How Maruti won the taxi market?

A car company's playbook for mastering product, price, timing & distribution.

Next time you’re stuck in traffic, peek out of your window. You’ll see that 7 out of 10 taxis are actually from Maruti. It’s not because the cars are incredibly cheap. Or that they have a stark difference in mileage. Heck, it isn’t even the brand name. So, what is it? We tried finding an answer to that question over the past couple of days. Here’s what we found.

Before we begin.

How often do you get to spend real time with people who are exceptionally good at what they do? Now imagine 3 full days with them — learning, debating, and sharing ideas that stay with you as you enter 2026.

That’s what GrowthX Offsite 2026 is about. This time, we’re heading to Goa at the Novotel Dona Sylvia. No distractions. Just good conversations, great company, and the sound of the sea in the background.

The Maruti story.

To understand why fleet operators choose a Maruti Suzuki over other cars, let’s think like a fleet operator. All taxis are cars. But not all cars are taxis. Even for fleet owners, a car is a high-ticket investment. So, every vehicle choice affects profitability.

The first question a cab operator will ask themselves — “What kind of business am I running?”. A medium-sized van works if you’re serving schools or large families. A compact hatchback fits up to 3 people better for city commutes.

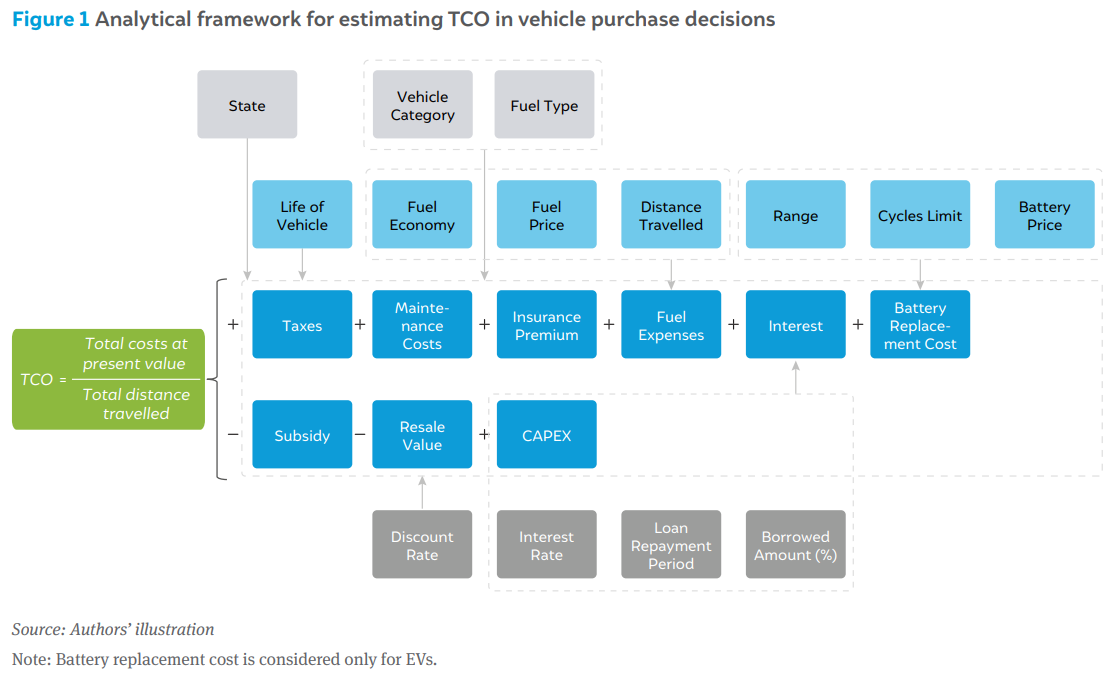

The 2nd question they ask is “What’s the total cost of ownership?” — that includes the cost to buy, run, and maintain the car over its operational life. Plus, how convenient is the service network? A great car with a bad service network isn’t the wrong bet here. Here’s an expanded decision framework for cab operators.

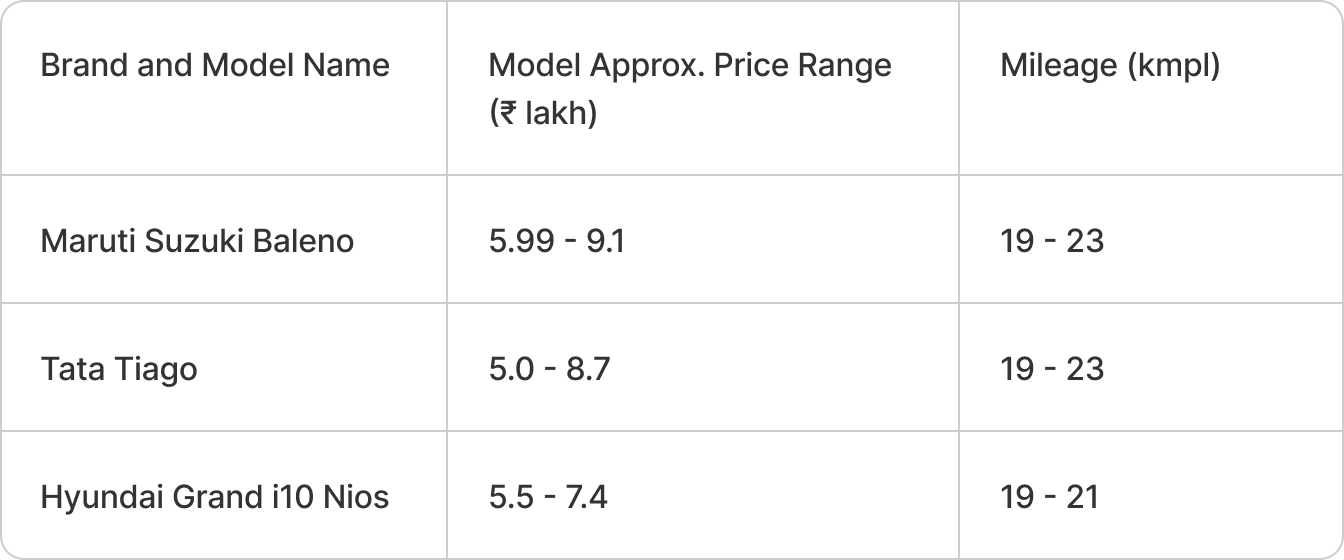

Let’s look at it in practice. If you wanted a mid-range hatchback retailing for about ₹7 lakhs, you’d have these options. Each offers comparable mileage for the price. Which would you pick?

Still a Maruti Suzuki. So, is it just brand? Or is it something else? This decision is no accident. There is a deeper reason why Maruti Suzuki cars are the default choice for cab owners.

Digging deeper into the insight.

Maruti Suzuki, a collaboration between the Indian Maruti & the Japanese Suzuki, entered the market in the 1980s. This was around the time when Hindustan’s Ambassadors and Fiat’s Premier Padminis were ruling Indian streets. Cars were a status symbol then—a luxury for the rich. Maruti Suzuki changed that.

The company launched the Maruti 800, a hatchback with bucket seats, top-line gearboxes, and even air conditioning. More importantly, a compact vehicle that uses fuel efficiently. That made the 800 an attainable luxury compared to the ruling cars at the time. Maruti 800 was an instant hit. And with Omni in 1998, the taxi monopoly began.

The mistake that worked.

Maruti Suzuki launched the Omni to help larger Indian families move around. It had sliding doors, movable seats, decent mileage, but most importantly, extra seating space. But Indian jugaadu had other things in mind for this car.

School operators loved that it could safely carry 8 to 10 children. Small businesses used it for goods transport. Tour operators deployed it for group travel. And yes, taxi operators loved it for its versatility and extremely low running costs.

The Omni was an excellent commercial vehicle on paper. At a time when other car manufacturers used ads to push the market to adopt their products as they imagined them, Maruti did the opposite. They openly encouraged commercial adoption.

They went one step further with the Omni Cargo in 2003, specifically for business operators. It disrupted the 3-wheeler market with an efficient, RTO-approved, 4-wheeler.

But why did other brands reject going into the commercial vehicles category?

Fear of losing the premium positioning. Selling to businesses would mean two things: selling in bulk (if everyone owns a premium product, it is of lesser value) and lowering prices (bulk purchases give customers negotiation power).

Next came the first Maruti Sedan.

Maruti’s first modern, compact sedan in the Indian market was the Maruti Esteem. Unlike its competitors, the Esteem was compact and sleek, while still giving India’s growing middle class extra legroom and luggage boot space. People loved it.

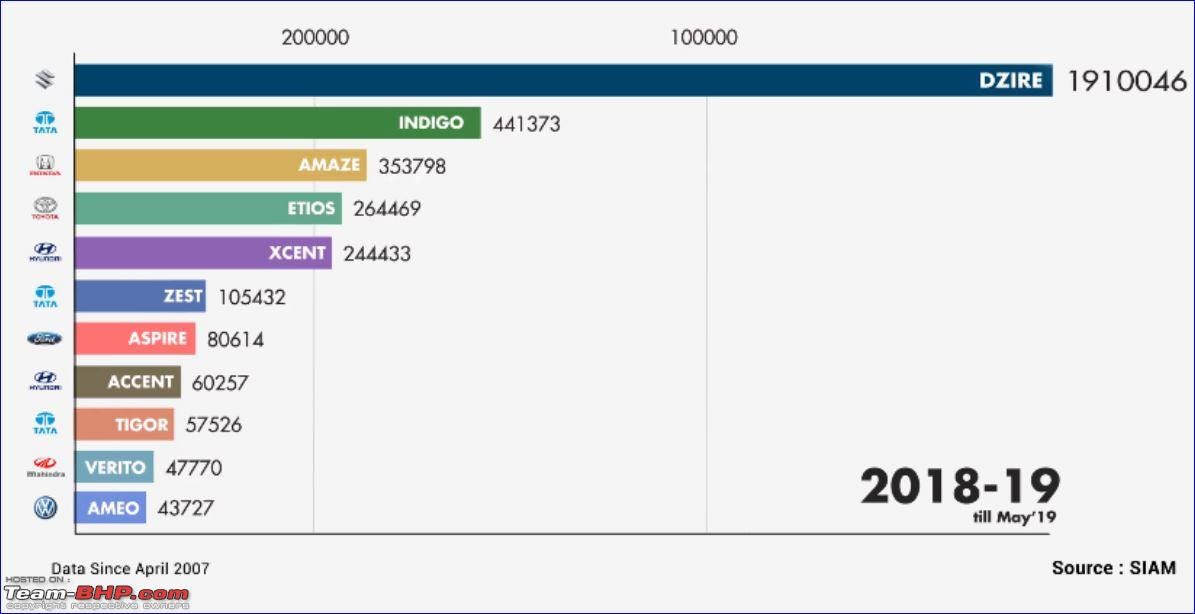

Then Maruti introduced the Swift Dzire in 2008, offering the efficiency of a hatchback in a stylish sedan form factor. The Dzire too was a hit with both taxi operators and passengers. At its peak, Maruti was selling ~2 lakh units of the car per year.

The smart taxi wave of the 2010s.

The organised taxi market grew from just kaali-peelis to include app-based ride-hailing platforms like Ola and Uber. As a result, demand for commercial vehicles grew. So, car companies had two options —

Open current models for commercial sales. The risk was losing status-conscious passenger vehicle buyers.

Launch separate vehicles for commercial buyers—also a risk, given there was no guarantee that ride-hailing services would pick up. If ride-hailing services became popular, the car companies would lose a large chunk of revenue from private buyers. And if it didn’t, the manufactured cars could end up in the dump.

Maruti played it smartly.

When they launched a new generation of a popular passenger model, they made tweaks to the older model for commercial operators. This became the Tour variant. Tour variants didn’t need extra set-up costs. Maruti could use existing resources to bring them to market.

Now, Tour variants came with pre-installed speed governors (a legal requirement for taxis), tougher vinyl interiors instead of fabric, simplified feature sets to keep costs down, and enhanced cooling systems for long operating hours.

Plus, the pricing was clever.

The Tour variants — built for commercial use — typically cost ₹50,000 to ₹80,000 less than their consumer counterparts. That makes it a better buying decision for fleet operators.

At the same time, Maruti has been careful to protect specific models from being associated with commercial use through its premium Nexa retail channel. It’s where you get premium models like the Baleno, Ciaz, S-Cross, and XL6. These vehicles keep being positioned as aspirational for regular buyers. And that’s why customers also keep buying them.

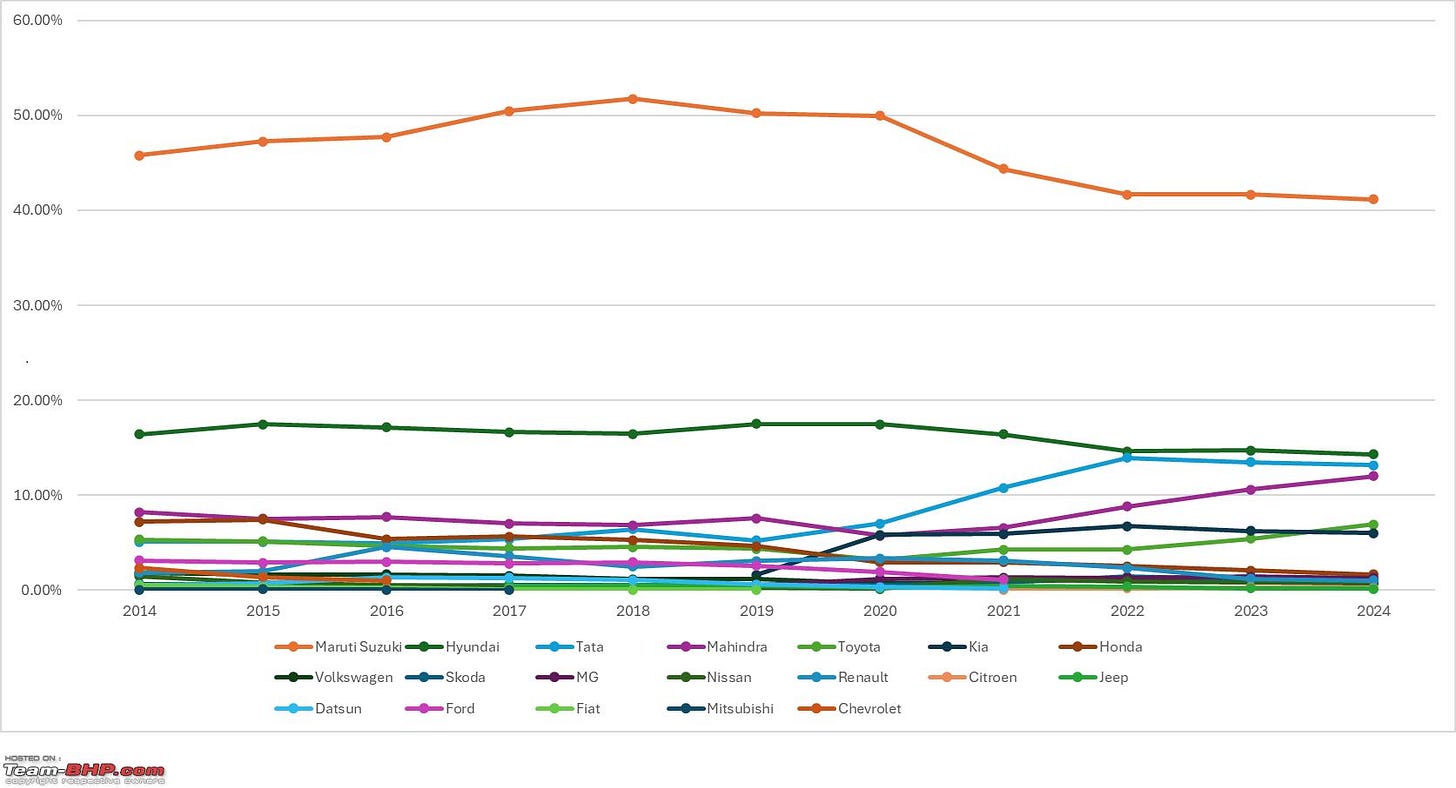

Over time, other car manufacturers, such as Tata and Hyundai, have adopted this exact strategy. But they still don’t come close to Maruti in sales.

Taxi wars: The best car model doesn’t win.

Volume matters

Take the case of the Toyota Etios. Launched in 2011, the car had excellent performance, good mileage, the right price — overall, a really good taxi vehicle. Yet it couldn’t beat Maruti.

Why? It boils down to the company’s conservative production strategy. Setting up dedicated factories is incredibly expensive, and there’s a limit to how much you can maximise production, especially when you don’t know if taxi ridership will pick up.

On the other hand, Maruti has been around since the 1980s, enjoys excellent market penetration, and has a proportional manufacturing capacity. Easier to scale up to cater to the booming taxi market here.

Distribution influences market share.

Would you buy 20 cars from a brand with 100 stores or a new brand with 10 stores? Now, let’s ask that again if you are buying 100 vehicles. The reasons for purchases aren’t just the “brand”.

A larger distribution network means you can contact a service centre when you need help, and get help fast. Plus, if you want more vehicles, you can have them delivered quickly.

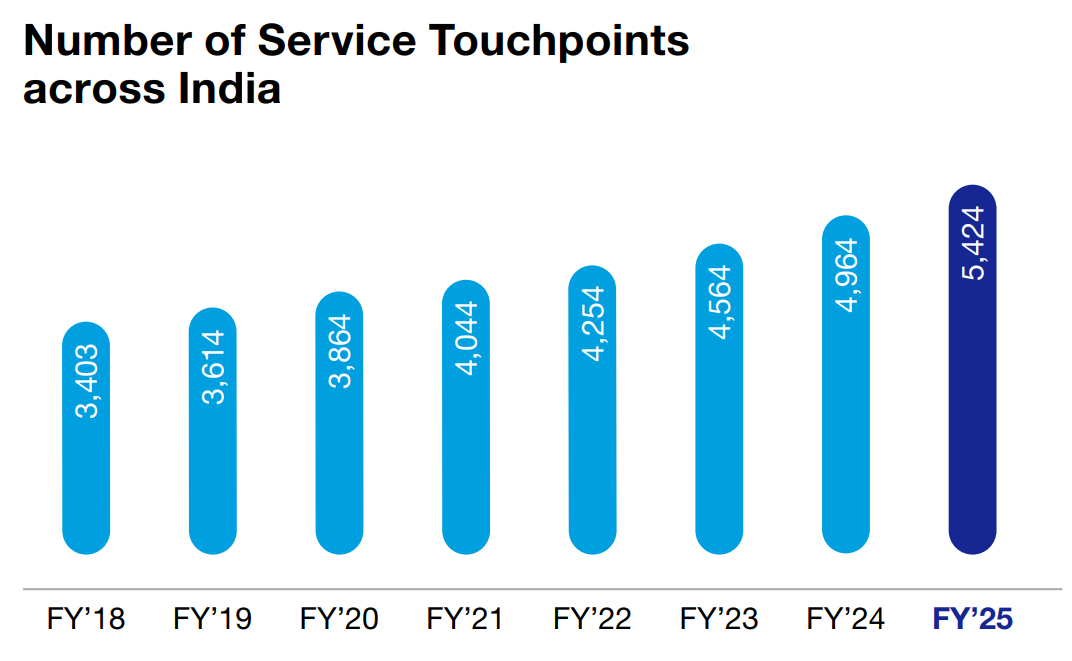

That’s why Tata India couldn’t capture the taxi market despite having more legroom and a fuel-efficient diesel engine. The after-sales experience sucked. They didn’t have enough service touchpoints back then. Even today, their number for commercial vehicles is ~1800. Here are the numbers for Maruti Suzuki.

Maruti Suzuki has increased its service touch points YoY. Source: Maruti Suzuki Annual Report. Resale price is important.

In India, used-car sales are 2X regular car sales as of 2025. Plus, resale goes both ways in the taxi space. Aggregators buy used cars for their fleets and sell them to buy newer models, too.

Naturally, beyond regular servicing, they want access to spare parts for replacement to bump up the resale price as well.

Maruti Suzuki serves this segment through its extensive network of aftermarket parts and accessories. Currently, they have 1,377 independent outlets for genuine parts, complementing their service centre network.

That’s the Maruti Story.

Maruti Suzuki beat its competitors on all three accounts every single time. And they had a lot of tailwinds (Uber/Ola launching), having the most fuel-efficient vehicles at a cost that made business-model sense for cab operators, which destined the company to own the Taxi market.

2026 is 56 days away.

That’s 56 days to get ahead in your career before 2026. We made a video to help you 10X that progress with a few AI skills. If you’re a generalist, product manager, engineer or marketer, you’ll find a lot of value in this one. Catch the entire episode on our YouTube.