The business of airports

And why Adani can form a monopoly

2 exclusive events you don’t want to miss.

Matt Plank (CRO, Rippling) is sharing revenue secrets (tickets), and Raunaq is hosting our first AI X Healthcare buildathon (tickets).

Today’s edition.

Some context.

In 2019, the Indian government opened up airport bidding for private players. Guess who outbid every other competitor — in some cases by 6X the lowest bidder? Adani.

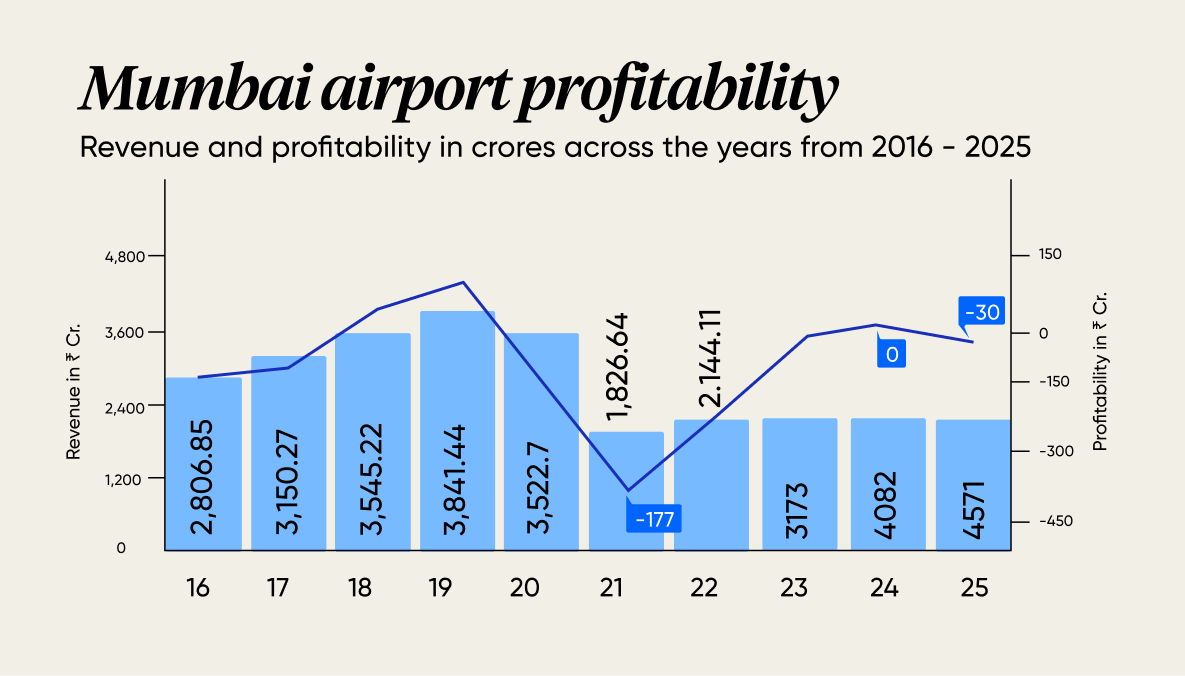

That’s a crazy amount to invest in a business that isn’t perceived to be profitable. To put this into perspective: GVK, one of India’s oldest airport operators, was ₹6,000 Cr. in debt until very recently.

Then Adani stepped in, buying the Mumbai airport from them.

Now, the company is investing another ₹1 lakh Cr. in acquiring airports. But why?

The business of airports.

Here’s the thing. The government plans to build airports to increase regional connectivity and boost Tier 2 & Tier 3 city economies. The UDAN scheme is a good example of that.

The catch? It’s not profitable.

Hence, the private player partnerships.

Here’s how the deal works.

Private operators bid on the revenue per passenger they expect in the future. The highest bidder wins.

Think about it. If an operator wins, they could charge airlines extremely high fees — landing, parking, and security fees. More profits for them.

But in price-sensitive India, that would kill demand.

Reason? Airlines would pass these costs to passengers through ticket prices. Fewer passengers = less revenue for everyone.

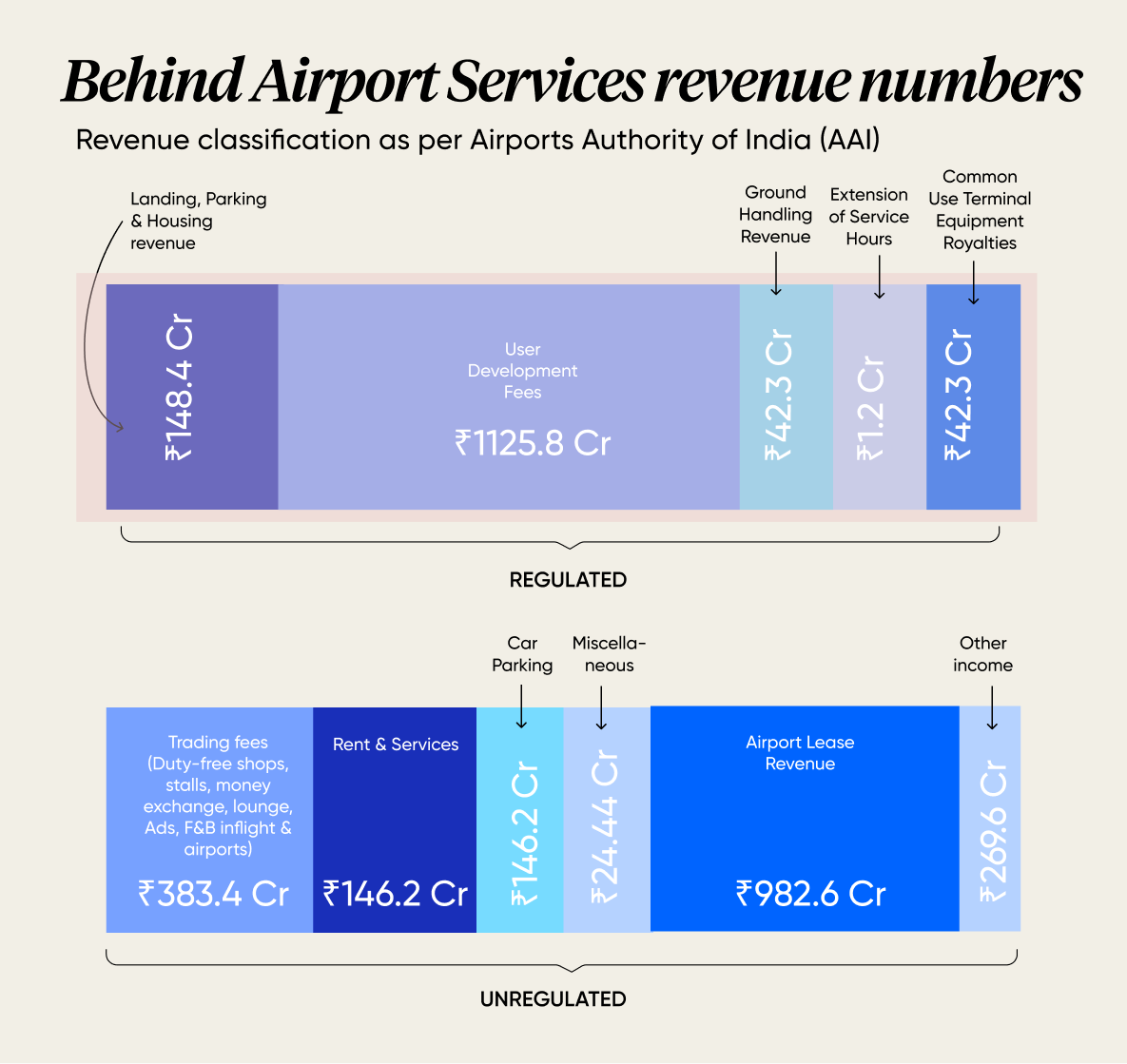

So the government steps in and caps what airports can charge airlines. These are called 'aero revenues’, and they’re heavily regulated. Meaning, airports can’t make much money from airlines.

So where’s the real money?

Operators control everything that’s not airline-related: which duty-free shops operate, how many lounges to build, retail store rents, and land leases. These are non-aero revenues, and they’re huge. Delhi airport, for instance, makes 75% more from non-aero revenues than from airlines.

With numbers that promising, you’d expect a bidding war for airports. But while multiple companies bid, most place conservative bets. Only Adani goes all-in, often bidding several times higher than competitors.

Why are airport operators cautious investors?

Think about the economics.

Operators invest heavily up front — infrastructure upgrades, operations, and employee salaries. Companies like GVK even took massive loans (remember that ₹6,000 Cr debt?).

The bet is simple: enough passengers will shop at the airport to generate commissions that eventually cover costs.

But here’s the problem: Indian passengers don’t spend much.

~80% of passengers don’t spend on retail or duty-free, and ~60% don’t spend on Food & Beverages at airports. Additionally, airport operators probably earn ~7.5% of retail stores’ gross sales. On every ₹1,000 purchase at the airport, the Airport earns ~₹75.

Do the math.

Low passenger spending + thin margins + massive upfront costs = a tough path to profitability. So, most operators bid conservatively — they’re trying to avoid the GVK trap of overbidding and drowning in debt.

So, why is Adani bidding aggressively?

First — the retail + F&B margin breakthrough.

See, most airport operators rely on rent from third-party retailers. They either pay the Minimum Monthly Guarantee (MMG), the baseline rent the retailer must pay, regardless of performance. Even if zero customers walk in, the airport gets paid.

The 2nd path is revenue share: If a store exceeds its sales target, it pays a percentage of net sales to the operator. So, if Starbucks agreed to 15% at the time of acquisition, they’d pay 15%. Either way, the airport operator is an outsider taking a small cut.

Adani’s approach is to own the stores.

Take the Cococart at Mumbai airport. Adani Group now owns a 74% stake in it. Now, they’re not just collecting rent. They’re also keeping a larger share of their net revenue.

Second — the city-side development bet.

Here’s what most people miss about airports: they’re not just transit hubs. They’re money-printing real estate plays. Think about it.

Who does an airport impact?

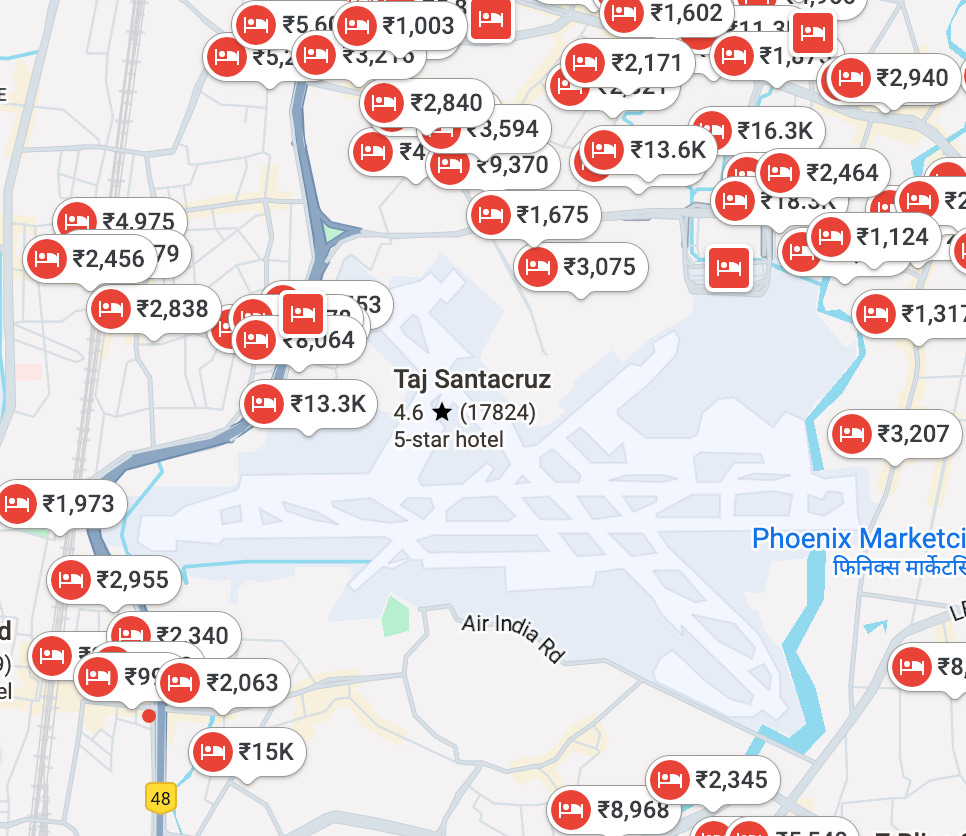

Of course, travellers. Mumbai airport alone saw 5.5 Crore passengers last year — 1.6 Crore of them international visitors. Travellers who needed a place to stay & were willing to spend money. Premium hotels, malls, retail stores, and F&B spaces all make sense for this group from an infrastructure development perspective.

But there’s a second group nobody talks about: the locals.

And they, in our opinion, present a bigger revenue opportunity. Airports are usually located far from city centres for a reason. Cheap land and lots of it. But once the airport is built, land values rise, and communities begin to form. Airport employees move in. Next, businesses. This new community needs hospitals, shopping centres, office spaces, and transport connectivity.

Now, imagine you’re Adani.

You don’t just operate the airport; you own the land around it through long-term leases. The best part? Any revenue you earn is yours. So while other operators are fighting over that retail commissions inside the terminal, you’re building an entire city outside and keeping 100% of the profits, while the land value keeps appreciating over decades.

Third — the bigger trade agenda.

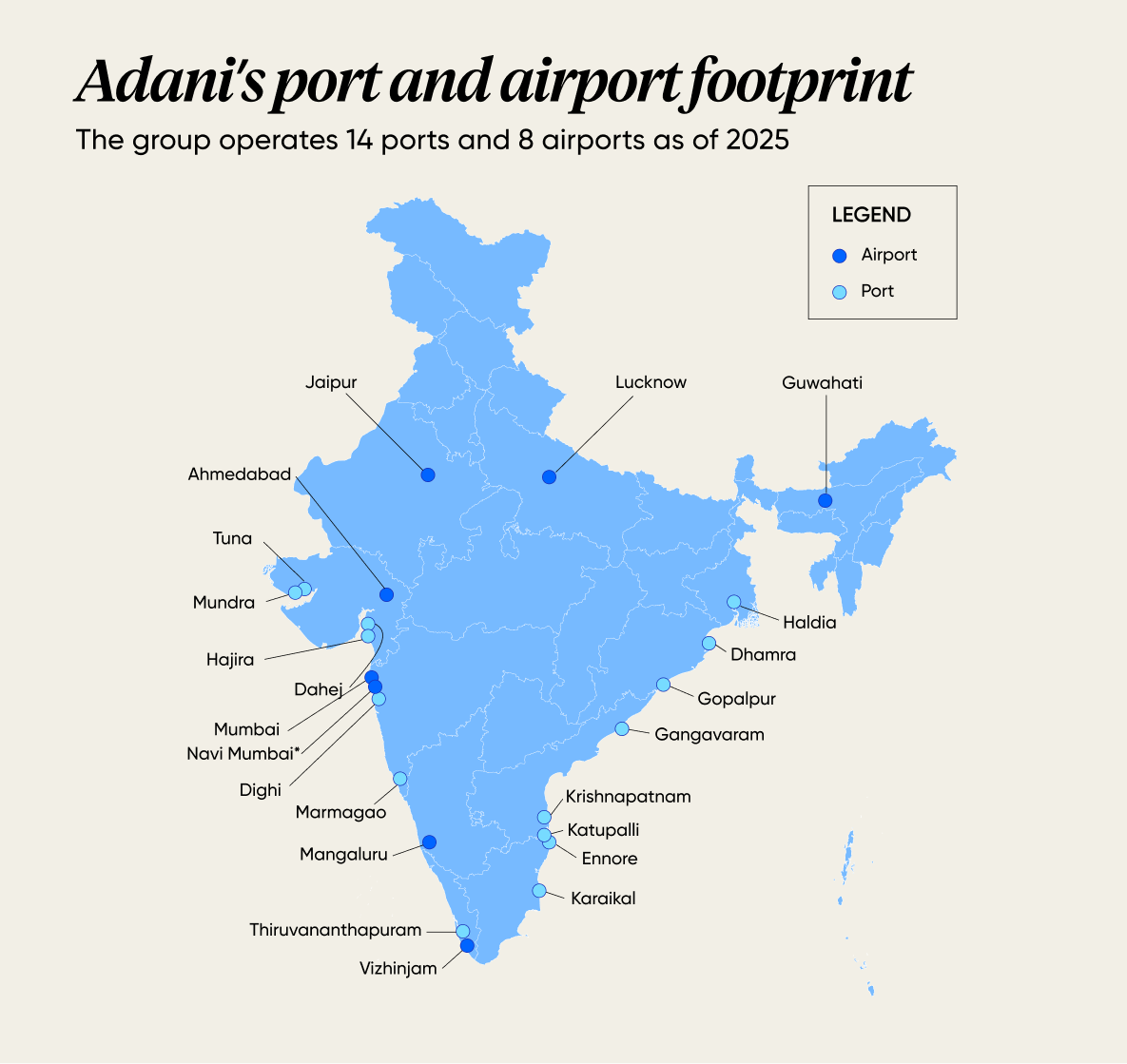

Adani airports aren’t just passenger airports; they are massive cargo transhipment hubs. Currently, Adani airports handle ~33% of India’s air cargo traffic with just 8 airports. So, when you think about it, more airports = more hubs = more cargo handling revenue. Simple math. But that’s not all. Look at the image below.

Adani’s airports & ports line up almost perfectly along India’s west coast. That isn’t a coincidence, we think. If Adani’s indeed looking to facilitate sea-air transhipment, they have an excellent opportunity here.

Take Vizhinjam, for example.

It already handles a bulk of international cargo shipments and is just 16 km from the Thiruvananthapuram airport. Rumours suggest that Adani officials are considering adding an integrated check post at Vizhinjam to enable sea-air transhipment. Think about the massive contract value of the trade that enables.

Will Adani’s airport bet pay off?

We think so. Plus, a monopoly will follow. Here’s why.

There are 3 ways in which monopolies form in business. Either government-created (through regulations), natural (high infrastructure costs/ economies of scale) and/or market-driven & strategic (through mergers and acquisitions). Adani’s airport bet has all 3.

Let’s recap.

We learned that airports are highly regulated — almost all aero-revenues are government-controlled. That’s a classic government-created barrier to entry.

Next, we saw players like GVK take on massive loans to build airports. Those high infrastructure costs are the second barrier.

Lastly, we noted that Adani has a capital advantage. Thanks to their diverse revenue streams, they could pull off moves like buying the Mumbai airport from GVK. That’s the acquisition angle. A new player would have to cross all three barriers to compete. And that seems unlikely, at least with the current regulations.

But what about actually running profitable airports?

Adani seems to have a plan. In 2025 alone, the Group expanded from 50 to 270 retail stores and added 40 F&B outlets to boost non-aero revenues. Whether it pays off? We’ll keep watching.

If you’ve come this far.

We know you’re not just browsing. You care about staying on top of business news and using it to get better at your job. While newsletters are great for case studies and insights, they can’t replace strong fundamentals and peer interactions, especially in the AI world. That’s why we built the GrowthX community.

5312+ experts from companies like Google, Meta, and Sarvam are inside.

Really insightful take on the city-side development angle. Most anlayses focus on the terminal retail play but miss how airport land leases create this compounding real estate moat. Reminded me of how some logistics companies shifted from pure shipping to industrial park development, same bet on infrastructure-driven land appreciation. The cargo-port alignment on the west coast is kinda genius if they pull off seamless sea-air transhipment. That could change alot for time sensitive exports.