Breaking down Indus Valley Report with Sajith Pai (BlumeVC) 🇮🇳

Ft. Sajith Pai - Key insights, opportunities & challenges.

👋 Hey, I’m Abhishek, Co-founder of GrowthX, a community of 4,000+ top leaders in Indian technology companies. Welcome to the 287th edition of the GrowthX Newsletter. Each week, we bring you stories of great Indian businesses, consumer insights & curation of high-paying jobs. Not a subscriber? become one for free.

We recorded a 4.5-hour podcast with Sajith Pai (VC at Blume Ventures). This podcast covered the 2025 Indus Valley Report, the most sought-after report that provides an in-depth understanding of the India opportunity. The full video is here.

I asked Sajith if he’d be willing to share (and expand on) the Indus Valley Report with a broader audience, and I’m so happy he agreed. Indian and global LPs, founders, and VCs have expressed appreciation for this report, and this story will only increase that trend. Follow Sajith for more on LinkedIn and Twitter.

Also, a huge shoutout to Anurag & Elton from the Blume team for helping publish this edition to the world. Enjoy the read :)

What is the India Opportunity?

Since 2023, India has earned the moniker of the “world’s fastest-growing major economy,” driven by robust growth in both public and private sectors. It boasts a population exceeding 1.4 billion while maintaining a growth rate of 6.2%.

But to capitalise on the India story, it is crucial to understand where value is getting created (and not captured yet), who’s spending (and why), and understand business models that are uniquely Indian.

Let’s break it down into two parts — Part 1: The macro picture and how India’s consumption economy is evolving, and Part 2: Specific market opportunities for the next decade of startups and careers.

Part 1 - The India macro story isn’t just about growth; it’s about “Who’s Spending”

India’s GDP bounced back from the COVID-hit years (-5.7%) to nearly +10% in FY22. While India’s current GDP growth has slowed down to 6.2%, the economy is expected to keep growing faster than most of the world for the next decade.

India is expected to overtake Germany. We will become the world’s third-largest economy by 2027. So the question isn’t — “Is India growing?” but more importantly — “Who’s driving the growth & how?”

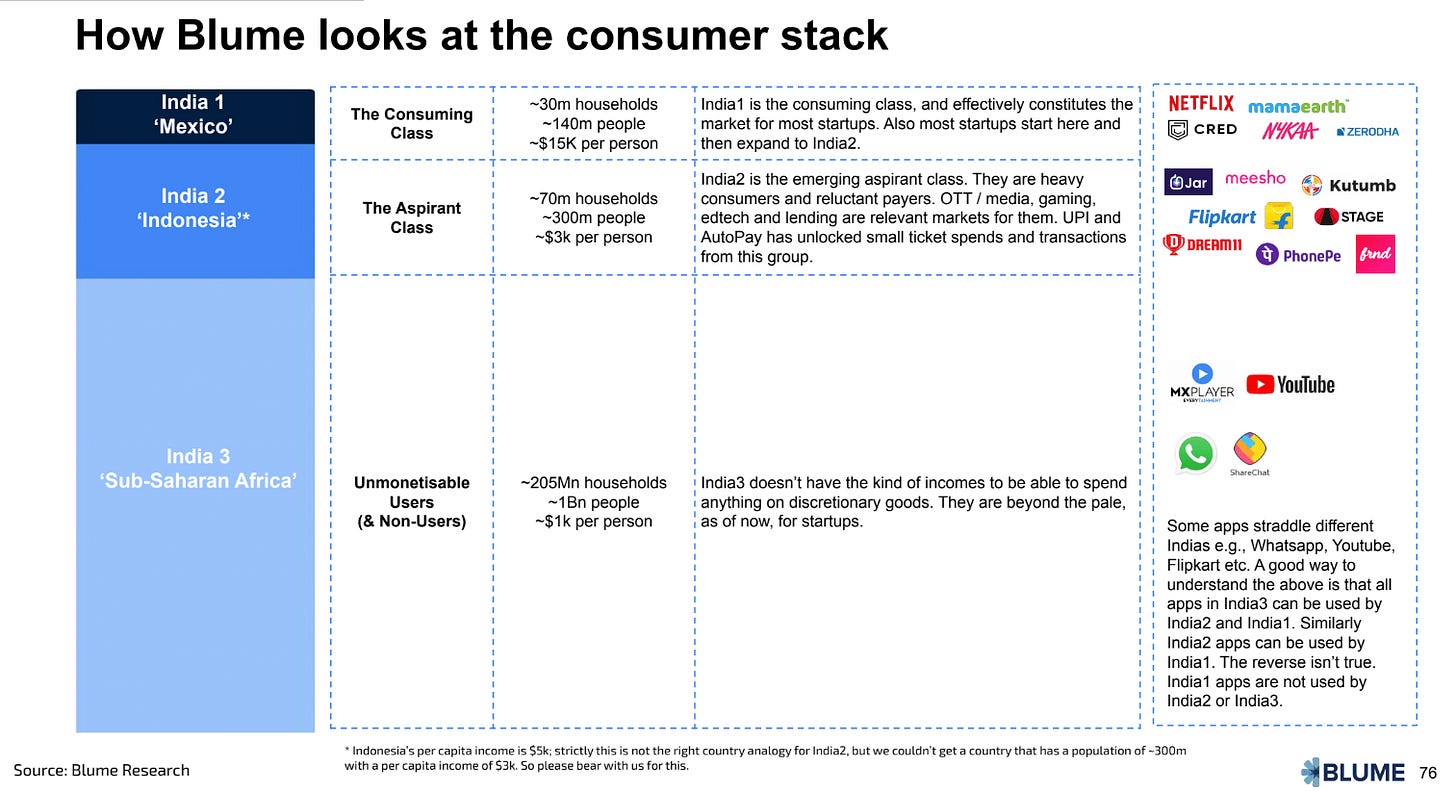

The Indian population can roughly be segmented into three sections: India 1, India 2, and India 3. Let’s understand them one by one —

What is India1?

~140M people (consuming class), with a per capita income of $15,000, India1 forms the market for most startups in India. They have the highest ability to spend on discretionary goods.

What is India2?

~ With 300M people (aspirant class) and a per capita income of $3,000, India2 are heavy consumers but reluctant payers. They have limited ability to spend on discretionary goods.

What is India3?

~1B people (Hard-to-monetise users), with a per capita income of $1,000, India3 is viewed as a hard-to-monetise user (at least for most startups). They have no ability to spend on discretionary goods.

India1 isn’t getting much wider,

but it’s getting deeper. Incomes are rising, and it shows — premium motorcycle and SUV sales are up, demand for luxury real estate is growing, travel spending (especially international) is booming & Equity investments are hitting all-time highs.

Meanwhile, India2 & 3 are growing more slowly.

This means if you're building something new, the shortest path to traction is still India1. They’re the early adopters, the spenders, and the ones shaping demand.

Part 2 - Where is the real market for founders? What are the trends to look for while building for the next 10 years?

Quick Commerce - Instant delivery works well in India.

When 10-minute grocery deliveries were launched in 2021, many people quickly dismissed them as unnecessary. After all, why would you pay someone to deliver your groceries when your neighbourhood Kirana store is right around the corner?

Fast-forward to 2025, and quick commerce has altered customer expectations; 10-minute and quickish deliveries are the norm. India is uniquely suited for quick commerce—high population density = Short delivery distances, Low rider costs = Cheap last-mile fulfillment, and urban customers = High repeat usage.

Quick commerce works in India because its cost structure allows it to be profitable faster (unlike the West), and consumer expectations have attuned to quick/quickish deliveries. Also giants like Amazon, Flipkart, JioMart, Myntra, Ola, Nykaa experimenting too.

As the quick commerce model establishes itself across India, the market beyond groceries is set to expand. Medicines, home decor, beauty, personal care, sports and wellness, etc, will become natural category expansions in the quick commerce boom.

AI: Still Early in India, But the Momentum Is Real.

China’s DeepSeek moment generated ripples across the entire AI industry; it upended the notion that only companies with deep pockets could develop groundbreaking AI models. This has spurred countries like India to join the AI race with tangible support from the government. India’s AI ecosystem is still early, but it’s poised to change; here’s how —

Indian startups in AI are growing 3–4x YoY.

The Indian government has acquired over 18,000 GPUs.

Plus, it’s funding the “AI Sovereignty” mission (Rs. 2,000 Cr)

Global Capability Centers of Microsoft, Google & IBM are hiring 100s for AI work.

Developers now can access public data, Indian languages, and India Stack infra.

While trying and winning the AI foundational model race is commendable, India has a real chance of winning verticalized, Indian-context AI. A few examples —

Legal AI tools that work in regional languages

Health AI trained on Indian patient data

AI tutors for school kids in Tier 2 cities

Support tools that understand Hinglish & Desi accents

There is a lot of government backing and momentum to achieve revolutionary feats in AI domain in India. India’s Digital Public Infrastructure and ISRO’s space mission are tremendous examples of frugal innovations punching above their weight.

India-Specific Playbooks: Not Copying the West

Today's most exciting startups are not just building “the Indian version of X.” India's constraints, opportunities, and demographics demand new business models.

The most common playbook for launching a proven Western product to suit Indian tastes and language preferences is Ola. Now, however, playbooks fall into two categories: Evolved & Emerging.

Evolved playbooks involve re-engineering the product for the Indian context, user behaviour, and margins(!) that benefit from the Jio & UPI boost. For example, STAGE is an OTT platform that exclusively focuses on regional languages in India. It tapped into people's discontent about the lack of representation of their local language in popular media.

Emerging playbooks involve rethinking the product around the fundamental need to be solved (or job-to-be-done).

For example, Uber used to charge a commission per ride, which it facilitated. That is until Namma Yatri came on the scene and started charging auto drivers a flat fee to use the platform versus a commission model.

Namma Yatri was built on top of India’s open mobility protocol (Beckn), a legacy of India’s robust Digital Public Infrastructure (DPI). While they offered the same service as Uber, their monetisation model differed. It worked so well that Uber followed suit, too. Here’s why Namma Yatri model worked —

Consumers are price-sensitive

Indian drivers care more about daily earnings than per-ride metrics

Open protocols = Better trust, less gatekeeping

Apart from the evolving and emerging playbooks, two other factors contribute to building successfully from India —

1. Frugality and Scale: The Jio Playbook

Reliance Jio made mobile data nearly free to monetize later through subscriptions, bundles, and cross-selling. A lot of Indian startups follow the same playbook —

Give a core product at near-zero cost

Monetize through volume, add-on services & subscriptions

Use India Stack (Aadhaar, UPI) to keep costs extremely low

Think of fintechs using UPI rails. They don’t pay infrastructure fees like companies in the West. That’s how they offer free transactions and still make money via lending, insurance, etc.

Frugality also influences customers' purchase decisions. Harsh Jain, the founder of Dream11, Sajith recalls mentioned that customers on his platform are more comfortable paying Rs 10 every day versus Rs 300 upfront. This is a classic example of the ‘Indianisation’ of business models, which leads to positive unit economics.

2. The Indian diaspora: India0

As of May 2024, the total number of overseas Indians worldwide is approximately 35.42 million. The Indian Diaspora is affluent and influential. Their economic power is reflected in high remittance flows into India - the highest in the world ($107 Bn in 2023-24) and interestingly greater than FDI flows into India ($70.9 Bn in 2023-24)

This makes “India0” a prime customer segment for startups that want to go beyond the constraints of the traditional Indian market. To tap into the Indian diaspora, it’s key to understand how affiliated they are with Indian culture and their purchasing power. This helps you understand your marketing mix for different types of Indian diaspora. Here’s a 2x2 framework to help you understand this better.

Final Thought. The India Opportunity = Build Where Value Gets Created.

The India opportunity is not about chasing trends. It’s about looking hard at: Where value is being created (even if it's not monetized yet) → Who’s willing to pay for it (India1 today, India2 tomorrow) → How you can build a business model that fits.

India has unique characteristics: Low per-user ARPU but massive user bases, price-sensitive users but high frequency, friction-filled infra, but fast adoption once the friction is removed. It's an interesting time to build for India and the world from India.

Try GrowthX Deepdives for free 💫

At GrowthX, we bring top industry leaders from Swiggy, LinkedIn, Razorpay, and more to solve real-world growth, marketing, and product problems. Our deep dives dives gives our members access to structured, actionable learning from the best in the industry. Now, you can start learning for free with GrowthX.

India 1 is not widening? What does that mean?

One of the best newsletters I read!