Netflix will now have ads 🍿 🤯

Call it lazy, call it bullshit, but we think it was about time.

Welcome to the 86th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Quick context 🗓

Netflix has been struggling to grow it’s subscriber base, period. Netflix’s slow growth has been a combination of competition from other OTT players (Disney+, WarnerMedia’s HBO Max worldwide & HotStar in India), pulling out of certain geographies (Russia), inflation & more stuff which is core to it’s product.

Interestingly, it’s revenue retention has been quite good.

So the problem isn’t with retaining users. It’s with new user growth.

Before we dive in, you’ll have to understand how economic layers of society think about spending patterns. What do they consider luxury? How do they trust new products? At what price do they are open to experimenting with their money. This is where it gets interesting.

Most OTT encounters three type of users. First, those who want content for free. Second, those who want the cheapest plan to get premium features. Third, who wants the plan with most features.

Netflix has already got the #3 kind of users into the ecosystem. A look at Netflix’s India penetration numbers being at ~5.5 million. That breaks the first high adoption audience segment and goes into the slower to adopt, SEC A audience as Google likes to call it, 45 million base.

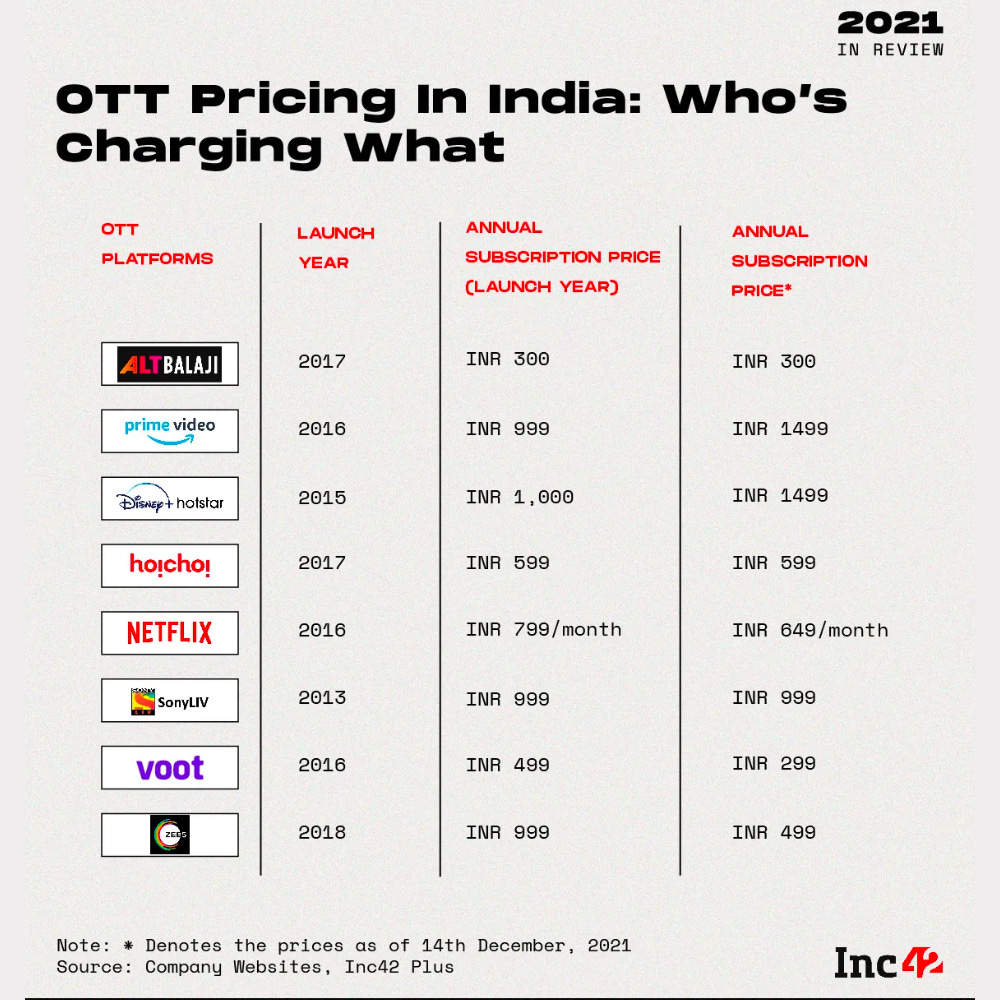

These users are price conscious (value conscious to an extent) & want bang on the buck. The same logic applies in other markets where users are conscious of their spending patterns. If you think about Netflix’s cheapest plan of Rs.199 per month, it’s still expensive for this SEC A audience.

That’s where Netflix Basic (with ads) comes in.

The plan which will be available in few countries starting November in will allow its viewers to subsidise their monthly subscription in exchange of 15 and 30-seconder pre/mid rolls. So if a user was paying $9.99 a month, with basic plan & ads it will drop to $6.99 per month.

To save $3 per month, users will be expected to watch ads.

Plus Netflix predicts to add $3 billion to it’s bottom line with ads by 2026.

I do think it’s in the right direction.

We don’t necessarily need to agree on current plan with Ads & will it will work. To truly test elasticity on pricing, Netflix will have to run few more aggressive experiments with ad-only model & then roll back segments to understand at what price point does the paid subscriber volume will maximize.

Netflix need to find the right range of pricing for price conscious customers and do this at country level. One global pricing would not work.

The other after effect of doing this would solve for speed of growth.

Most of these value conscious users have not experienced a Netflix product (they might have seen the pirated version of shows on Telegram / Torrent) but experiencing a product and reducing the price barrier (even with ads for now) will help Netflix gain momentum it’s been losing for last few quarters. Time will tell what’s in Netflix’s growth future in India & worldwide.

Struggling to figure right pricing strategy for your product?

Most products struggle to charge higher to their customers. Most leaders struggle to find the right decision framework to design monetisation for their products. Typical struggles are around which model to go for → subscription, transactional, ad-monetisation of a combination.

At GrowthX, we go in depth to design into monetisation for each stage of the product from early stage to mature scaling products. Learn the science of monetising your product & come out stronger on your this quarter’s pricing plans.