How to topple a pencil mafia?

Unpacking DOMS' branding & distribution playbook.

It’s been an exciting week. Some big names just joined the GrowthX Club.

Over the past few weeks, the community has grown to 5,314 members who come from diverse backgrounds — founders, marketers, product managers, engineers, analysts & more. If you are serious about career growth in this AI world, take the bet.

Today’s edition.

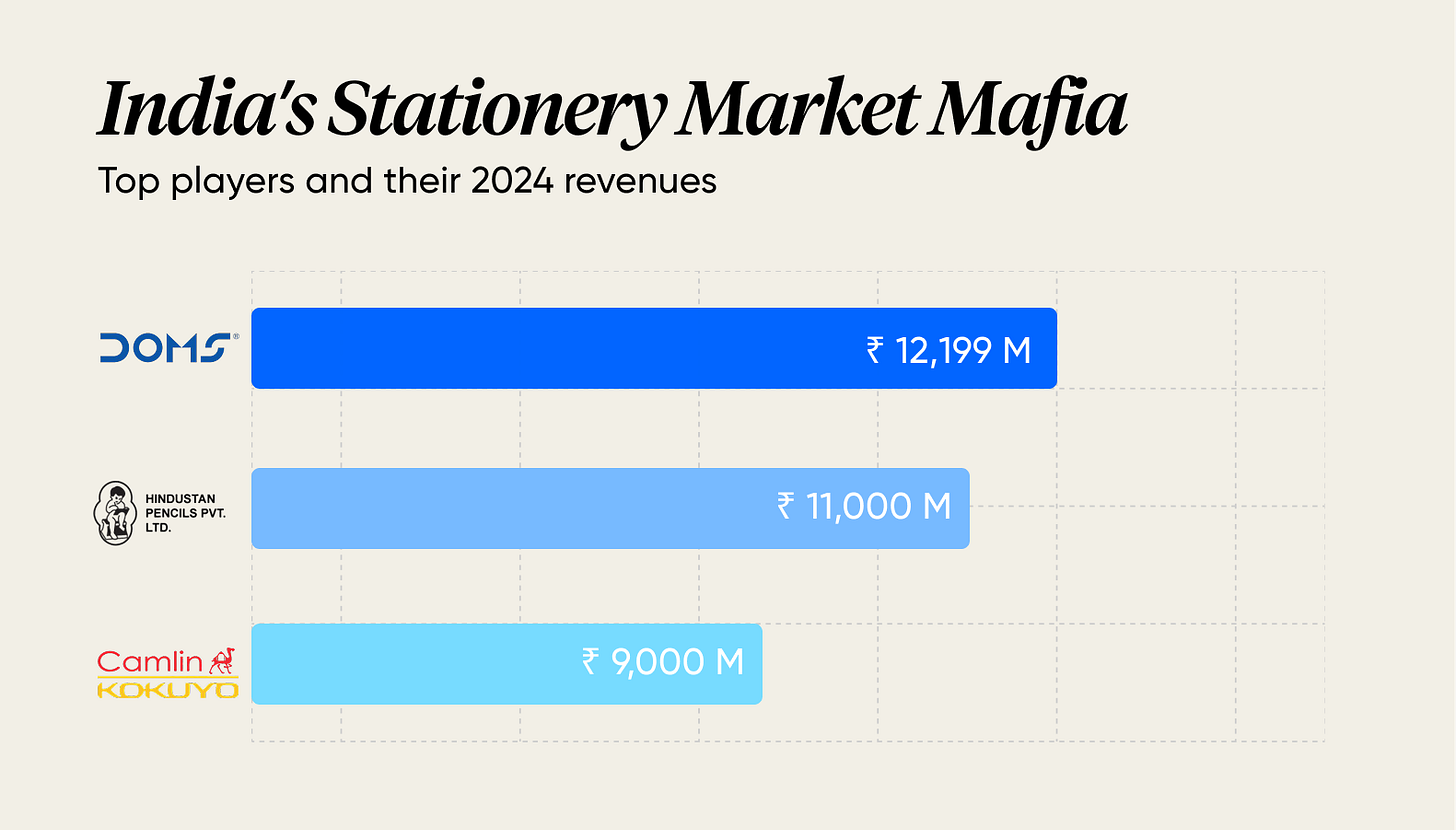

Twenty years ago, there was a 50% chance that your grandparents, parents, and you all used the same pencil. Not anymore. DOMS broke Hindustan Pencils’ and Camlin’s 100-year duopoly and now owns ~35% of India’s pencil market. That’s a feat most companies can’t pull off in decades. Let alone in a commoditised category like pencils. So, how did DOMS do it? We tried to find answers to that question over the last week. Here’s everything we learned, packed into a tight 8-minute read.

Pencil companies are growth engines.

Hindustan Pencils (Natraj and Apsara) played the volume game. They began mass-producing pencils right after imports dried up post-World War II, flooding the market with affordable pencils. Today, they have a 45% market penetration.

Camlin had distribution locked down after 20 years in the stationery industry. They entered late (1970s) but used their dealer network to grab shelf space everywhere—market penetration: 15% now.

RR Pencils & Maharashtra Pencils realised that they couldn’t compete with either giant. So they didn’t. Instead, they became the factory—manufacturing pencils that Hindustan & Camlin would brand as their own. That meant hyper-efficient operations and ₹0 marketing spend. Then, RR’s founders split. One of them, Santosh Raveshia, started DOMS in the mid-2000s.

Santosh knew the market and the manufacturing inside out. But launching a new brand? Still brutal. He couldn’t compete on volume—that meant building multiple factories, hiring labour, and sourcing raw materials, all sky-high costs. He couldn’t compete on price either. Pencils retailed for ~₹2-5. Manufacturing and marketing had to fit inside that price. The margins were razor-thin.

So, how did DOMS do it?

DOMS pulled five levers to dominate the market.

Product innovation

Here’s what a good pencil looks like: it’s dark, it glides on the page, and hopefully doesn’t break often. This formula has two moving parts: the wood slat (covering) and the graphite lead.

Now, wood slats are standard. Every Indian manufacturer uses the same ones from Phulwama in Kashmir. So, the lead quality makes or breaks a good pencil.

Most pencil manufacturers mix fragile graphite with clay to make the pencil lead. This makes it stronger, blacker and smoother on a page. Proportions and precision determine quality here.

DOMS innovated in this white space.

The company replaced clay with polymer (plastic). Leads were still dark and smooth. Now, they were also cheap.

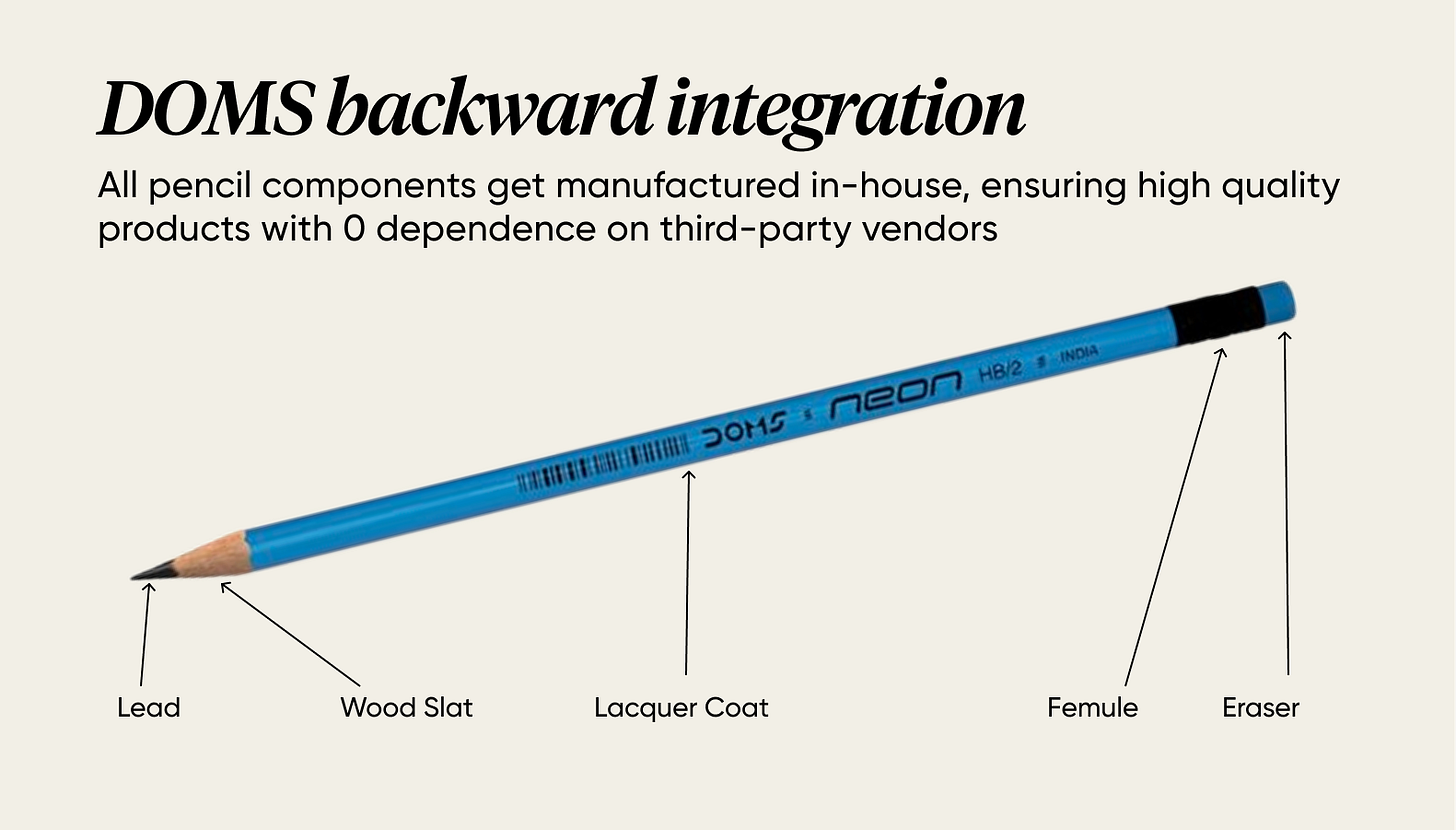

Then, they went one step further. DOMS set up fully backwards-integrated systems. That means the company sources and manufactures all its pencils in-house, reducing markups.Nailed the ideal customer

Most products have buyers and influencers (those who convince buyers to make purchase decisions). When you were kids, your parents were both the influencers and the buyers. And they cared about two things: the brand and the price.

Now, kids influence their parents. And it makes sense if you think about it. They use pencils daily and know the difference between a smooth pencil and a rough one. Plus, they see their friends using different pencil brands, try them out, and occasionally even trade them. So, their likes are influenced not just by the price but also by packaging, colours, and fragrance.

So, while Hindustan and Camlin kept marketing to parents, DOMS did the opposite—it marketed to kids. And their brand played a huge role here.Branding

Pencils are a saturated market—everyone uses them. But Santosh realised that, despite being a commoditised product, people cared about branding. “It should not appear as a commodity,” in Santosh’s words.So, DOMS began branding both the pencils and the boxes. Why? Because demand in rural areas is on a piece-by-piece basis. In urban areas, demand is on a per-packet basis.

That’s why DOMS’ pencils, boxes, sharpeners, and erasers were brightly coloured, and the shape was triangular for better grip. The cherry on top? Every DOMS product had a distinct sweet smell that children loved.

Kids raved about DOMS to their friends, who demanded a DOMS pencil from their parents, creating an endless word-of-mouth loop. This boosted the company’s organic sales without ads and marketing spending.DOMS has increased marketing spend in recent times. Just this year, the company launched a new SKU in a theatre chain with the release of the movie Sitare Zameen Par. Also, it partnered with Kaun Banega Crorepati around the release of the children’s special episodes.

Distribution

In the 2000s, Kissan had mastered distribution. Their ketchups reached general stores, wholesalers, kiranas, even remote rural outlets—everywhere a pencil needed to be. Santosh spent two years at Kissan learning their playbook and applied it at DOMS.

Today, the company has 100+ stockists, 5725+ distributors, and 145,000+ retail outlets across India. Plus international reach through their FILA (Fabbrica Italiana Lapis ed Affini) partnership.DOMS’ FILA partnership isn’t limited to distribution. It helps 3 things -

1. DOMS gains access to global stationery experts and product development knowledge. 2. They manufacture for FILA as an OEM. 3. They hold exclusive marketing rights for F.I.L.A. products across seven countries.

It’s a two-way street — DOMS gets scale and expertise, FILA gets a manufacturing partner in India.Bundling

All pencil manufacturers know this. It’s why they bundle erasers and sharpeners with their products. The idea is simple. A set increases usability and clears slow-moving inventory. Most importantly, urban Indians buy them regularly.

DOMS spotted another opportunity: urban parents spent heavily on stationery during back-to-school (June-July) and holidays (November-December).The strategy was simple: bundle complementary products to boost value.

DOMS launched premium kits—Smart Drawing Kits, Art Kits, gift sets—priced at ₹350-500. From 2018-2024, DOMS grew at 22% CAGR—more than double Hindustan Pencils (9.5%) and seven times Camlin (3%).

DOMS is just getting started.

Looking ahead, DOMS is doubling down on scale. The plan: boost production capacity, acquire new companies, expand the product portfolio, build retail presence, and launch e-commerce. Given their track record? The journey’s worth watching.

Btw, three curated events are happening this weekend.

AI Ads Build-a-thon in Chennai (tickets), a night of acoustic performances hosted by Tejas (tickets), and How the top 1% PMS think in the age of AI by Bhargav and Venkat(tickets). Plus, 7+ more events this week.