FabIndia's fabulous ₹16,000 Cr game🥻

How FabIndia made mass-retailing of ethnic wear "cool" in 60 years?

July is a lot happening at GrowthX ✨

We are launching 8 new learning programs, 12 masterclass replays & atleast 4 in-person events for our members. This includes learning programs that are built for product & marketing leaders, founders, analysts & those owning revenue growth in their current role.

First, 8 learning programs include — Tech for growth, GTM for leaders, Org & hiring design, Growth model design, Brand led growth, Data led growth, Event & partnership led growth - taught by leaders at Netflix, CRED, Razorpay, Lifesight & more.

Second, 12 masterclass replays over the years at GrowthX from marquee leaders nailing specific micro and macro revenue growth topics from distribution, product building, strategy, raising capital, ESOPS & more.

Third, 4 members only events In Bengaluru, Mumbai, Delhi NCR, Pune & Hyderabad ranging from offline mixers to operator & founder focused sessions. And I’m not even mentioning 10s of casual catchups across major Indian cities in June.

You can experience all of it with one single membership. Take that leap of faith & become a GrowthX member today - massive upside awaits.

FabIndia’s 60-year-old story✨

FabIndia is making ~₹1,600 crores in revenue and had an estimated valuation of ₹16,000+ crores when it was filing IPO in 2022. But the shocker is that it was started by an American and as an exporting company— John Bissell came to India in 1958 as an advisor to help artisans. John started FabIndia to uplift artisans and later, his son, William Bissell pivoted it into a lifestyle retail giant. So, let’s dig deep👇

But first, why ethnic & handicrafts?

The Indian apparel market is 65% westernized & 60% un-organized, a super branded space with few big names in ethnic— Manyavar, Biba, FabIndia & W. But despite high westernization, 1 of every 5 online orders is a saree or a kurta as Indians still fancy ethnic.

Fact: India makes 95% of world’s handwoven cloth.On the handicrafts side — the situation is a little critical as it’s a decaying art form. But with the rise in desi values, higher per-capita consumption and a rise in tourism, this industry is only seeing tailwinds.

What did FabIndia crack?✨

Cracking trust with retail.

FabIndia has 320+ stores in India and 10+ stores abroad. The company has a unique approach to this. But how? Let’s find out. Fabindia uses the COCO model (company-owned-company-operated outlets) rather than franchises— owns 2X the number of stores than it has franchises.

A capex-heavy approach that’s different from someone like Manyavar has almost all of its stores being run as franchises, either the COFO model (company-owned franchise operated) or FOCO model (franchise-owned company operated). The company has also been bullish on EBOs (exclusive branded outlets) too— the big single-brand outlets that contribute 80% to the sales. FabIndia now has the 4th biggest EBO network in the country.

The logic is - give great experience → communicate the story → charge a premium.

Cracking supply chain.

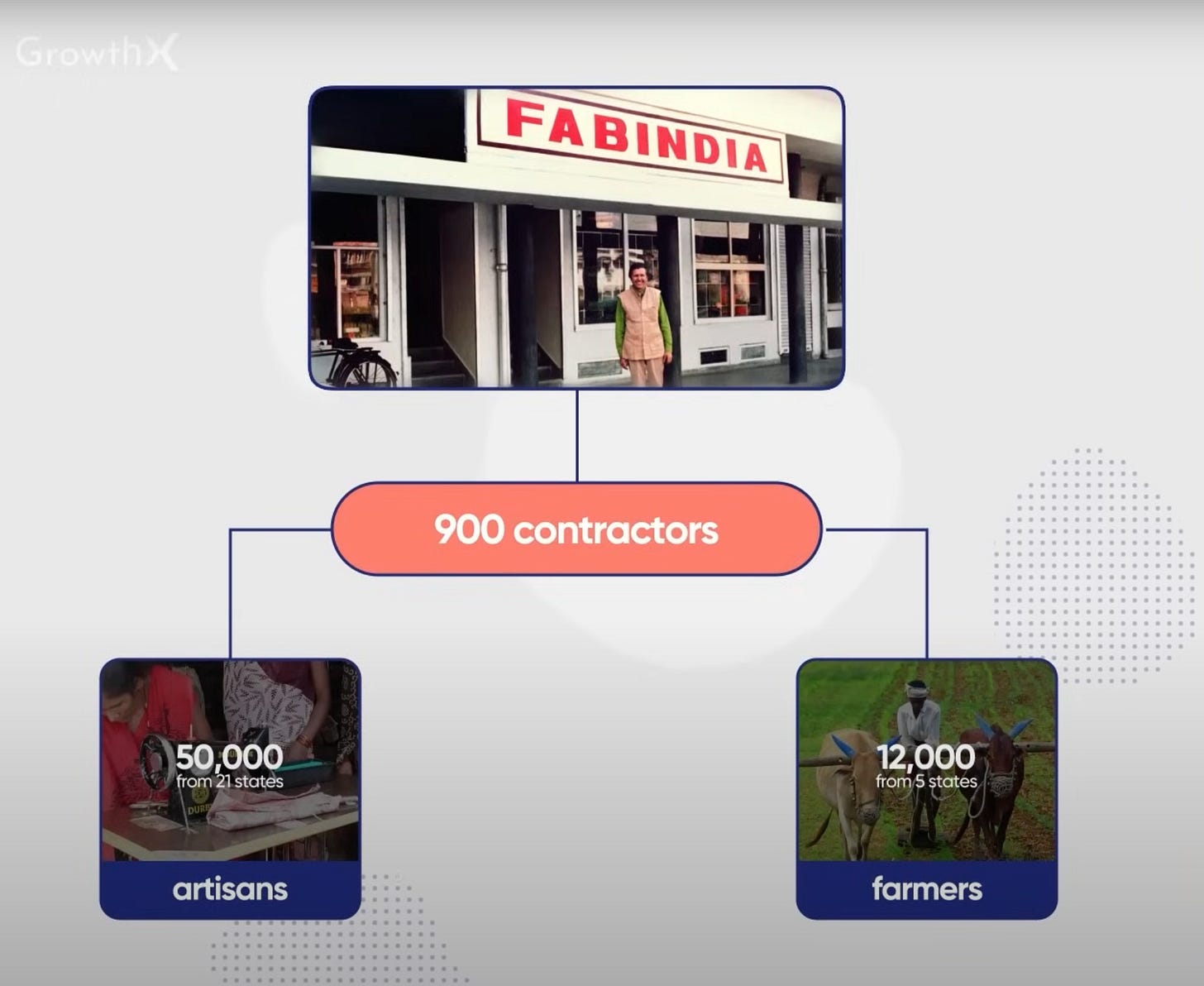

The company has access to a community of 50,000 artisans & 12,000 farmers— with a solid layer of 900 third-party contractors in the middle. Craftsmanship is a rare art form that has decayed by 30% in the last 3 decades. FabIndia has worked on helping it thrive by developing clusters— artisan communities of certain geographic area that practices a certain craft.

Invested in expensive programs like a ₹50 Crore project “Craft Cluster Development Livelihood Impact” to make clusters organized by giving financial literacy, technical training, giving trial orders & doing quality checks to instill professionalism. The company was even the founding member of the NGO— All India Artisans & Craft Workers Welfare Association (AIACA) and has taken multiple initiatives to uplift artisans. Give back to the ecosystem → Gain trust → Form long-term partnerships

Cracking diversification.

The company has 80% of its revenue coming from apparel but they don’t want to be an apparel brand but a lifestyle brand. Expanded into multiple categories with different brand names as they knew customers would put them in the “apparel box”

In 2000- Added non-textile home products

In 2004- Added organic food

In 2006- Added personal care

In 2008- Added handcrafted jewellery

Today- Added home design & dining too

A “startup-like thinking” by a 60-year-old brand. Btw, they acquired Organic India back in 2013 but are now about the sell the brand off to the TATAs.

That’s not all, we launched a new episode of GrowthX Wireframe, where we cover The FabIndia story in depth —

Thanks for supporting this newsletter!

If you’ve enjoyed this piece, do consider referring our newsletter to a friend. For your first referral, we’ll send you our Infographics ebook, which has a collection of growth & business infographics that have generated 1 Million + impressions across our social channels.