it.

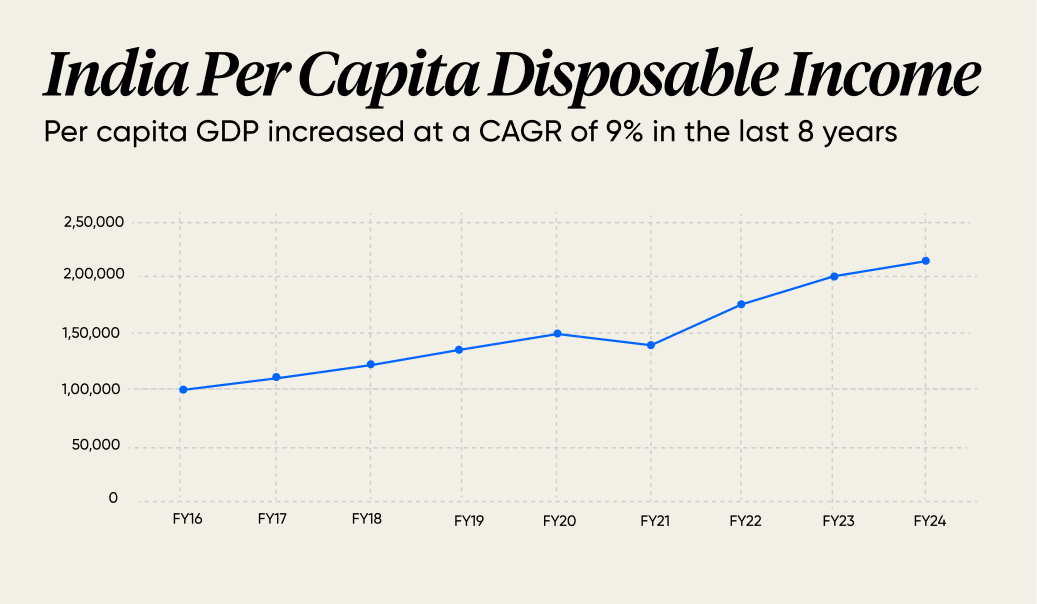

3. Rise in disposable income

Since 2014, disposable income has been on the rise.

That translates to greater splurge potential (discretionary spending), leading to more mass-premium product purchases. And what happens when you have a little extra cash to spare, and can’t buy expensive, solid gold jewellery? You’d buy the demi-fine gold necklace.

See, the demi-fine category sits between the cheap fashion jewellery and the expensive fine jewellery segments. You get premium finishes and light-weight, trendy designs at pocket-friendly prices. Here’s a visual of where this category sits from a purely price perspective.

Palmonas is disrupting the demi-fine segment.

In just two years, they’ve fulfilled 6.4 lakh orders and opened 50+ stores. They’re among the first celebrity-backed players to organise gold-plated jewellery and establish it as a legitimate category.

How did they pull this off so fast? We decode their playbook in the next newsletter. Know someone who’ll want these insights? Share this newsletter with them. Our editions are free for everyone.

Good Post

Anyone whatever can you improve your web conversation daily feel free check my profile in last projects

Great post, growthx

If you ever want help improving your newsletter layout or website conversion, feel free to check my profile I share past projects there