BluSmart crisis, boAt IPO, Delhivery's acquisition & VRO's $10 M funding 💸

Too much this week in India tech world.

We are back with our business newsletter edition. Today, we’ll cover 4 business topics in one go — let's dive in.

boAt files for IPO 💰

First, some context.

This is boAt’s 2nd attempt at going public. In January 2022, it had filed for a Rs 2,000 crore IPO but shelved the plans blaming market conditions & raised $60 million in private capital through convertible preferred stock notes from existing investor Warburg Pincus and new investor Malabar Investments. It was raised at a minimum valuation cap of around $1.2 billion.

Some quick revenue numbers.

FY 2021-22 : ₹1,314 crore

FY 2022-23 : ₹2,873 crore

FY 2023-24 : ₹3,376 crore

FY 2024-25 : ₹3,117 crore

The revenue dip was to cut lossses from ₹100 crore to ₹53 crore. The company also reported a positive EBIDTA.

The market has changed.

Last 3 years at the market, recent Trump Tariff war has made public markets not so worthy of good liquidity. The new IPO valued at $1.5 Billion does take all of this into account.

What does this mean for D2C companies?

Look, its important for the entire startup ecosystem to have larger companies IPO well at the public markets. The more predictive this becomes, more companies will start thinking big, be able to raise private capital and solve for jobs. Only talking about lets not build Ice Cream startups & let’s do deep tech startups is good for bakar - nothing else.

Delhivery acquires Ecom Express 💸

First, some context.

Ecom Express, is a ecommerce logistics player. And, competes directly with Delhivery head on. It was started way back in 2012 by former Blue Dart executives. They scaled to 2,400 Indian cities over last decade.

Things went wrong.

In October 2022, it raised $39 million from existing backers Warburg Pincus, CDC Group, and Partners Group as fresh funding proved elusive. The company was caught in the late-stage funding winter. It’s IPO plan failed. This has now led to the acquisition by its own rival, Delhivery, for a ₹1,407 Cr — it is a 80% discount on it’s ₹7,000 crore valuation a year ago.

Why the 80% discount?

The IPO failed because they (Ecom Express) were relying on Meesho as a big client, which accounted for 50 percent of their business. In February last year, Meesho launched its own in-house logistics platform Valmo.The loss of Meesho’s business via Valmo, which is now servicing over 50 percent of the firm’s orders up from 22 percent at the time of launch, struck a huge blow to the revenues of several 3PL operators, and particularly Ecom Express, a company heavily reliant on Meesho for its business.

What will we see ahead?

One word — Consolidation. Blue Dart, Xpressbees (reported ₹180 Cr loss),Ecom Express, Gati Limited, and eKart Logistics (reported ₹1,718 crore loss) are the only major competitiors of Delhivery. Delivery CEO is very clear that they want to actively acquire more companies at the “right price” - the stock market turmoil has has huge effect on private deals. Strong headwinds for next few quarters.

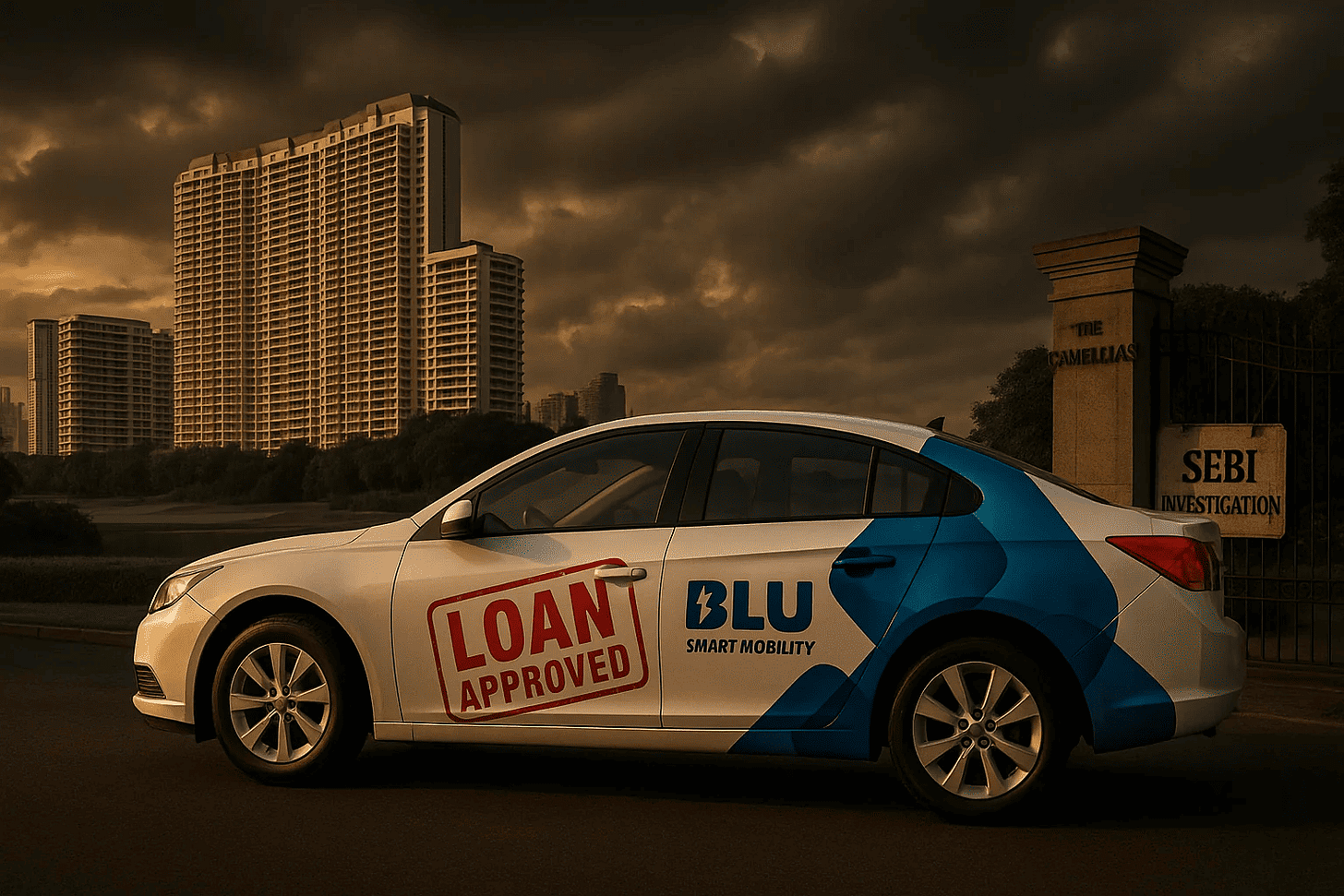

Blusmart is in flux.

In the last few hours, allegations have been made of the company's promoters' misappropriation (strong word) of funds. At GrowthX, we never want to jab Indian builders, but this story is really, really concerning.

BluSmart got its parent company Gensol, to raise $114 million in loans to buy EVs. But only ~60% of these loans were used to buy vehicles. Promoters used the rest for personal expenses, including buying an apartment in DLF Camellias, which was horrible. Again, this story is legitimately 11 hours old and will develop as more information comes to light.

But this impacts everyone.

We don’t understand how private markets work—how trust works. VCs sell the India story to global Limited Partners (Pension funds, sovereign funds) and raise funds to invest in Indian private companies from the Early → Growth → IPO stage.

It breaks trust.

Will Indian founders misappropriate funds? Is this a good economy to pursue? And so on. Builders have enough problems of their own to build large-scale companies out of India, and we don’t want mistrust to become a deal-breaker.

VRO Hospitality (Mirage, Plan B, Hangover, Badmash) raises $10M 💰

First, what is VRO hospitality?

The owners of F&B businesses — Badmaash, Plan B, Taki Taki, Cafe Noir, Hangover, Mirage, Nevermind & Holy Doh.Interesting trivia.

The current round was led by Axis Bank, Nikhil Kamath (through Gruhas), Kunal Shah (CRED founder) & actress Mouni Roy.

The covid era allowed the parent company acquire a lot of these brands. Last financial year, they were on track to have 55 retaurants, topline of Rs. 300 Crore.There is a lot to unpack in this story; We invited the founder to help us understand the whole food & beverage business well. Watch the full episode on YouTube 👇🏼

It’s easy to talk about the diversity of thought. It's hard to put into action.

Starting this coming Sunday, we have curated the most diverse cohort of people for our Advanced Growth Strategy Program.

Our new members who joined in the last 30 days have —

Median 8 years of work experience

Represent nine 1,000+ Cr companies

47% in D2C/ B2C, 45% in B2B SaaS & 8% in others.

Senior roles in product, marketing, business among others.

The Advanced Strategy program is built for you if you are in a product, marketing, or business role.

The 4-week live program teaches you the absolute A → Z of solving revenue growth for every product—here’s what we cover, it is a live online experience & built on case study method of learning.

By the end of the program, you will apply 4 key levers of growth on a real product. Application deadline to apply for the program is April 19th.