#Breaking | UPI is killing India's candy business 🥵

Welcome to the 82nd edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

When was the last time a shopkeeper gave you toffees in exchange of ‘Chutta’?

It’s probably been years, maybe since the inception of UPI payments post the great Indian demonetisation or maybe it was COVID-19 that trigged the irrevocable user behaviour of using digital cash as much as possible.

Back in early 2010s almost all big players, including Mondelez, Mars, Nestle, Perfetti Van Melle, Parle & ITC reported staggering growth & future prospects.

Fast forward to 2020, most of these brands have reported a steep decline in sales of toffee. Hershey’s, one of world’s biggest chocolate & toffee maker said India is one of the worst hit markets in the post COVID era, says the expansions are uncertain.

So what really changed? ⏱

Enter → Unified Payments Interface aka UPI

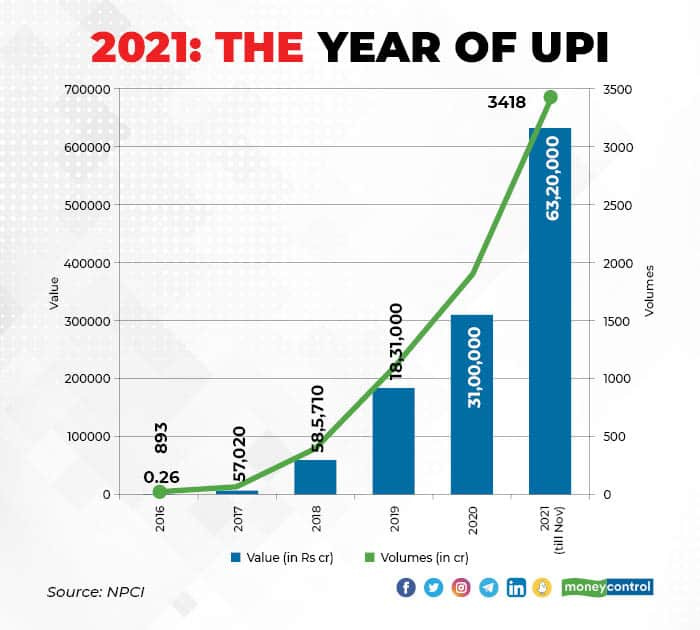

In 2016, UPI was launched in India with a vision to create a real-time payment connection that works as an intermediate system. This fast, easy, & convenient mode of payment was far from being deplorable.

But as chaos theory would explain butterfly effect, it ended up eating a huge pie out of the candy market. Before UPI, shopkeepers would shamelessly trade toffees for loose cash, a transaction that wasn’t happening other way round.

These small amounts over days did wound up to becoming large sums of money, as accepted by many buyers in studies. With UPI, all of this stopped. People paid the exact amount that was due with no scope for change, ultimately eating up the daily toffee sales.

The pandemic added fuel to the fire ✨

With most of the audience scared of the pandemic, everyone wanted to do contact less payments. This also created soft of push towards digital payments and toffee went off the picture.

Urban adults who became the prime market for chocolate makers in 2013, with them doing most of the household buying and munching on the toffees they pocketed post their visit to the local grocery stores was now the worst hit segment.

This is a classic case of category substitution.

I’m sure no chocolate (toffee) company would have ever thought of finance products as their competition (Chutta = Toffee which got broken with UPI). That’s the insight we want you to learn from today’s short.

Ask yourself & your team.

”What are the reasons people buy our product and what would change that behaviour? Do we find reasons which aren’t really our direct competition but can potentially replace our product usage?”