3 things smallcase did right ✅

5.3X jump in operating income in 1 year is NO JOKE!

Welcome to the 43rd edition of the GrowthX Newsletter. Every Tuesday & Thursday I write a piece on startups & business growth. Today’s piece is going to 94,400+ operators & leaders from startups like Google, Stripe, Swiggy, Razorpay, CRED & more

There are 138 crore Indians

Yet, only 0.86% Indians invest

Why?

What’s the challenge?

People don’t know how to invest & very few really want to learn.

What do people want?

Manage & control their finances with a little help & full autonomy.

Solution?

Smallcase

✅ Invest in theme, idea, or strategy

✅ Let experts / professionals create portfolios for you

✅ Get started immediately

So what did smallcase do so right?

Integration

smallcase on-boarded 13+ brokers and over 300 partners, but the real growth roped in when they on-boarded Zerodha & Axis in 2018.

One can see the growth in pre and post this era, since smallcase only hosted a meagre 1 lakh users before 2018 and are sitting at a user base of 42 lakh right now. Today, smallcase is on ICICI direct, upstox, Groww, Zerodha.

Marketing based on first principles

Using first principle thinking in marketing means addressing - how your users will discover you, what’s the detractor, what’s the answer users are looking for?

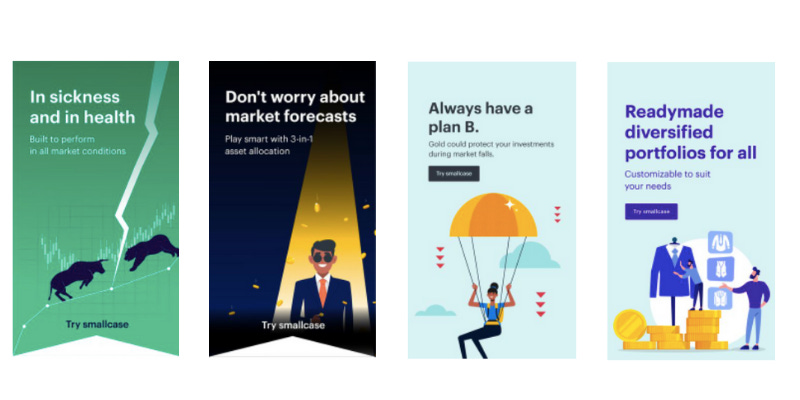

All of this reflects in their adverts & communication. Their ads address user fear. Their ads address affirmation from Nitin Kamath. Their ads address user testimonials of pertinent questions, solutions, resentment.

Multiple revenue streams

It’s a revenue first company. A poor growth/ marketing/ scaling strategy is the one that focuses on spends but doesn’t move the needle when it comes to revenue in the initial days. Setting up small streams of revenue, much like smallcase, helps in recouping the spends much faster.

Broking existed for 50+ years

Smallcase moved that dependency & gave control to users, well almost. Managing money is challenging. People want autonomy, even when they’re busy or have no time. Smallcase gave them the control.

What can we learn?

Less is plenty. Oiling even 1 acquisition channel well is more than enough. For smallcase, it was integrations. It’s pretty evident the growth it drove for the brand.

Did this issue help you?

Tweet this to your network (takes 5 seconds), would mean the world to me ❤️

Loved this issue? Share this in your team slack channel

Trancation fees is transaction fees right?

Great post, had a question though.

I’ve never seen smallcase being promoted on any of the brokers directly except Zerodha’s non trading platforms where they used to talk about their portfolio companies or their “universe”.

Then how can we say that product integration drove acquisitions? If the products (brokers in this case) are integrated on the smallcase platforms, primary acquisitions will have to be through the other sources no?