The ₹1000 Cr startup story no one expected — and it’s not in tech

A fan company’s distribution masterclass

Some context

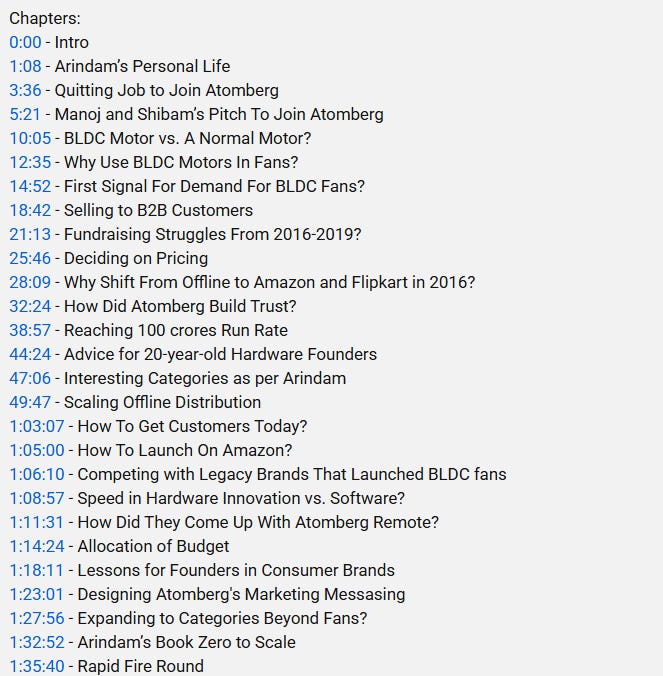

In August 2025, Atomberg crossed over ₹1,200 crores in revenue. In September, we sat down with Arindam, Atomberg’s Chief Business Officer, to understand how they did it. From finding PMF in an established industry to figuring out distribution. This is our attempt to condense a 1.5-hour conversation into a 7-minute read. If you’re keen on building a manufacturing/ hardware business from India, this is a goldmine.

Arindam’s hosting a book reading session exclusively with the GrowthX fam. He wrote Zero to Scale, which is winning the top spot in the business category. We will have Q&A post the reading and book signing too. This is on Sunday, November 2nd.

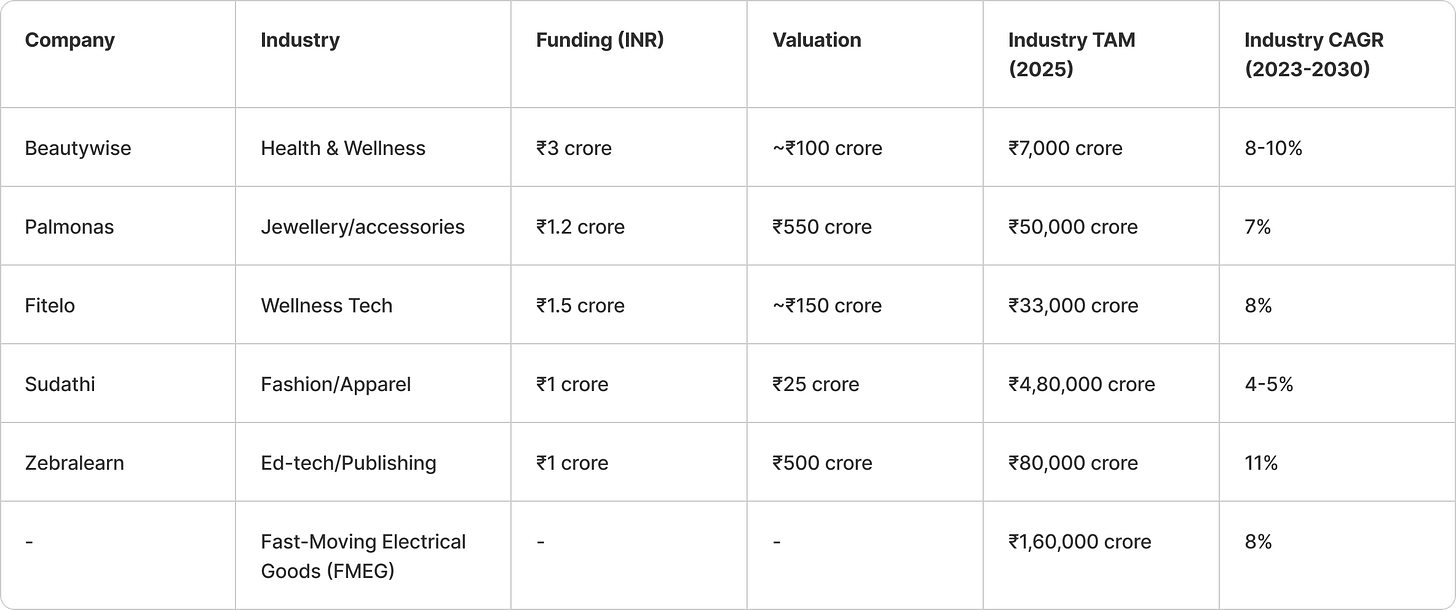

How much sense does it make to start a new dhanda in an unsexy industry in 2025? Think fast-moving electrical goods (fans, lights, switches) or construction (pipes, building materials, tiles). Turns out, a lot.

The money isn’t where you think it is.

Let’s look at a list of Shark Tank India 2025’s highest-funded companies. We’ll use this as a benchmark for popular industries to start a business in. Compare their total addressable market & industry growth rate (CAGR) with fast-moving electric goods (FMEG) giants like Orient, Havells, and Crompton.

Now let’s zoom in a bit.

Look at a single product in the FMEG category, fans. Breaking out here isn’t easy. The ceiling fans category grows about 2% every year & has a market size of 43.1 Mn units. Giants like Usha, Havells, and Crompton have captured the majority of this market.

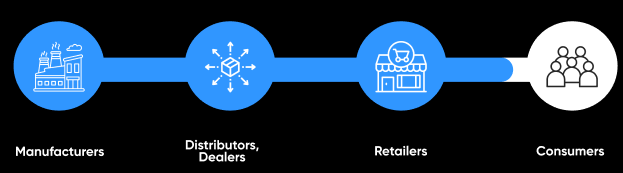

These category leaders have perfected everything from manufacturing and sourcing to product positioning. They’ve established distribution networks with distributors, wholesalers & retailers. And they have survived multiple generations of changing customer behaviour. If there’s anyone who understands selling fans, it’s them.

So, will people really want to buy from a new brand?

Indians have great expectations from an average fan. Fact – Indian customers are price & value-conscious. Most are one-time purchases. And when these purchases are made, here’s what matters —

Will this fan be quiet in my living room/ bedroom?

Will it look aesthetically pleasing? Even better, can I brag about it to their neighbours? (Indians spend more on the living room interiors than on bedrooms for the same reason). And will the electricity bill be lower even if the fan runs all day during summer? Oh, and can I get all of this for the lowest price?

Atomberg’s wedge with energy-efficient fans.

It all began with an idea.

Ever fought over who switches on the fan? Yeah, same. But two IIT grads, Manoj and Sibabrata, fought over it and unlocked a market opportunity — Indians would love a remote-operated fan.

That insight in 2015 gave birth to Atomberg.

Remote-controlled fans could become extremely popular. Even your sibling will tell you that. But they don’t have a big enough market (IoT products have a market size of ~₹1,210 crore). So, Atomberg pivoted to the energy efficiency category. For perspective, the energy-efficient fan market is worth ~₹12,000 crore.

Why BLDC fans? Creating an engineering wedge.

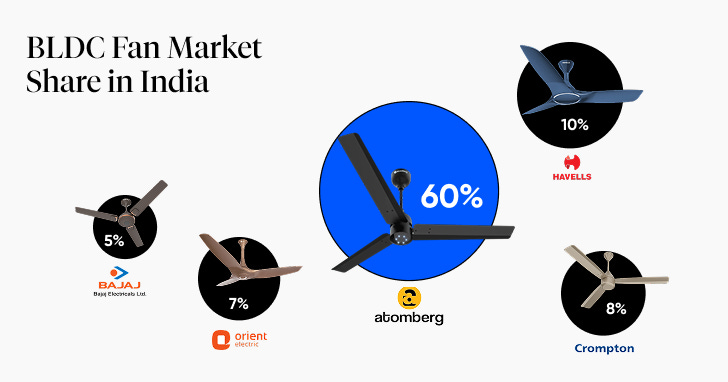

In the 2010s, BLDC (brushless direct current) fans were entering the Indian market. Legacy players like Usha and Orient didn’t see a demand for energy-saving fans at the time and didn’t innovate.

It’s a fan that could cut your electricity bill in half! And that’s exactly what allowed Atomberg to capture the fan-buyer market that actually cared about savings. These fans use ½ the wattage and eliminate friction, making them more energy-efficient, durable, and quiet.

Finding an unlikely product-market fit.

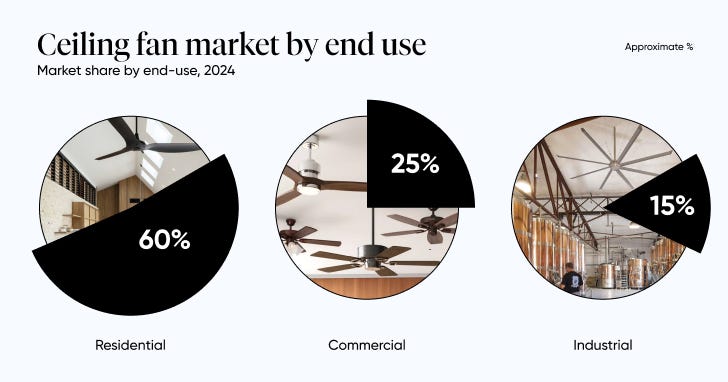

You already know that finding product-market fit is easier in established categories. Just follow the trend of where similar products are used. For example, if you see more men use dating apps, sell to them. Easy. Here’s a distribution of how ceiling fans get used in India.

Makes sense to sell to household end users, right?

Atomberg did the same and ran into two problems.

Problem 1: Retailers refused to stock a ₹3,000 fan.

Back then, only India 1 (urban) would invest in an energy-efficient fan. The majority of India 2 and 3 (semi-urban and rural) still wanted a trusted fan that would get the job done.

With Atomberg BLDC fans priced ~2X those of regular fans, it was obvious the product would sell less. Plus, star ratings (energy savings) for fans only began in 2023. So, there wasn’t a standard way to teach customers how a fan could reduce their electricity bill by half. Of course, retail consumers would consider energy efficiency a gimmick.

Add to that, the only time higher-priced fan models would sell was during sales. So, it didn’t make sense to stock them all the time.

Problem 2: Retailers were the only way to reach customers.

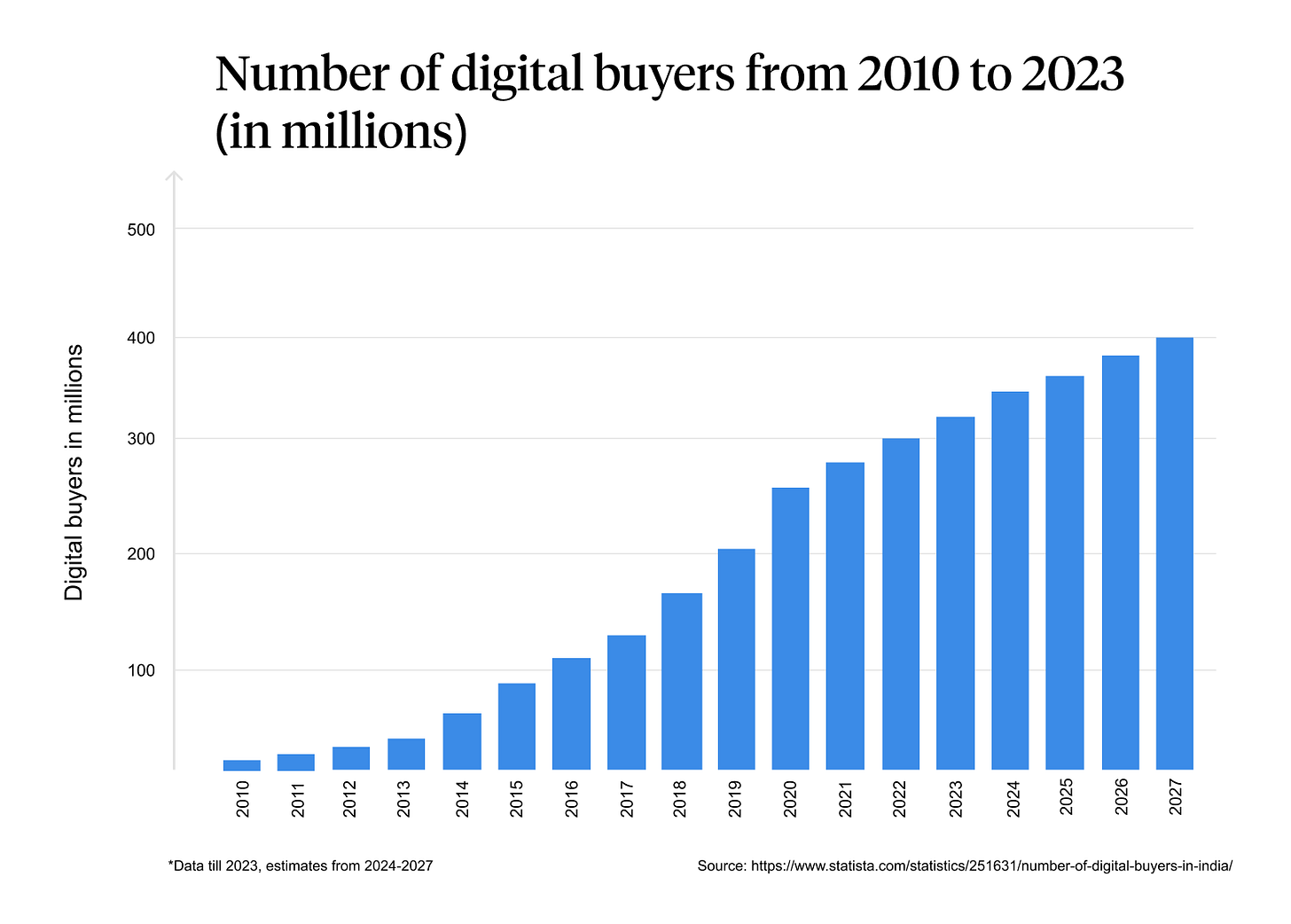

Back in 2015, online shopping for electronics wasn’t big. A regular person would only go to a retailer like Vijay Sales to buy electronics, including fans. Meaning it was essential to be visible on retail shelves to sell to regulars. And with retailers refusing to stock fans outright, selling to retail consumers looked more and more like a no-go.

Selling to businesses instead.

Remember the graph from above? Corporations and industries use 40% of all fans. And the thing about businesses is that they’ll do anything to cut energy costs. Currently, these are around ₹6.5 to ₹9.2 per unit. Large industries use over 20,000 kWh, 24 hours a day, all year long.

So, Atomberg began selling its energy-efficient fans to corporate and industrial customers. The pitch? Get as many savings in 2 years that the fan cost comes down to almost zero.

Atomberg made its first sales in the ceramics industry, where factories use ~1,000 fans year-round. Eventually, Atomberg cracked sales in sectors such as textiles and cold storage, and with corporates such as ITC and Tata Group.

Building distribution — D2C first.

After Atomberg found a steady stream of business sales, they wanted to capture a larger market — retail users. For perspective, if 43.1 million fans are sold annually, residential users buy about 25.8 million, while corporates and industries combined buy only up to 17.24 million.

In 2016, they found an opportunity to enter the market.

E-commerce. 2 major things worked here. One, Jio launched in 2016, providing high-speed internet access to the masses. Two, online shopping saw its first boom.

But didn’t most residential users buy fans from retailers?

Yes, but they don’t need to on a first principles level. Because even in a store, fans rarely have demos. Why does a customer buy from a store then? A retailer’s accountability.

If you purchase a fan from Vijay Sales and it stops working, you won’t call the company; you’ll call Vijay Sales. The insight was that customers wanted a trustworthy point of contact if things go wrong. Atomberg’s decision? Setting up call centres for online sales. Now, people buying fans online could contact Atomberg with questions and buy the product. Combine this with ads, and you have an engine for online sales.

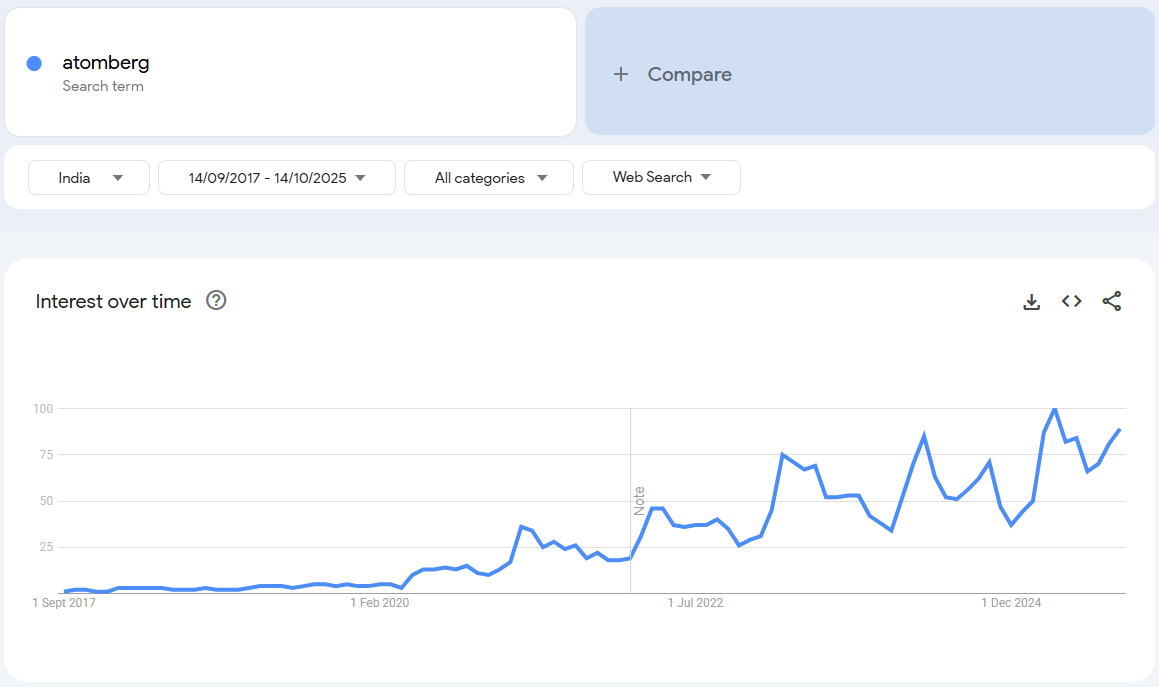

Ads bring customers to the Amazon page -> customers contact the Atomberg call centre -> they buy the product on Amazon. Eventually, the word of mouth spreads, visibility increases, and online search increases as well. This helped them build a customer base among sustainability-conscious and early tech adopters.

Going where the market is – retail stores.

One can’t change an end user’s channel preferences by a lot. Even the Jio wave & the e-commerce boom couldn’t push retail customers to shop for fans online entirely. Most homeowners still shopped offline at retail stores. So, to scale, Atomberg had to exist on retail shelves.

How did they convince retailers to stock ~₹3000 fans this time?

From 2015 to 2017, Atomberg’s brand perception, effort, and strategy had changed.

Firstly, thanks to Atomberg’s performance marketing efforts and e-commerce presence, end customers would ask retailers if they had an Atomberg fan. This signalled demand to retailers.

Secondly, Atomberg employees, including Arindam, would set up meetings with retailers consistently. After a few failed attempts, retailers would listen to their pitch. Persistence signalled seriousness to retailers. Plus, stocking just a few pieces of Atomberg fans meant lower risk.

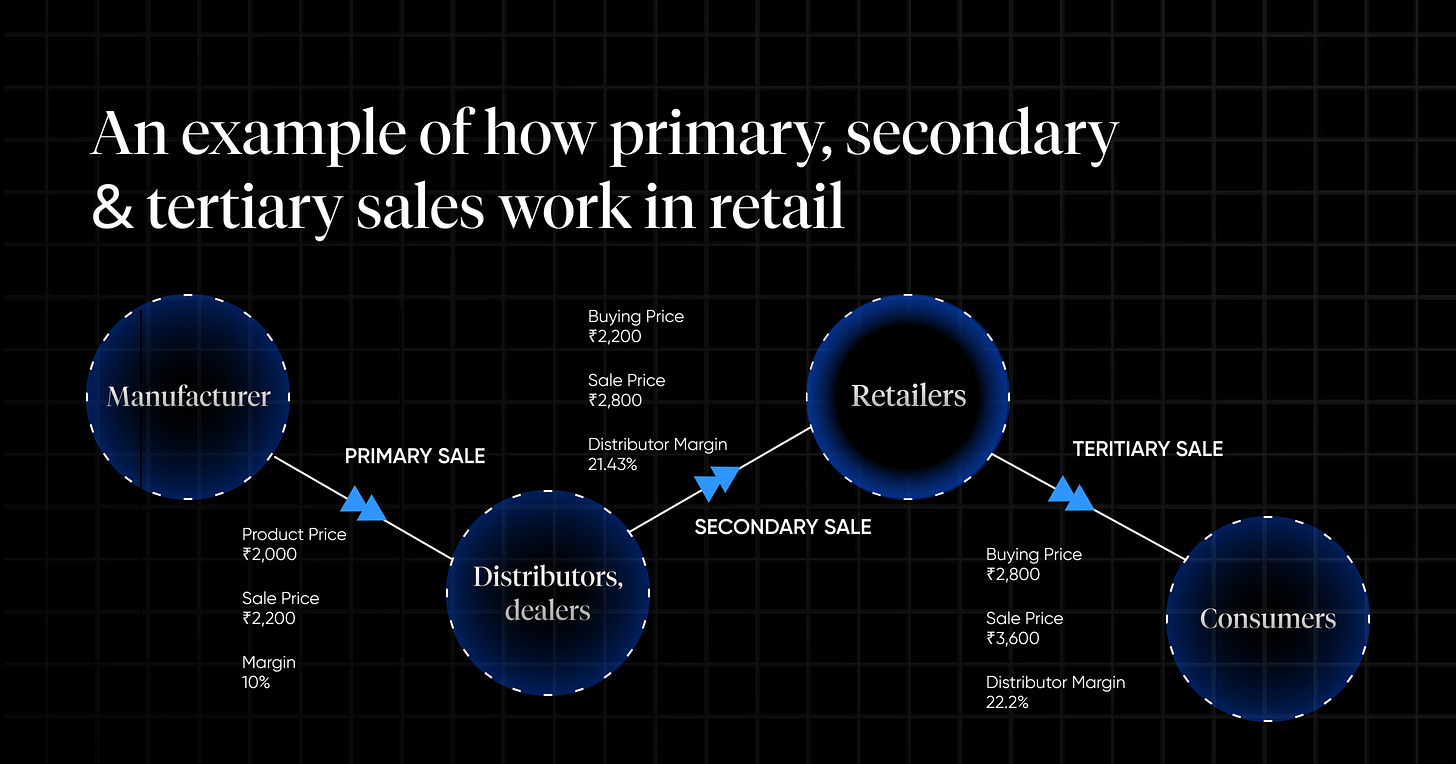

Thirdly, higher margins and ensuring secondary and tertiary sales. A retailer or distributor will only stock up a product if they can sell it for a profit. So, the product must sell, and they should make a profit or margin on it. This meant Atomberg had to adjust its pricing and ensure items were sold.

Established players like Usha have a set margin for distributors and retailers. It works because retailers know that the items will sell out. In contrast, when a new player like Atomberg quotes the same margins, retailers don’t know if it will sell out. The solution? Giving distributors and retailers a higher cut by adjusting pricing. This is what Atomberg did.

Once Atomberg sold fans to distributors and retailers, they had to ensure that the stock flew off the shelves. After all, this would reduce distributors’ and retailers’ risk and make them stock more fans the next time around. So the Atomberg team physically visited the distributor’s offices and retail stores to sell their products. This gave Atomberg the initial push for its retail expansion.

Going beyond customers - the electrician.

Apart from retailers, residential end users trusted only one person with knowledge about fans – their electricians. If electricians recommended Atomberg fans to end users, end users would ask about them in stores, signalling demand to retailers.

This would create a ripple effect: retailers would stock more Atomberg fans, and sales would increase. Everyone would win. But electricians, too, were cynical about an expensive new product in the market.

After initially offering commissions to electricians to recommend the fans and failing, Atomberg unlocked a core insight: Electricians consider themselves engineers and take pride in their work.

So, Atomberg began educating them about BLDCs, even showing them the motor and how it works. This alone made them feel respected like engineers, and eventually, they started recommending Atomberg to residential end users.

How to convince the price-sensitive customer to buy a ₹3,000 fan?

First, communicate your value.

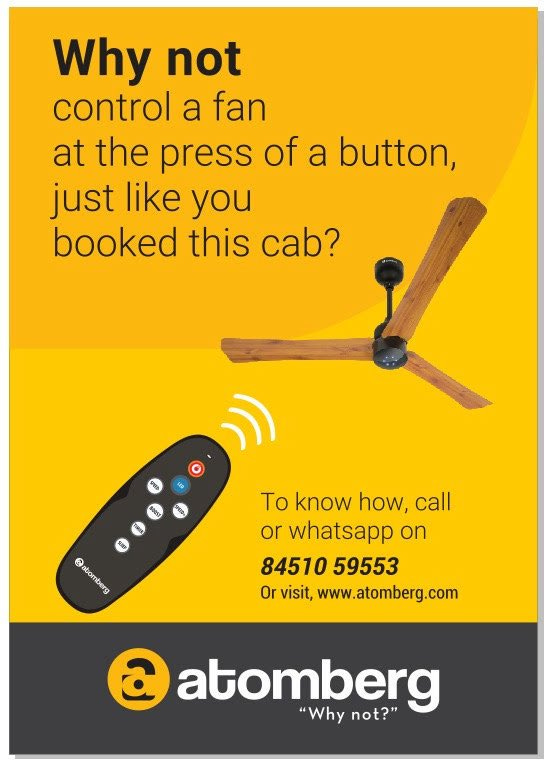

Atomberg fans have three main features: the motors, the design, and the remote control. Among these, customers only understand good design. That too, because ads have a product image. So, it’s important to communicate your value in terms that the customer understands.

The easiest way to do this?

Telling customers how a feature benefits them. So, instead of saying our fans have a BLDC motor, say our fans will cut your electricity bill in half.

Second, good customer service is good marketing.

Word of mouth will get you to places that marketing can’t. Say, you buy a watch from a brand. It arrives damaged, but after contacting customer service, you get a quick replacement and a gift. You would recommend the brand to your friends, right

Atomberg learned this, too.

Good customer service was key to their sales numbers. Remember the time they set up call centres to answer customer questions? That increased their e-commerce sales. Offering free repairs on their ceiling fans earned them their retail customers’ trust.

Establishing omnipresence on every channel.

If Atomberg’s name feels familiar, the credit goes to their channel presence.

And if you’ve purchased an Atomberg product, their marketing’s probably working too. Why? Because they cracked messaging and communicated just enough to connect to users. For instance, you won’t see an Atomberg billboard ad highlighting all three pillars; it’s usually just one. Look at any of the ads above.

But ask a salesperson at a retail store about Atomberg, and they’re most likely showcasing all three pillars. Arindam says, “Retail is like your landing page. Since your landing page has all the information, all the information needs to be there in the selling.”

Advice for a 20-year-old starting a hardware company from India.

1. Your product is your moat in an established market.

To know where you stand, ask these questions: Is your product new? Can it solve a real customer problem? Is it easily copyable? Ideally, your product should be new (this is how you separate yourself from competitors). It should solve a customer pain no one else is solving (this is why customers will buy) & shouldn’t be easily copyable (you don’t want brands to copy your product before you figure out distribution).

2. Focus on product-led communication till ~60% of your target market knows about your brand. That includes answering these questions through marketing. What does your product do? How does it perform compared to competitors? Why should you buy it?

This marketing could be directed to your in-market audience — anyone who wants to buy your product through performance ads — and to your entire target audience (including current and potential buyers) through brand marketing.

3. Look for PPCMF (Product Pricing Channel Market Fit) rather than PMF.

In a country like India, customer behaviour changes every thousand kilometres. Atomberg, for instance, has a very strong PMF in Kerala with about a 30% share, as compared to the north, where the market share is just 2%. Factors like design and energy-savings education matter here because they change with every state.

Also, how you price the product matters.

As a brand, you’re spending on customer acquisition and margins to make every sale. But how these impact each other can change. For example, reducing the price of your product from ₹7,000 to ₹6,999 could make it appealing to more buyers.

Same reason why a book costing ₹299 looks less expensive than one costing ₹300. Such products will sell more and require less customer acquisition effort (spending). Note, this changes with industry. So, a company like Atomberg has to price its products so that more people buy them. And that involves both extensive market research and testing.

Lastly, how much a fan sells also depends on where it is available.

For example, a new fan company might make more sales online or on D2C platforms, while premium fans sell more offline. Why? People shop on D2C to satisfy an impulse, while interior designers specifically pick designer fans from the store.

Don’t know if you’ve acquired PPCMF?

Look for these signals.

- Conversion rate increase

- Rise in organic discoverability

- Positive ratings and reviews

Honestly, this is just the tip of the iceberg. The full episode captures the true essence.

There’s more.

At GrowthX, we have done multiple deep dives (90-minute live learning sessions)on building every part of the D2C business with experts at AbinBev, GoZero, Meesho, SleepyOwl Coffee & more.