India's ₹16,000 Crore bottle company🥫

VBL - India's 4th most valued FMCG company

Varun Beverages Limited story.

Pepsi does not make its own drinks in India. Varun Beverages Limited (VBL) makes & distributes 90% of India’s Pepsi products like Slice, Sting, Dew, & Gatorade etc. It makes ~₹16,000 crores in revenue & ~₹2,700 crores in profits. It has a bigger market cap than giants like Britannia, Dabur, & TATA Consumer Products. The company was founded by Ravi Jaipura, the billionaire who also founded Devyani International- the QSR giant that runs Pizza Hut & KFC in India. Let’s dive into key insights behind VBL —

But how does this partnership work? 🤝

Pepsi wants to be an asset-light because it has seen a 7-year loss streak in India (until 2018). Pepsi & VBL have clear distinctions of roles. Pepsi works on demand creation and VBL works on demand delivery. So when it comes to decisions at the innovations, product, or recipe level — Pepsi owns it and when it comes to the on-ground hustle like the production, distribution, logistics, and maintaining relationships with kirana shops — VBL takes care of it. Btw, if you’re wondering if there’s a similar competitor for Coca Cola, there is none — Coke works with 11 different bottling partners.

What did VBL crack, really? 🤔

The scale insight.

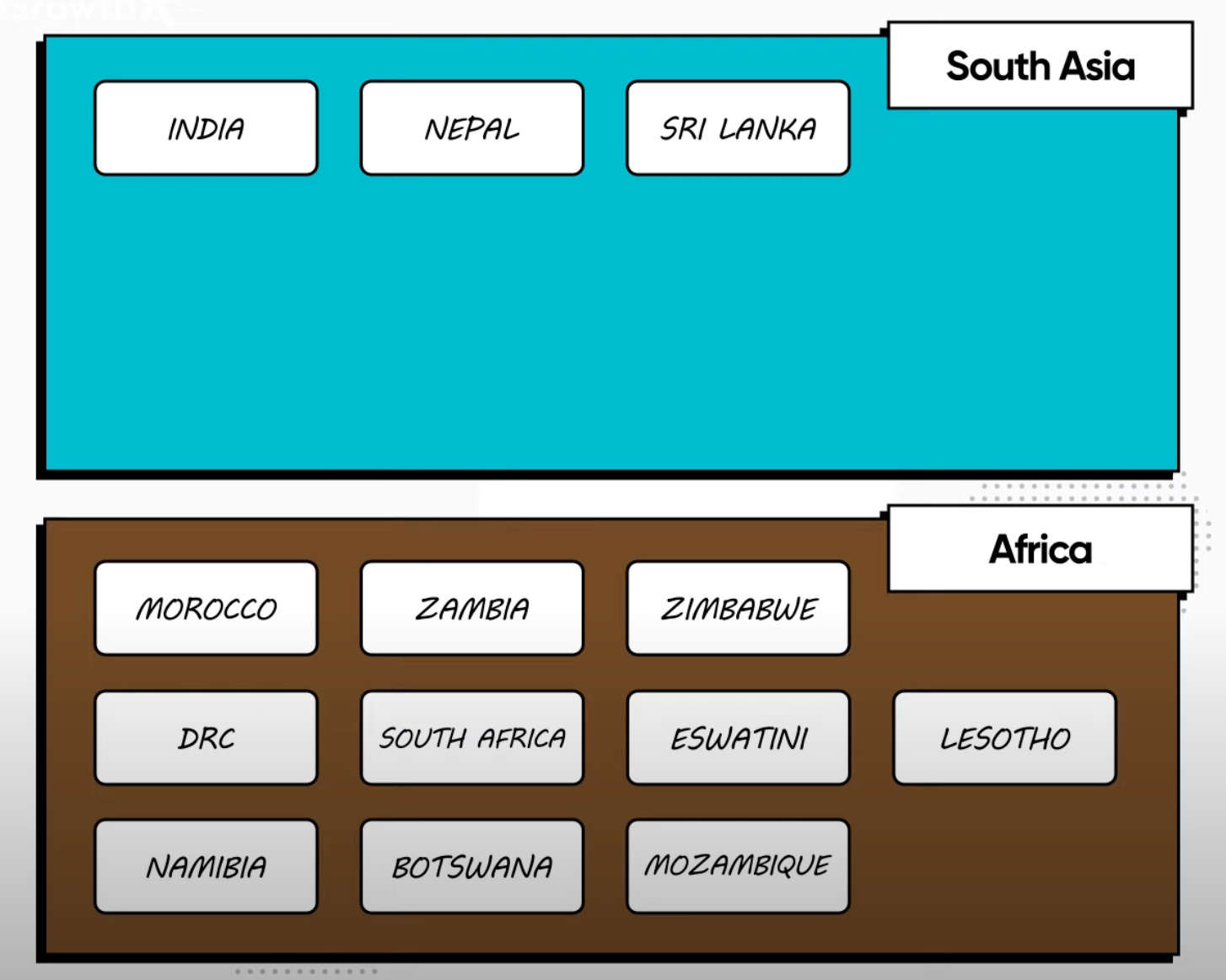

VBL’s biggest moat is its scale— the 47 plants across 12 countries. In India, it covers 27 states & 7 union territories. The company was not Pepsi’s favorite child since starting— its production share for Pepsi’s Indian volumes was 27% in 2011, 45% in 2016, and is now 90%— pure domination.

But how does VBL do it? The answer is acquisitions— both domestic & international. Some recent big ones —

₹1,800 Crore deal for PepsiCo's bottling franchise in South, West India.

₹1,300 Crore deal for South African company BevCo.

They want to be super-close to Pepsi. So if it’s not making Pepsi’s products, they try to get rights to distribute Pepsi’s products — be it beverages or chips. The logic is simple : Acquire more plants or rights → Enter more territories → Achieve results → Develop on-gound relationships → Gain Pepsi’s trust even more → Achieve monopoly status. Fun Fact: 20% of sales now come from international markets.

The SKU insight.

It has expanded into 9 SKU categories and keeps on suggesting changes to Pepsi as per on-ground demand, for ex.— the no-sugar drinks share is now 40% of its portfolio considering the “no-sugar” trend. All products are some of the hottest FMCG products inc. top market players like Sting & Acquafina.

Lately, the company has been eyeing the chips category and got the distribution rights for Lays, Doritos, and Cheetos in Morocco and the manufacturing rights for Kurkure puff-corns in India. If this works out, this can open the door to a huge new universe of business for them.

The operational insight.

The operational excellence of VBL can be broken down into 2 pieces:

Vertical integration— almost 1/3rd of their plants are backwardly integrated. The company increased its margins by 3-5% by moving the manufacturing of crown caps, bottles, plastic crates, and corrugated boxes in-house. Vertical integrations leads to 3 benefits:

Less dependance on third-parties

More control on quality and volumes

Cost savings in long run & faster scaling

Visi-cooler implementation— currently, they have 10 Lakh visi-coolers active in the country and aim to add 50,000 every year to the retail ecosystem. This visi-cooler is the ultimate customer acquistion tool and VBL is the one who installs this. The loop is simple: Get in front of customers — Associate yourself with the feeling of grabbing a fresh drink — Convert them into buyers.

But that’s not all, we covered the full teardown in the latest episode of GrowthX Wireframe —

Thanks for supporting this newsletter

If you’ve enjoyed this piece, do consider referring our newsletter to a friend. For your first referral, we’ll send you our Infographics ebook, which has a collection of growth & business infographics that have generated 1 Million + social.

Are you new to growth function?

We built a collection of jargons that will get you upto the speed. Here’s a complete collection of over 23 core metrics in growth with formulas.