Why PhonePe <> ZestMoney deal is falling off?🔎

The core macro levers are pushing M&As to the side.

Welcome to the 139th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,300+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

2022 → News of PhonePe <> ZestMoney acquisition 📝

2023 → PhonePe deal is off the table 🤯

Here’s why the acquisition is falling off ⬇️

Quick context 🗓

Announced in 2022, ZestMoney was a distress sell to PhonePe with cash burn & funding macro was going from bad → worse, valuing ZestMoney at ~$200 million.

But, things have changed in last 24 hours 🔻

Citing due diligence concerns and discomfort over the valuation, PhonePe has backed out of the deal → resulting in uncertain future for ZestMoney → possible layoffs due to cash crunch for the brand.

This deal has a major reason 🥲

And, that's exactly I want you to learn from.

Understand the chronology 📝

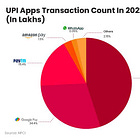

PhonePe owns nearly 50% of the UPI market in India. With newer regulation of merchant discount rate (MDR) it see a hope to make commissions on certain UPI transactions.

PhonePe is no more part of Flipkart group 💔

In December 2022, Flipkart completed the separation of PhonePe from Flipkart Group. Both companies will now operate separately. PhonePe was valued at $5.5 Billion with its last round in 2020. Plus, Walmart (Flipkart parent) now owns 70% stake in PhonePe.

PhonePe wants to solve for sustainable growth ✅

It can no more ask money from Walmart cause even Walmart needs to show positive business metrics in the US. For PhonePe, one piece of that puzzle was to monetise it’s huge user-base on UPI. And, lending is something PhonePe wants to push full pedal on.

But, PhonePe doesn’t have the lending license.

Enter, ZestMoney to the PhonePe Den 🐯

Started off in a heartbeat, the deal to acquire ZestMoney was primarily for its lending license and merchant network of 10,000 online & 75,000 physical stores. The supposed deal should help PhonePe solve it’s monetisation problems.

But, 2023 has been tough for private & public markets 📉

Most companies want to show positive unit economics, get profitable to an extent and really earn back the confidence from private equity market. They are even doing things like measuring operational profitability and growth at all costs is dead.

PhonePe has no plans to go public 🚫

With the macro in private equity changing, bear public markets → it has to solve for business growth with limited cash. It has two key jobs to solve for. First, maintain the market share. Second, monetise its base.

Paying $200 million for a lending license? 🥲

Could have made a lot of sense at the start of 2022, but not at all in 2023. Plus, Walmart is majorly dictating this deal and it doesn’t want to acquire a loss making business like ZestMoney - not when market sentiment is bearish. It’s not about just the $200 million but the impact it could make on Walmart stocks too.

Call it due diligence or concern over valuation - the real truth is just pure macro and recessionary moves from giants like Walmart. That’s the honest truth nobody wants in say it out loud in the PR release.

That’s all on the ZestMoney story 🥹

If you are solving monetisation problems like every freaking product company right now, you might want to check out the monetisation deep dive at the GrowthX experience. It helps you understand core levers to monetisation, user segmentation, pricing discovery, and elasticity and helps you build a structure around your monetisation strategy in 2023.

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.