Inside Kusha Kapila's 150 Cr. brand ⚡️

The Underneat story to 150 Cr in annual revenue.

2025 ends this week.

This year was all about helping GrowthX members truly become AI-first. We started with a lower membership fee on purpose, as a test. We wanted to see if the environment actually works. If the rooms were sharp. If people showed up prepared. If conversations went beyond surface-level gossip. If members helped each other without being prompted.

They did.

Our 5,400+ members are landing their first AI-first roles, getting larger charters in their companies, building AI products & generating revenue. They are not learning AI as trivia, but as leverage. And more importantly, holding each other to higher standards.

In 2026, the GrowthX membership fee will increase.

You can lock in the 2025 membership fee until Tuesday, 30th December 11:59 PM. If growing your career in 2026 is on your mind, trust us & take the leap of faith.

Today’s edition.

Remember Anomaly, Priyanka Chopra’s haircare brand? They did $10 M (~₹90 Cr.) in revenue in their first year of launch. Underneat, an innerwear brand by Kusha Kapila, just crossed ₹150 Cr. in 8 months. Profitably.

Both are D2C brands. Both target mid-premium buyers. Anomaly even has the more famous founder. Yet Underneat does more sales. Is it the category? Timing? Pricing? Or something else?

We tried to decode exactly that over the past few days. Here’s everything we learned condensed into a 6-minute read.

It’s too late to build a do-it-all D2C brand.

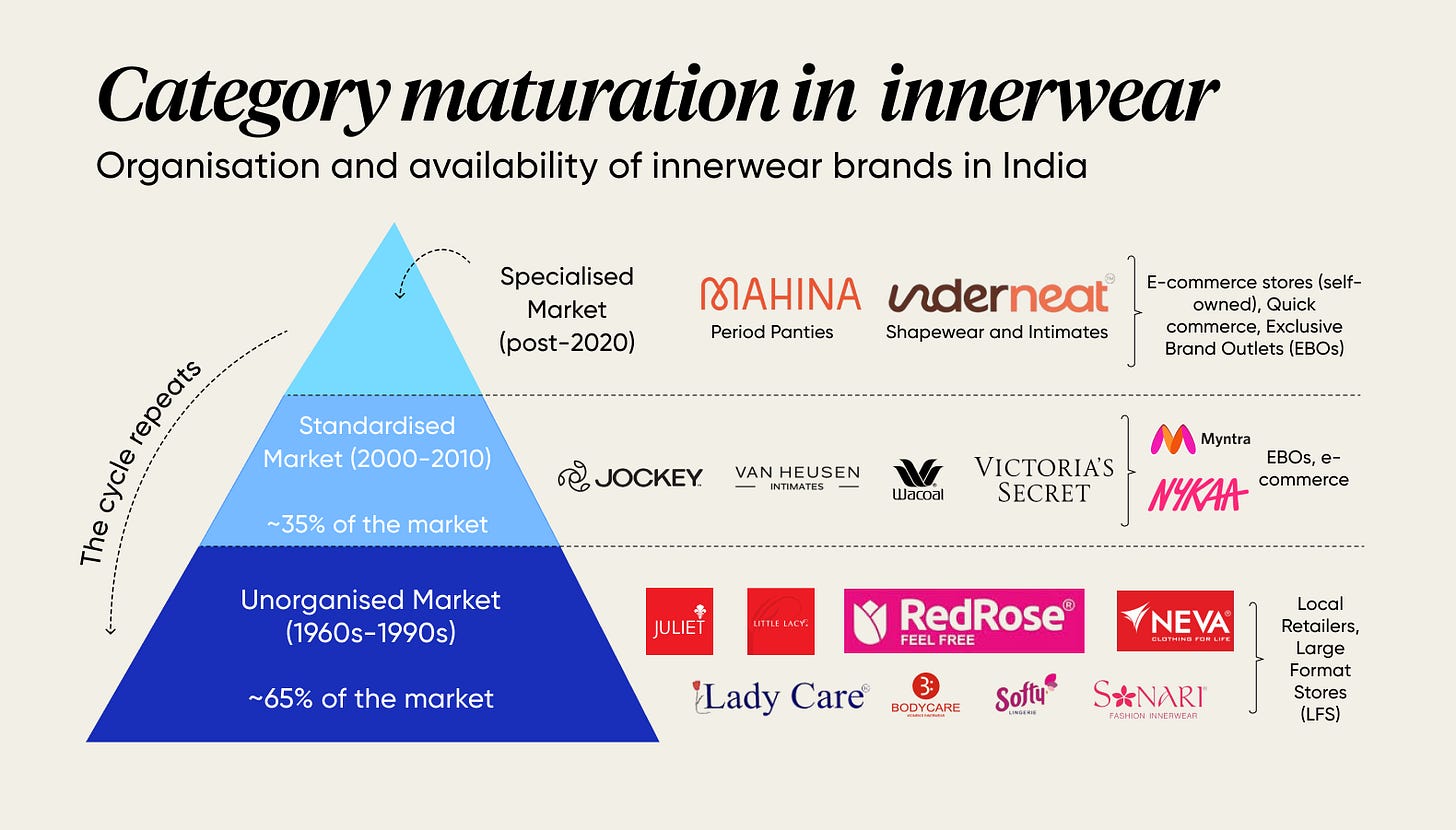

The innerwear category has been around since the ‘60s. For decades, it was cheap, available everywhere, and completely unorganised. No one cared about brands—the products just did the job.

Then, in the early 2000s, international players entered the market. They brought size standardisation, including clearer grading, fitting protocols, performance fabrics, and premium finishes to the mainstream. Product catalogues expanded horizontally—more variations, more options. The category became organised.

When e-commerce boomed, these organised players were first in line. Amazon, Flipkart, Myntra, Nykaa, they locked down listings everywhere. How does a new D2C brand compete against that? It doesn’t.

A new brand can’t beat a local player’s accessibility or an organized giant’s massive catalog. But here’s what it can do: spot a gap, build something new, and move fast.

The trick is finding a wedge.

A segment too small or too risky for the big players to bother with. Think about it. Building a new product line requires R&D and manufacturing setup; it’s too costly for big players. Plus, returns are uncertain if the product doesn’t sell.

Underneat doesn’t have those concerns.

It can enter a small niche, own it, then expand. And that’s exactly what they did with shapewear.

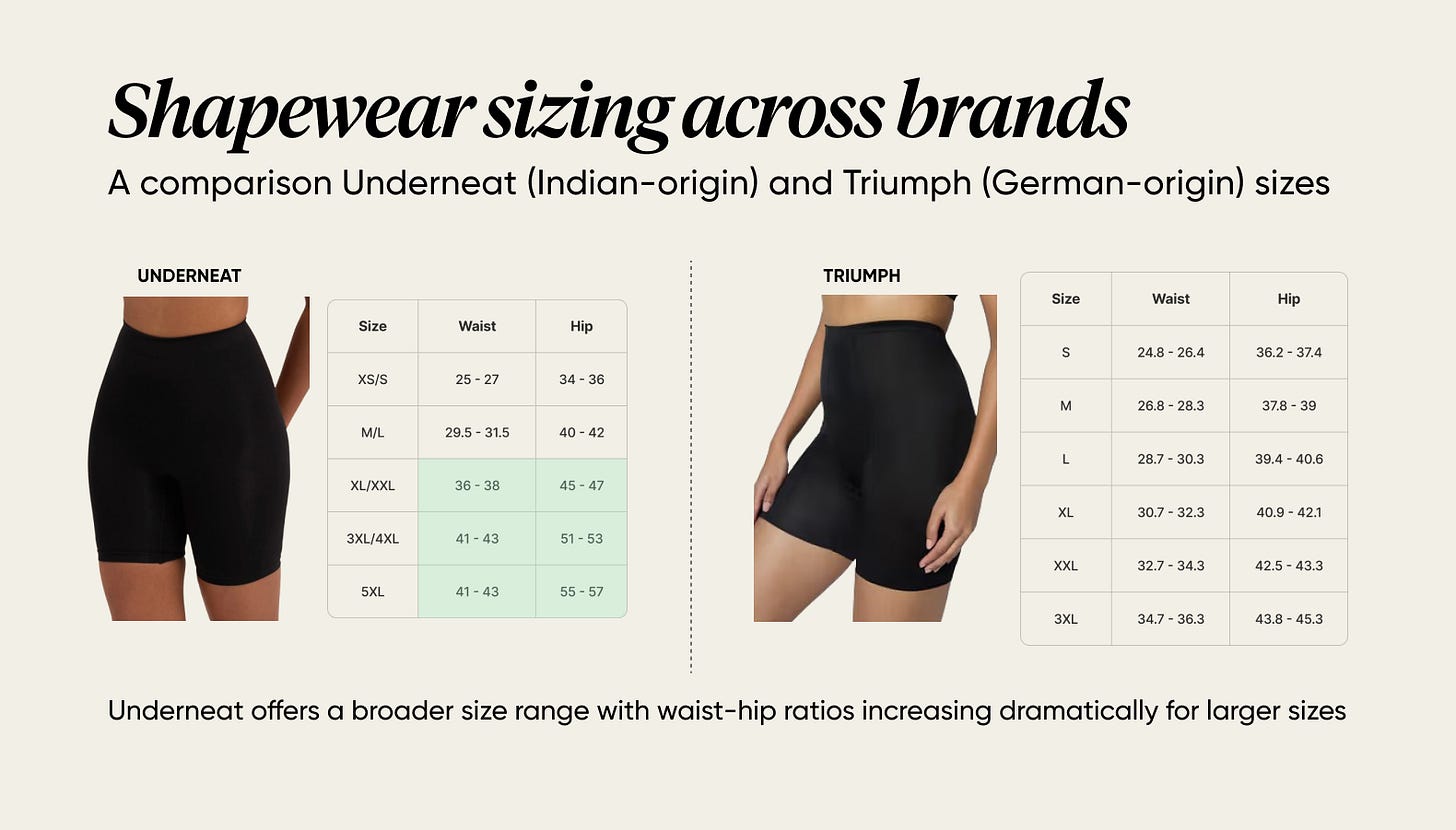

Indian innerwear is designed for Western bodies.

Fact — Indian innerwear, even the mass-produced stuff, follows Western sizing. Probably why inners that fit at the hip don’t sit right at the waist; the fabric suffocates, or worse, slips.

Yes, Indians have different proportions.

Broader hips and more pronounced waist-to-hip differences are common, especially at larger sizes. Underneat figured this out by asking 12,000 women how shapewear actually fit them.

The result?

A completely different approach to sizing. Take a look.

The second problem?

Indian weather. Most sculpting fabrics work in Western climates—not here. Underneat needed something that stretched and breathed. They found it in German-invented Sensil Yarn.

The kicker: Indians don’t want what Western shapewear promises.

Unlike the West, which aims for an hourglass shape, Indians just want to hide flab. (That’s why pinpoint solutions, like tummy tuckers, sell so well!)

So instead of maximum compression (30-40%), Underneat kept it at 10-20%. Less constriction, more comfort — perfect for the Indian woman. And there’s still no guarantee the product will sell.

Indian innerwear isn’t a mature category yet.

Here’s a question.

What is innerwear for?

Took you a few seconds, right?

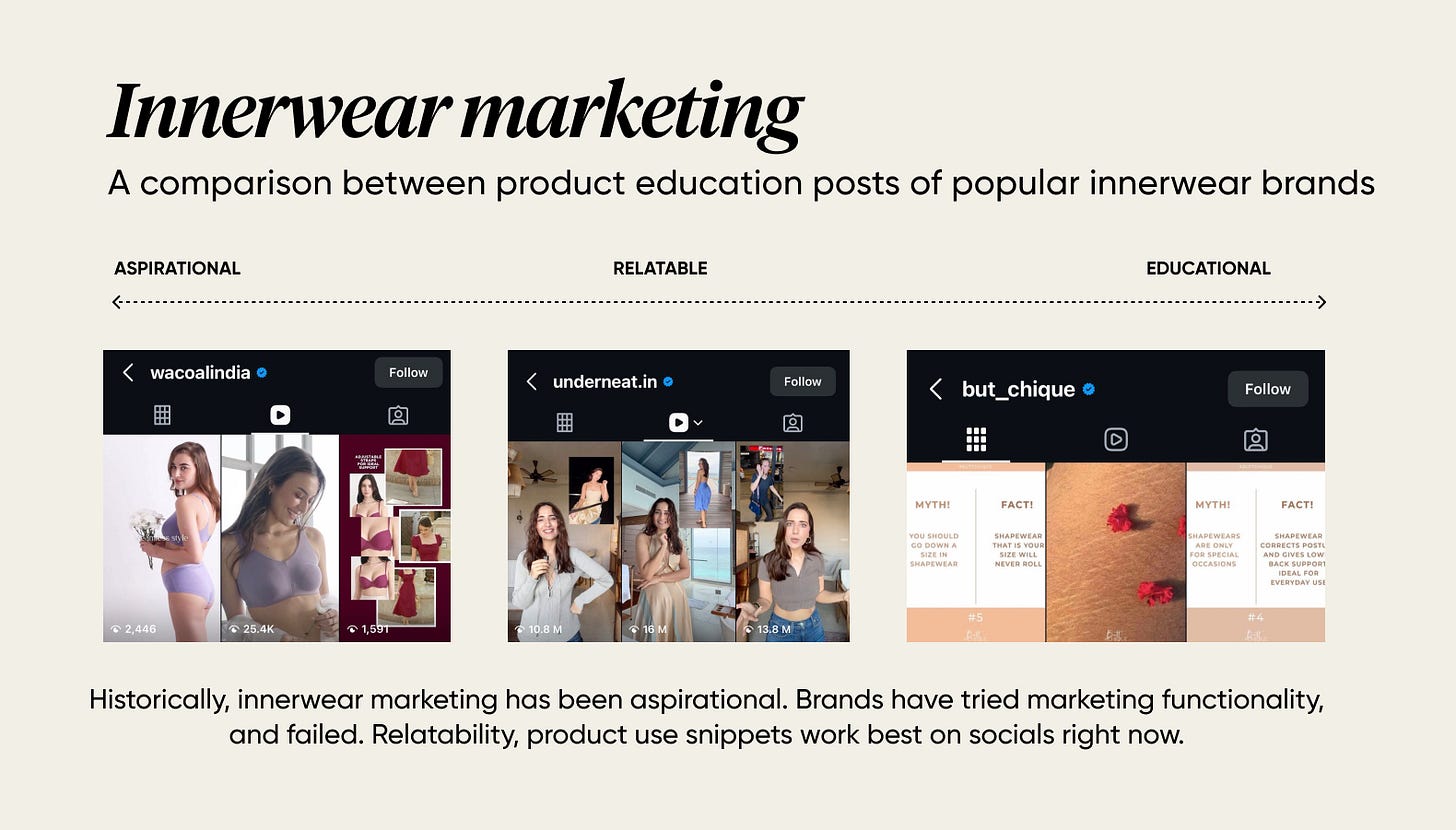

Shapewear, padded bras, and body sculpting products are still taboo. Marketing happens quietly through word of mouth, private recommendations or closed communities.

So, how do you sell here? Especially when no one knows their options. UGC reels work. But Underneat cracked a different approach. Take a look below.

See, Kusha, Underneat’s founder, has been creating relatable content since her iDiva and PopXO days 7 years ago. She’s even built a massive ~4.3 M Instagram following on the back of it. No one knows the content game better than her.

Instead of going the classic Get Ready With Me (GRWM) route, Kusha maximised for the edutainment format with the “What Are You Wearing Under?” series.

Every problem was addressed — discomfort, sizing, lack of options, and potential solutions. After 3 months, Kusha launched Underneat to a primed audience. It’s classic marketing.

Step 1: Talk about the problem.

Step 2: Try all the available solutions and why they don’t work.

Step 3: Talk about possibilities, and bring in your solution. You just built a case for why people should buy your product.

Product placement matters.

The real test starts when your product hits the market. Sales tell you if customers want it. Feedback tells you if it actually works. Marketplaces (Myntra, Nykaa) only show you part of the picture — sales numbers and a few customer reviews if you’re lucky.

Your own website gives actual customer behaviour data: What did they browse? What did they buy? What did they abandon in their cart? Plus, you can reach customers directly and ask them what’s working and what isn’t. That information lets you shape your product to meet real market expectations.

Underneat launched on their website in April 2025 and took customer feedback seriously to build better products. Then they launched Underneat 2.0 in the mass market channels.

Marketplace reach can’t guarantee sales.

Wait, but is more eyeballs with spending power = more sales? Not really. Visibility doesn’t matter if you’re visible to the wrong people. Your customers will only buy if they actually need what you’re selling.

That’s why Underneat launched on Myntra & Nykaa first.

Both platforms had a large female user base with disposable income, who were already shopping for mid-premium brands—a perfect fit. Amazon & Flipkart? Dominated by male users buying electronics at the time. Not the right audience.

Next, Underneat expanded to quick commerce.

The play here was different: impulse buying. Indian women do retail therapy—stress, events, and last-minute wardrobe emergencies. Quick commerce captures that moment perfectly. The dress doesn’t fit? Order shapewear, get it in 10 minutes, even if it means paying more.

Panic purchases became a growth channel on quick commerce.

Today, Underneat sells on major e-commerce platforms. The difference? They’re no longer hunting for the right audience — not because the audience has changed, but because they've proven demand and need wider distribution. Last week’s $6M funding round will help them further scale distribution across Tier 1 and Tier 2 cities.

That’s all we have on Underneat for today. Building a D2C brand? Send this article to your colleagues who should read insights from the Underneat story.

Neat writing!