How Honda Activa became India's 2 wheeler king & queen?

India’s most-loved scooter for the last 20 years.

If you are in product, marketing, or strategy roles and trying to crack revenue growth, I have an announcement for you. We are accepting the final set of applications this week for the GrowthX 8-Week Live program starting October 20th. Here’s a quick note on how this Live program works.

Week 1 covers customer acquisition. You’ll learn to define the ideal customer persona, pick the right channels at every growth stage, and dive deep into channels—content, referral, partner programs, paid ads, and integrations.

Week 2 covers user onboarding. You’ll learn to understand existing user flows, where the funnel inefficiency exists, and how to solve onboarding rates on web & mobile apps. You will design new onboarding journeys for your product.

Week 3 covers retention design. You’ll learn to define the right retention metric, segment customers & design user journeys + campaigns to retain your most profitable customers. You will also design resurrection journeys for churned users.

Week 4 covers monetization design. You’ll learn to design pricing, figure out GTM for monetization, and define experiments to nail free-to-paid and cross-sell/upsell opportunities.

Weeks 5 → 8 covers an optional capstone project. You’ll be given a revenue problem statement for a real product and build a strategic plan that can be executed by the real company. During this project, you will work with dedicated mentors from top companies like Flipkart, Zepto, CRED, Razorpay, Lenskart, Freshworks & more

Some marquee names joining October 20th Immersion program to learn revenue growth include Anand (Director of Marketing, Netmeds), Pallab (Global Business Marketing, Truecaller), Saumya (Ass. Vice President, Credit Suisse), Anirban Chief Growth Officer, IDFC First Bank & 160 more.

The Honda Activa Story 💫

Activa is India's 1st-ever scooter to sell more than 1 crore units. Used by more than 3 crore customers, it has changed how Indians travel and given top bikes a run for their money. Even today, Activa’s yearly sales stand at 22.5 lakh units — equal to the sales of the next 5 top-selling scooters combined. Let’s dig in.

How did it all start?

India has been a 2W-obsessed country. Why? well,:

The average distance travelled in the country is 25 km.

Affordability is a big pain and every can’t afford cars. India's car penetration is among the lowest globally, with just 34 cars per 1,000 people, compared to over 200 per 1,000 people in China and the US.

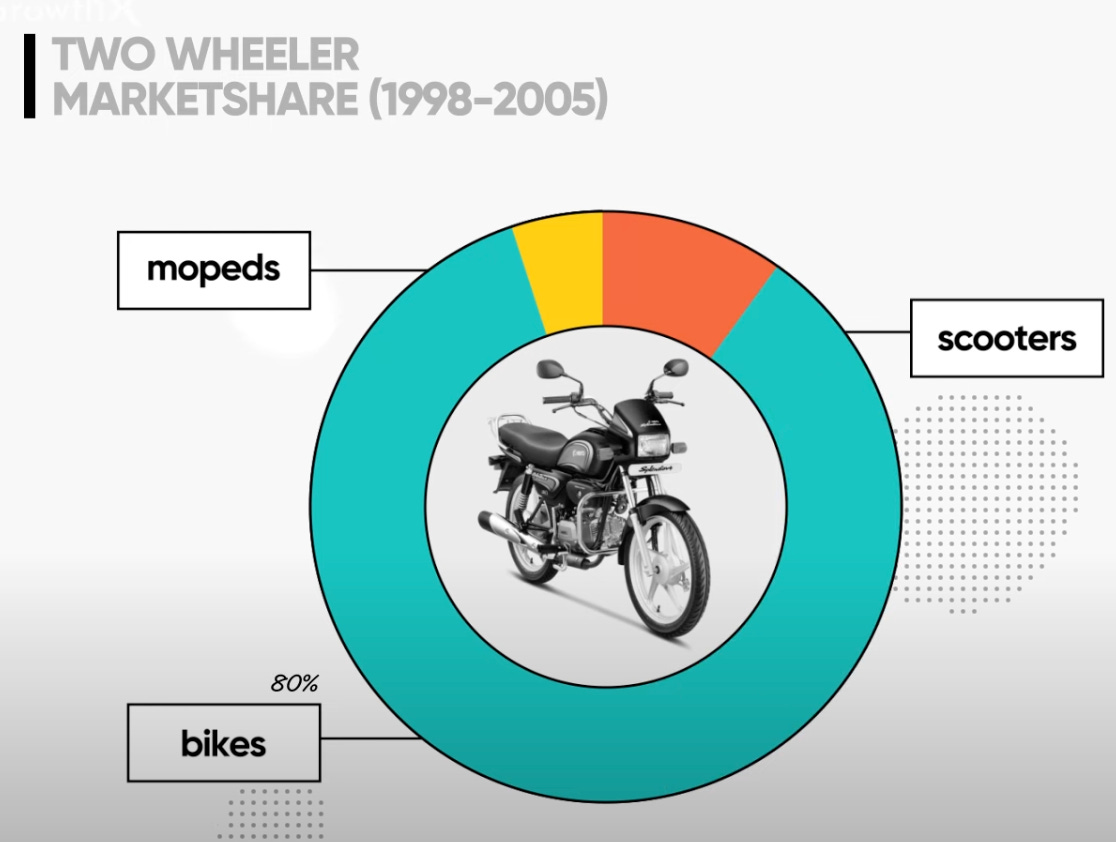

By 1998, scooters dominated 42% of the two-wheeler market. Later, India saw a transition towards bikes and moved from the Chetak era to the Pulsar era. And during this, Honda launched the Activa in 2001 because of the whitespace for the best of both worlds.

What did Honda crack?

Family Vehicle Insight.

Honda spotted a whitespace everyone ignored: while bikes targeted young males, there was a need for easy-to-use vehicles for women and middle-aged people. Activa filled this gap with a durable, gearless scooter designed for all, appealing to families. Its unisex approach made it a hit, with ~33% of users being women for years.

The loop was simple: Target all non-male users → Penetrate into families → Solve for the commute of everyone → Build trust → Generate word of mouth.

Nailing the Swiss-Knife Insight.

Honda understood the maslow’s hierarchy of need for the Indian user. It wanted Activa to be a scooter for Bharat. To solve this, Activa made sure 3 tangible (highest priortity) user problems are solved make it a no-brainer purchase:

Mileage: Activa offered 60 km/L, better than competitors that offered 40 km/L, making it an economical choice.

Durable Engine: Honda’s world famous powerful engine came with an insane longivitivy of 15+ years overheating or sound issues.

Solid Build: The metal body and spacious design (including helmet storage) gave Activa durability, unlike plastic-bodied competitors like Aviator.

Activa wasn’t the most sexy scooter but was the most utility driven & safe scooter at an affordable price point for its segment.

Cracking the distribution game.

The Hero Honda joint venture laid the foundation for Activa’s distribution in the Indian scooter market. Later, the JV split happened and Honda realized that it would have to go aggressive and would need its own distribution, as earlier Hero had taken care of it. Post-2010, Honda went bullish on expanding distribution in Tier 2 and Tier 3 markets and also started setting up R&D centres in India. The goal was to:

Take India’s revenue contribution from 12% to 30%

Turn the country into a manufacturing hub for exports.

Honda’s overall bet on the India manfuacturing story with lot of money into distribution, helped Activa being available everywhere. Fun fact: 10% of all Activa sold have been sold abroad.