How Manyavar did over ₹1,000 Cr revenue? 💰

Build the right business model for once in a lifetime purchase.

Welcome to the 135th edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 95,300+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

Weddings is an unorganised market 🥺

Impossible to build around it 🙇🏻♂️

Here’s how Manyavar is nailing it ⬇

Quick context 🗓

The Indian wedding industry is currently estimated at ₹3.8 lakh crores (growing 20-25% YoY). Wedding apparels contribute to ₹1.35 lakh crores (growing 17% YoY). Interestingly most of it is unorganised.

Can you imagine this purchase being entirely an emotional decision? Can’t imagine any other category where emotional decisions contribute so much - except Gold.

The Manyavar story ✨

It’s journey started in 1999 with the aim to fill the huge void in men's ethnic wear segment. At that time, ethnic wear was largely overlooked by the big players and wasn't even viewed as 'fashion'. In fact, it wasn't even considered a category - classic whitespace in broad day light.

Insights to ₹1,000 Cr annual sales ⬇

Lessons for D2C founders building an online + offline distribution strategy plus a lot more on how to position their product right.

1/ Product positioning 🏆

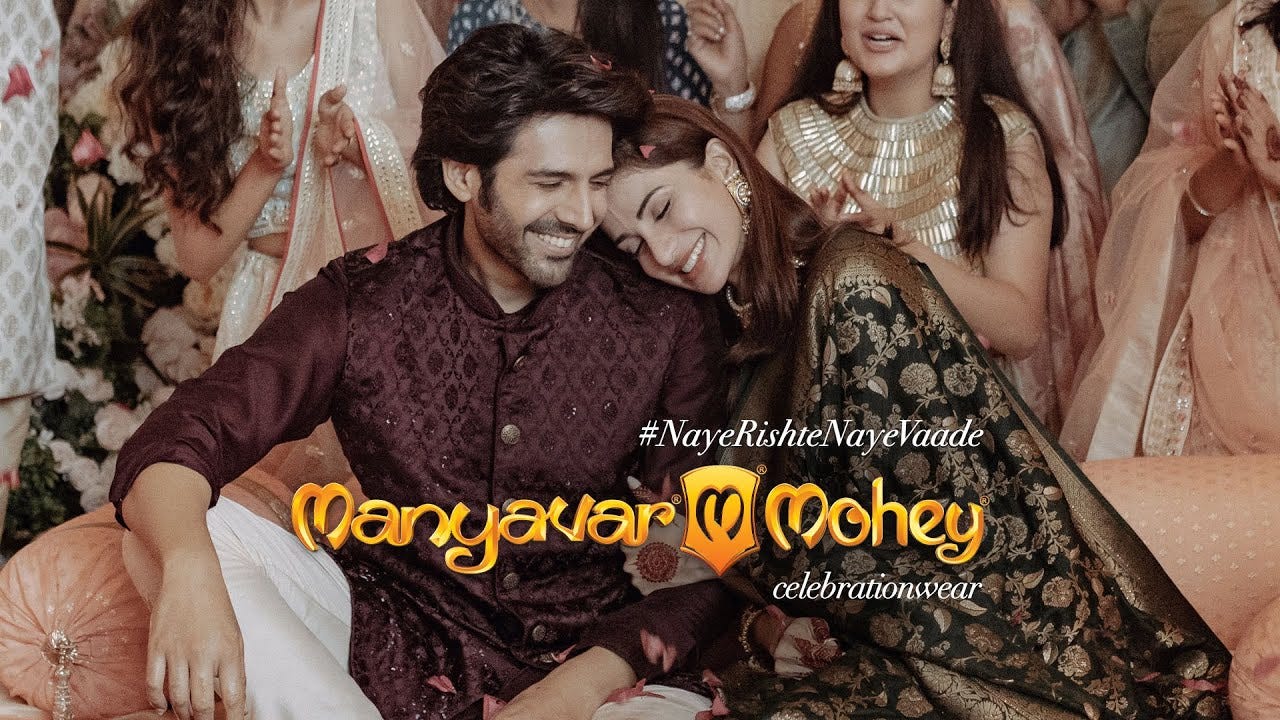

Most apparel brand want to stay away from seasonal audience - like wedding apparels. Manyavar saw this an opportunity to find it’s own whitespace. It associated itself with “aspirational weddings”. It’s marketing pitch consistently nails positioning.

2/ Understanding what not to solve 🤯

In the early days, ₹25-30 Cr annual revenues, the brand used to handle everything from manufacturing → distribution and even retail. The leadership soon realised - focus on a boringly predictable FOFO (Franchise owned and franchise operated) model that allowed it to open offline stores at scale. The active call to not get into full stack ops was the key to scaling distribution with a small corporate team.

3/ Solving for strong brand recall.

The wedding purchase cycle is super short (except the bridal collection). The brand need discovery during that short span of time. No wonder the brand focuses on pitching to customers who might not be immediate customers, creating a strong aspiration towards the brand - solving future demand.

Ask yourself - how many apparel brands come to your mind when I say “weddings”? The list is super short.

4/ Right combination of { Online + Offline }

The price point restricts the kind of customer Manyavar can convert. Almost always, the discovery for such high value purchases begin online. The brand focuses on online search intent (Google search) channels and solves for search impression share. But, it doesn’t want them to convert right away. The brand understands the “touch & feel” nature of the purchase.

5/ The right price point - feels expensive.

Indians want to feel good after they purchase for wedding apparels, especially the bridge and groom. It’s signalling to tell relatives how expensive that lehenga is. The brand has a low entry price point and has a range of upto 75K for a lehenga.

6/ Right entry into decision maker’s life.

Let’s admit - brides decide the theme & styling for apparels between the engaged couple. Manyavar hyper focuses on the bridal collection first → convert them first before cross selling to other’s in the family.

7/ Nailing cross-sell to the bride + groom family.

It’s hard to guess who is checking out the online collection when most customers aren’t logged into the Manyavar website. It solves for identifying who the customer is right on the home page. Enabling right cross sell for those attending a weeding.

What's next for Manyavar? 🎯

Short answer: penetrate the existing markets. It’s focusing on scaling it’s distribution with the “aspirational weddings” but also solving for retail pin-code capture. You’ll see a lot more Manyavar Mohey store in your locality if you are in a metro city.

Brands like Manyavar will win 💙

With no debt ever taken whatsoever by the business, this is the original "Dhanda". The fundamentals of understanding positioning, pricing, omnichannel distribution and consistently executing distribution is the holy grail of building a large D2C business. Interestingly, Manyavar is expensive than most local stores. Crazy - it understood perceived value game with “aspirational weddings”.

Go ask your team this question - What’s the one market that is under-looked by your competitors? What could be the “right to win” for those categories especially if they are high value but low frequency purchases?

D2C is a hard business to crack 🙇🏻♂️

Especially when you spend a lot to acquire a customer who might not be a repeat customer. That’s core to finding low cost customer acquisition channels. Over 300+ D2C leaders at GrowthX from BlissClub, Lenskart, MyMuse & more have designed their distribution strategy and scaled their revenues.

Thank you for supporting this newsletter 🪄

We spend a sizable portion of our time writing pieces for this newsletter. Share it with your closed circle / Twitter if you find it interesting.

Thank you for sharing these insights, Abhishek. They are really very helpful. Can I request you to also share more detailed information about certain concepts, like for example when you mentioned in this article that Manyavar nailed the positioning, it would really help if you could double-click on that subject to make it more exciting. Thanks again for sharing such insights. Cheers!