India's $100B EV Opportunity Explained ✨

Built for the ones building, investing & curious about EV.

We’ve had the privilege of building this edition with top EV venture capitalists, angels, founders & experts. Huge shoutout to our contributors to this Thesis from Rainmatter by Zerodha, Better Capital, Nexus Venture Partners, Gruhas, 2AM VC, AJVC, BluSmart, Log9, Bolt.Earth, Oben Electric, Blume Ventures & 100s of experts.

Did you know? By 2030, India’s EV sector will be worth $100 Billion.

And that’s exactly why in today’s edition, we are brining you a summary of our 30,000+ words & 100 pages long detailed Thesis about India’s EV Opportunity. If you’re building / investing / working or are just curious about India’s EV opportunity - this detailed edition is exclusively for you.

This Thesis covers insights into major components of India’s EV space.

→ Batteries

→ Charging infra

→ 2/3/4 wheelers

→ Access to credit

→ Cost of ownership

→ Cell manufacturing

→ Indian govt policies

→ Recycling / upcycling

→ The climate question

& honestly a lot more in depth

I’ll cover 4 insights from the full report.

India, being the world’s 3rd largest auto market, imports 80% of its crude oil and is also one of the most polluted nations, making EV adoption critical for a sustainable future.

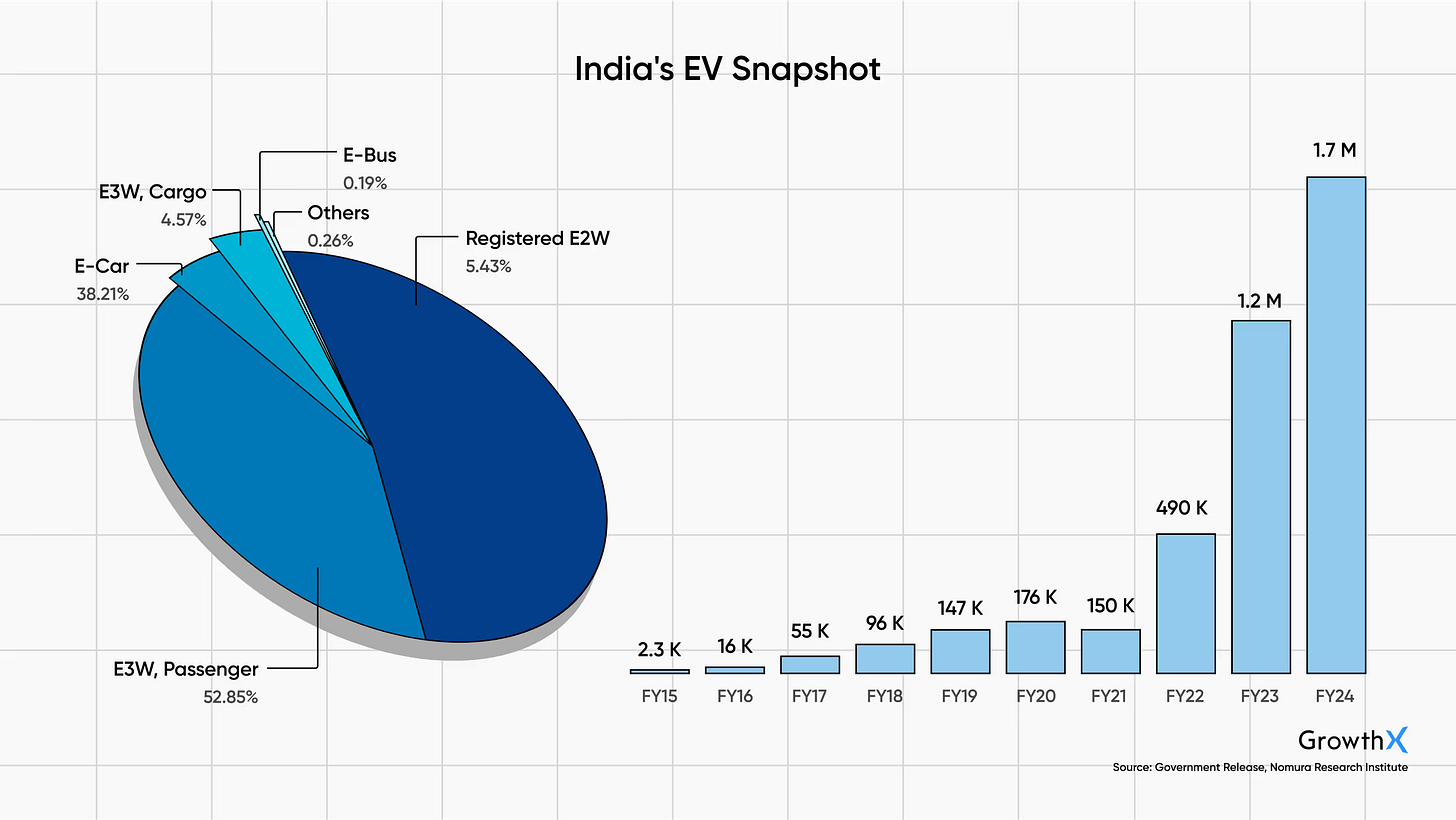

The push is no longer a choice, it’s a need. India’s EV sector got ~$4 billion in VC funding from Jan’19 to Oct’22. Our target is 30% EV penetration to hit carbon goals, but we’re far away at 4.4%. For context, the U.S. is less than 10%, while China is leading with ~50%. Let’s dive—

The bottom-up penetration.

India's EV market is evolving in a way that contrasts sharply with the U.S., where Tesla’s luxury-first approach led the charge. Here’s how :

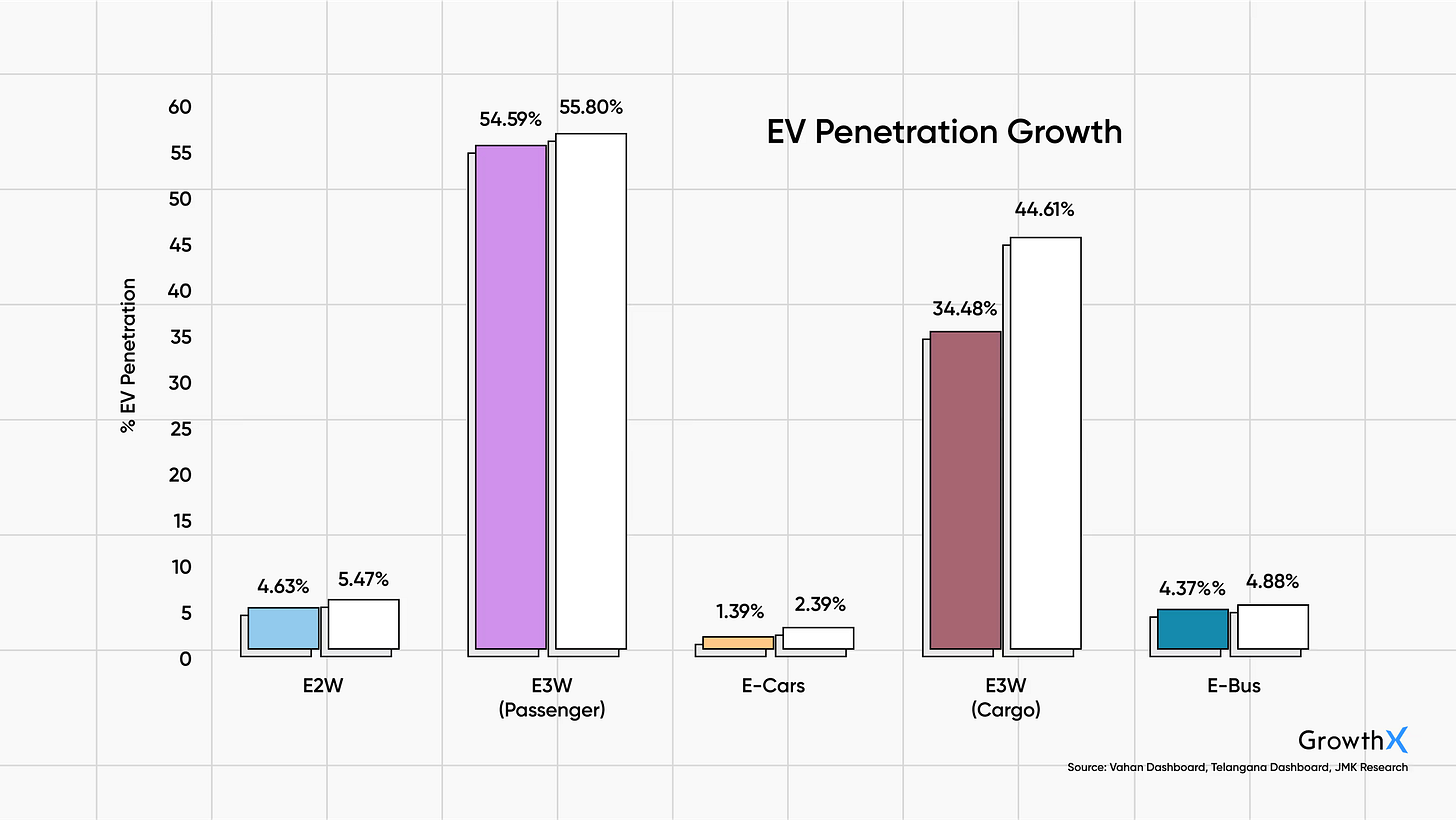

In penetration: Highest penetration is in EV 3W with ~50%.

In quantity sold: Most sold EVs are 2Ws with every second EV sold in 2W

In states: UP, Maharashtra, and Karnataka make for 40% country’s adoption.

Indian EV users focus on economical utility over status signaling. Unlike the west, buying an EV often reflects environmental or luxury reasons, Indian buyers prioritize total cost of ownership (TCO) and practical benefits.

The B2B tailwinds.

The major tailwinds for the increased penetration in the 3W & 2W categories are the need for:

Small-city goods delivery

Last-mile and Intra-city transport

E-commerce, Grocery & Food Delivery

Despite the upfront price being 55% higher than its gasoline equivalent, the average electric 3W model (auto-rickshaw) is 40% cheaper to own after 8 years.

Last-mile delivery accounts for 41% of the overall supply chain while an average food/grocery delivery rider gets paid ₹4 per km. Plus, now light-EVs coming into the picture like Yulu which are economical solutions for delivery companies and also for riders with minimal skills and license requirements.

The battery dilemma.

India only assembles battery packs and doesn’t make its own cells — importing 70% of its cells from China and Hong Kong. Btw, China controls 85-95% of global battery component production and 70% of lithium refining.

India’s import dependency on lithium-ion cells will take time to reduce. Startups like Log9 are making the country’s own lithium-ion cells, while vehicle manufacturers like OLA and Oben Electric are pursuing vertical integration by making their own cells.

Fun fact: Even Tesla gets its cells from Panasonic.

India’s decade's bet? Focus on R&D to own more of the cell manufacturing process in India.