Microsoft gets sued, Alphabet's $100B revenue quarter & Lovable’s 0-$100M playbook

AI news watchers, it's been an interesting few weeks.

Before we begin.

GrowthX Host Club is expanding. Our November curation has 15+ curated close-knit events. From the Comet shoes (Utkarsh) founder spilling the playbook for building a Rs. 100 Cr brand to ex-Netflix India CMO (Swati Mohan) hosting a hands-on brand marketing workshop & Aviral Bhatnagar demystifying the operator-to-founder journey from an investor’s lens. There is a lot to unpack here. Go explore.

Microsoft’s million-dollar hiccup.

Some context.

Microsoft recently rolled out new pricing plans for Australian users, and it is facing pushback over misleading pricing. The company allegedly notified ~2.7 M subscription users of a pricing increase for AI features without explicitly stating that they could continue on the basic plan. Now, the Australian Competition and Consumer Commission (ACCC) is threatening to take Microsoft to court and pay a $50 million fine (30% of the company’s adjusted turnover during the breach).

Wait, don’t SaaS companies already have vague pricing?

Yes, for enterprise-tier plans, and for a good reason. SaaS companies customise their products—including integrations, analytics, and premium support—and have long sales cycles with a lot of negotiation flexibility. Plus, they want to avoid price wars with competitors. Talking about pricing, 1:1 solves all these challenges. And it’s perfectly legal.

Microsoft, in contrast, sent a misleading email. Millions of paying subscribers ended up paying the raised prices because they feared losing access to basic services. Meanwhile, others who cancelled their subscriptions were notified of the basic plan. That is illegal, under Australian law.

What does this mean for the broader software company ecosystem?

Get transparent with pricing. Find structures that work, like usage-based pricing, seat-based pricing, and feature-based pricing, instead of vague 1:1 pricing conversations depending on feasibility. Also, communicate better. It’s the only way companies can retain their customers’ trust, especially in crowded spaces where customers aren’t locked into the product ecosystem.

Google makes a $100B in a single quarter.

Some context.

On 29th October, Google’s parent company Alphabet announced its Q3 earnings. They are now one of the few companies to cross $100B in revenue in a single quarter.

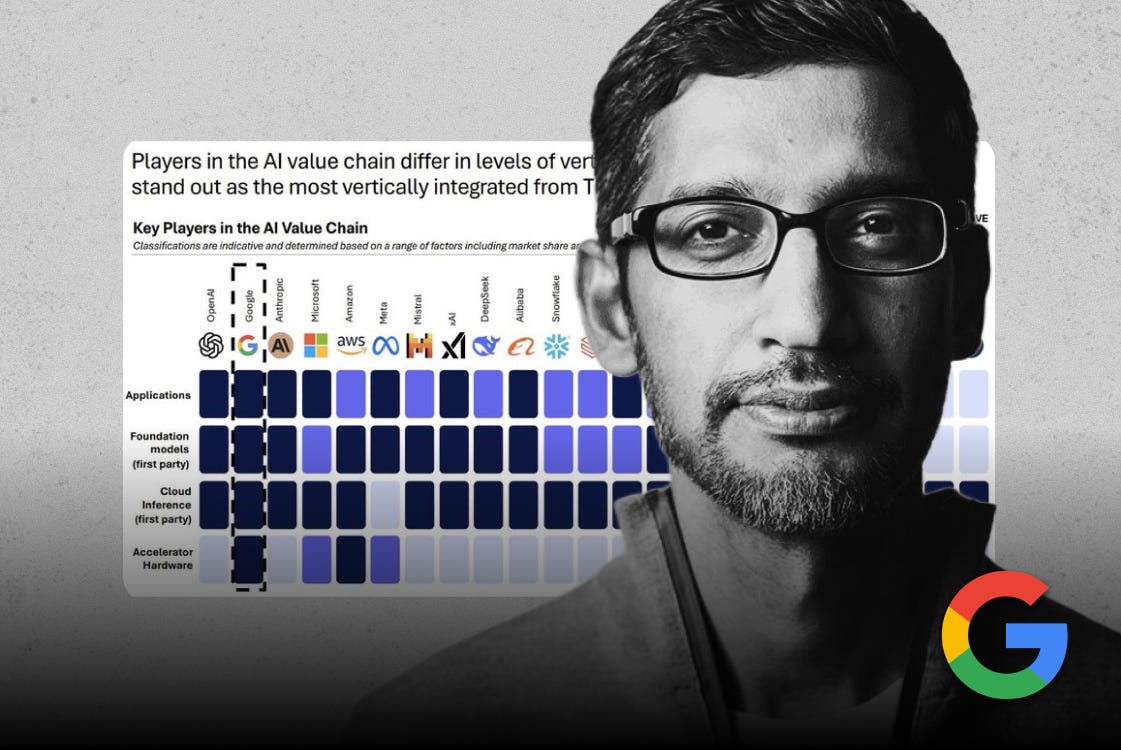

Why is it a big deal?

Google’s quietly moving away from being a tech company to being a full-stack AI company, and the earnings announcement validates this shift. Google Cloud revenues (including AI infrastructure and services like Gemini) increased by 34%, contributing a sizable chunk of the overall revenue.

Fact.

No other big tech company—OpenAI, Meta, Anthropic, Microsoft-follows a full-stack approach to AI. That means, they have different vendors for hardware (Nvidia), data centres, platforms for training and deployment (other AI companies haven’t solved for this fully yet), and distribution partners (Perplexity had to launch Comet with Airtel users, for instance). Hardware is expensive and hard to scale, model reliability depends on how well the platform supports training, and the company has no control over distribution.

Google’s full-stack AI is a smart move.

Google bypasses this entirely. It has custom TPUs (Tensor Processing Units) for deep learning, a platform that handles every step in-house (including building, training, and deployment), and distribution through the App Store, Search, and other platforms.

Behind Lovable’s 0-$100 M playbook.

Some context.

Lovable, an AI-based coding platform for web apps, reached $100M in ARR in just 8 months (it’s the only software company to do this!). Startup folks said their secret was tapping into a segment no one cared about.

But that’s not the only thing they cracked.

First, what is the core product?

Lovable is an AI-based full-stack software development platform that helps users build both front-end and backend with natural language prompts. It handles development end-to-end, including code generation and database modelling to API integrations, user authentication, and payments through a single tool, cutting prototyping time.

Most importantly, it is developer-first, solving problems like error-handling and reliability—no one did that then.

A peek into the business model.

Money comes in through usage-based subscriptions: Free, Pro, and Teams. Each tier offers different usage limits, advanced capabilities and collaboration features. Pretty standard for software products these days.

Nailing the distribution game.

Lovable did developer-led marketing and targeted a niche TG no one cared about. Since developers had their own active channels (you’ll find them on Discord, GitHub, Product Hunt, and Twitch, which other TGs don’t use), Lovable could capture their interest without worrying about competition.

They also launched on regular channels like X, SEO, and created founder content on LinkedIn. Plus, they collaborated with popular LinkedIn creators to build hype. Besides, Lovable was a breakout product in the small startup world ($10M ARR in 60 days!). So, the founders got invited to podcasts and spread the word.

Long story short, Lovable cracked finding unconventional spaces to show their product and did it well. This helped them capture a market that people easily ignored and quickly reach paying customers.

Hey, great read as always. Spot on about Microsoft, it's so easy for users to get confused by these 'AI features' tactics.