Jewelbox's $100M consumer opportunity 💍

Can lab grown diamonds beat natural diamonds?

Welcome to the 221st edition of the GrowthX Newsletter. Every week, I write two pieces that go to over 100,000 product, marketing, business leaders & ambitious founders in marquee internet companies around the world. If you haven’t subscribed yet, please do.

Jewelbox recently raised about ₹2 Cr for 6% Equity from Shark Tank India. But what makes Lab Grown Diamonds a Venture-backed business? Especially when natural diamonds already exist in the market?

The value chain of a diamond 💎

A diamond goes through four steps before it is sold to a consumer like you - Extraction, Polishing, Grading & Putting it in a jewel.

Before you can buy that ring the Gemological industry has graded it based on the 4Cs Cut, Clarity, Carat & Color.

This is where it gets interesting 💡

From a production POV, a lab-grown diamond can be produced in six weeks, compared to hundreds of years for a natural diamond. But from a chemical composition standpoint, there is almost no way to tell a natural diamond apart from a lab-grown diamond after it is polished 👀

The savings on a lab-grown diamond 🕺🏻

Compared to natural diamonds, a lab-grown diamond is ~40% of the price. See, 70% of the cost of producing a diamond is in exploration & mining. This is the cost savings that is passed on to the consumer.

The export opportunity 🚢

Just in 2021, we exported ~$26 Billion of diamonds, making us one of the biggest diamond exporters in the world. With the USA as one of the major export hubs, export is a huge opportunity - even for lab-grown diamonds. On that front, we are directly competing with China. But, I want to discuss a different opportunity for Jewelbox and lab-grown diamond companies - the Indian consumer opportunity!

What is Jewelbox’s $100M opportunity in India?

1/ The sustainability opportunity

There is a reason why Swiggy & Blinkit use paper/compostable plastic bags to send all their deliveries. Sustainability is not a novel concept anymore. Your GenZ & Millenials crowd are consciously choosing brands that offer sustainability in their production & packaging.

To find 1 carat of a natural diamond, you need almost 200+ litres of water and have to displace ~250 tonnes of land. Add pollution from heavy machinery used to do this and it drives the ‘sustainability’ concept home for Jewelbox. Also, sustainable product = bragworthy helps Jewelbox’s case.

2/ The cost opportunity

It’s no wonder only ~5% of Indian women own diamond jewellery. And the reason is out in the open - exorbitant cost $$$

Cost diff between natural Vs lab grown.

Tanishq (Natural) - 0.3 carat - ₹71,000 while Jewelbox( lab grown) - 0.6 carat - ₹35,000 (almost 4X cheaper). Plus, the tech to grow a diamond is still nascent. With time the cost to produce a diamond will also go down, opening up new use cases for buying & gifting.

3/ The gifting opportunity.

The gifting industry in India is threefold - festival, personal & corporate gifting. Corporate gifting aside, a diamond ring starting at ~₹5,000 opens up a lot of opportunities in the festival & personal gifting space.

₹5,000 diamond ring + roses >>> a chocolate hamper from Ferns n Petals.

₹15,000 lab-grown diamond ring as a gift to your mom > > > everything else.

₹20,000 diamond ring for a wedding anniversary >>> a gold ring.

This puts Jewelbox in direct competition with Ferns n Petals & IGP in the personal gifting space. Also, a diamond product is rarely expected as a gift owing to its cost disadvantage. From a gifting POV, a diamond still has a huge delta for consumers.

The lab-grown diamonds market is still early for consumers in India 💍

However, Jewelbox checks all the right boxes for them to become successful.

A market that values diamonds and has been devoid of owning one for a long time

Supreme e-commerce penetration + access to capital

A consumer segment that can pay & prefers sustainable products.

India has been known as the world’s processing and trading hub. The lab-grown diamond industry thrives on exports. But with lab-grown diamonds, I see a huge & thriving consumer market inside India.

We can expect some cannibalisation of the natural diamond market. But I see lab-grown diamonds as a starter product for this market. Eventually, it will help in the adoption of natural diamonds in the marketplace.

That’s all for now.

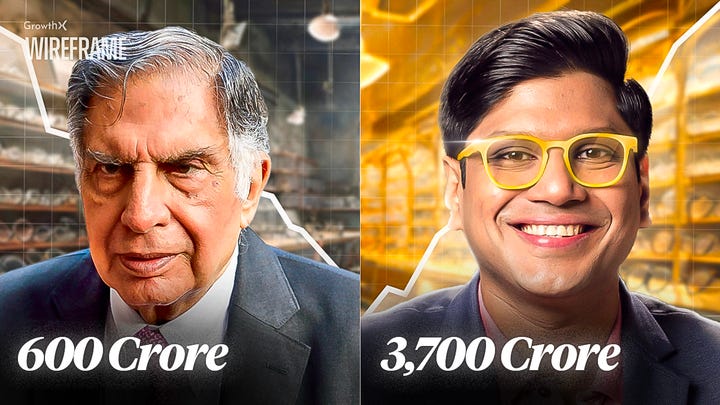

How did Lenskart disrupt India's organized eyewear industry and capture a 25% market share?

Despite starting 3 years after Titan Eye Plus, Lenskart is doing 5X revenue compared to Titan’s entire eyewear segment. One of the most interesting elements of Lenskart’s growth story is that how Mr. Ratan Tata himself invested in the company in 2016.

Find out in our latest episode of the GrowthX Wireframe 👇🏻

Thanks for supporting this newsletter 🙏🏻

I spend a sizable amount of my time writing pieces for this newsletter. If you find it interesting, please take a minute and share it with your close circle.