Behind Ixigo's Bharat Opportunity & IPO 🚞

Welcome to the 222nd edition of the GrowthX Newsletter. Every week, I write two pieces that go to over 100,000 product, marketing, business leaders & ambitious founders in marquee internet companies around the world. If you haven’t subscribed yet, please do.

Another week - another fam-win 🎉

GrowthX members solve for real outcomes both for their careers & their companies. If you are a marketing, business or product leader or founder & want to solve for revenue growth, we might be the right tribe. Round 2 deadline ends on March 3rd.

We spent some time on Ixigo’s DRHP - a document helps potential investors study the details of the IPO to gauge their interest before making the final decision to buy a public offering or not). And the competition is ugly, Ixigo’s path look more like railroads - here’s why 👇🏼

33 million Indians use trains every single day to commute within our outside cities. This number is more prevalent when it comes to long haul train travel. Classical for a developing country like ours where air travel still lacks scaled infra - with only 150 or so domestic airports, we are still catching up.

Tier 2, 3 & 4 cities account for 5% of overall air travel in India. Plus the entry price point for an air travel is still 5X to 10X of a general ticket in a long haul train. This is the Ixigo opportunity, honestly.

What is the “Bharat opportunity”?

Its cross sell but very focused cross sell of categories.

The Indian railway full stack story.

The IRCTC route on booking via Ixigo is the most user friendly path out there. I have personally used it to book the Rani Channama Express a couple of times in the last few years. No wonder Ixigo built an app just around train bookings.

But, IRCTC doesn’t allow for surge pricing nor allows Ixigo to take higher commissions than the ₹20 to ₹35 per booking. This is then a volume game of capturing IRCTC’s overall long haul train tickets.

In FY 2022-23, over 77 Crore e-tickets were sold for ₹54,313 Crores. Ixigo sold around ~14 Crore e-tickets of them & made ~ ₹284 Cr in direct commissions.

But, ticket commission revenue has a ceiling.

Ixigo’s core play is when a train passenger is on the trip. Here two models are clear path to cross-selling other services. The current Ixigo train app is used by passengers to track where the train is and also set wake up alarms based on their destination station - a core reason why most users download and keep the app.

The first play on the app is food.

Something that Ixigo hasn’t really solved for. It doesn’t need to be the food delivery player but just a pure User interface layer to order from every single delivery place that can deliver it on specific train stations. Opening up the Ixigo API to build on top especially from players such as Domino’s who have shown multiple initiatives with IRCTC to capture this market.

The second is the OTT play.

Longer train journeys mean more content consumption on smartphones. A native integration to play content right within the Ixigo app and doing content syndication. Plus, building an ad monetisation model to open up advertising real estate for bharat OTT players is a clear next step.

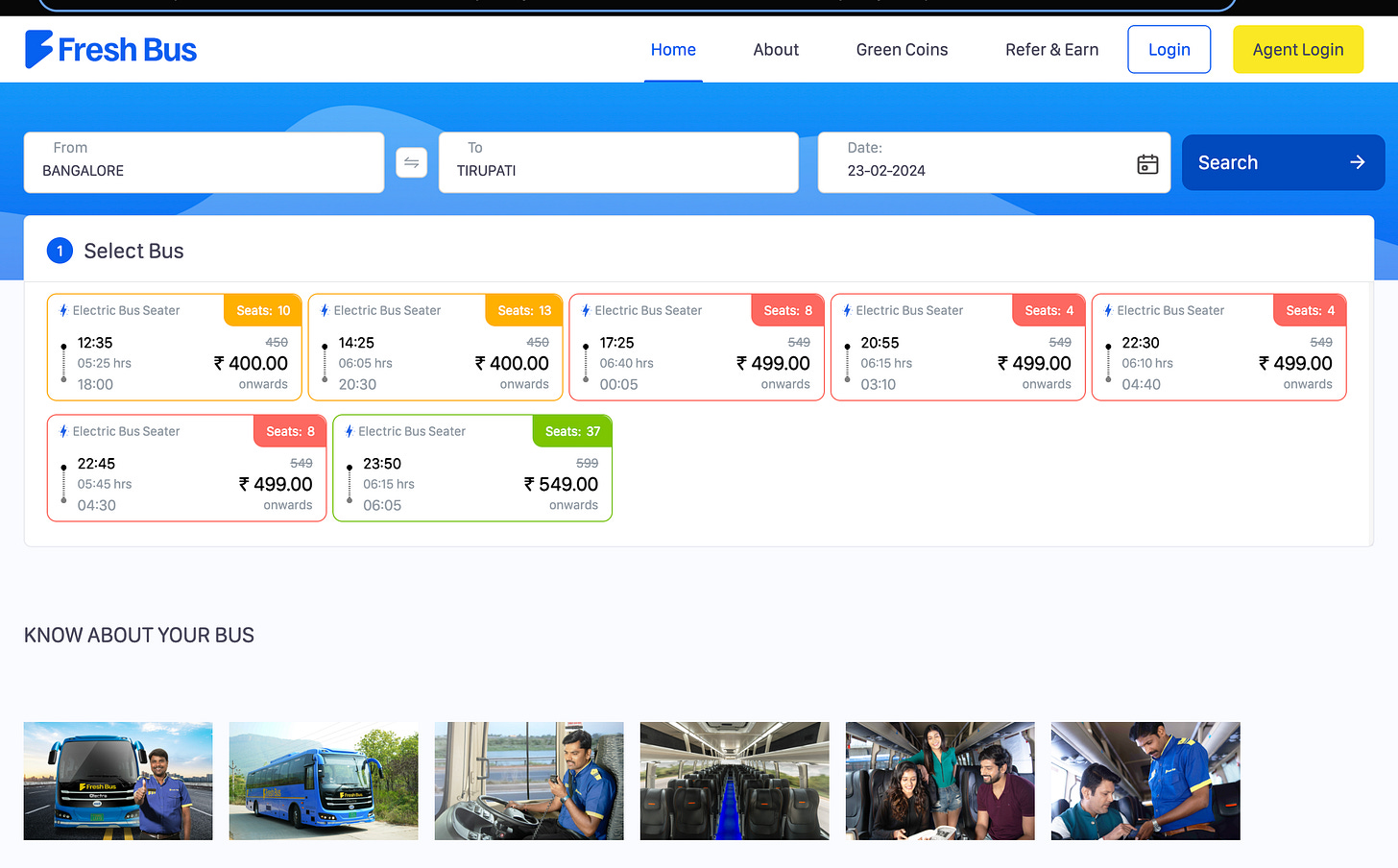

The electric bus opportunity.

Ixigo invested Rs 26 crore (around $3.1 million) in Bengaluru-based electric bus startup FreshBus for the launch of inter-city electric bus services across India. Interestingly, Ixigo took a >40% shareholding in the company which is interesting for a marketplace company like Ixigo.

The game here isn’t just electric vehicle with better mileage for per unit cost of electricity, but building the charging infra specifically designed for long haul bus journeys - solving range anxiety & dependency on third parties for DC fast chargers.

EVs are less about environment & more about the pure cash savings on fuel cost for this operators. The exponentiality will come in when Freshbus scales to 1,000 routes from all major metros Mumbai, Delhi, Bengaluru, Hyderabad, Chennai & more. Ixigo owning 46% share in this company seems more strategic than just revenue acquisition.

The advantage here isn’t that the Ixigo backed Freshbus can only do this EV play, but other bus operators will have to move away from the capital they invested in diesel buses they have or have bought in the recent time. The Freshbus advantage is only that they don’t have the luggage of a diesel fleet.

The budget train/bus traveler hotels.

How you and I travel isn’t how Bharat audience travels - especially when they are traveling solo. If you make a simple search on any of the hotel booking platforms, you will understand the budget traveler isn’t going to book through for those prices.

These travellers will always land up in the destination city by bus/ train and figure out the stay for the night. This is very different than how India 1 pre-plans the stay and has a lot of willingness to pay for a comfort stay.

It is a clear whitespace that no one except Ixigo can nail.

Other platforms can’t position themselves as budget options a lot. It will destroy their positioning to sell expensive properties to those wanting to spend more on their stays. And focusing a lot more on predictable affordable options is the holy grail to nailing hotels.

The final hope for Ixigo to nail flights.

And it’s not a consumer play. It’s the Make My Trip Business play - helping companies manage their employee travel - especially flights + hotels. It is something that Ixigo didn’t prioritize a lot because of its clear focus on the Bharat audience. But, this could be another play that helps make a real dent in its bottom lines considering the margin on flight business. That’s all for now.